Risk management

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

The famous fifty

To celebrate Energy Risk’s 10th birthday, we have created the Energy Risk Hall of Fame: a group of individuals whose commitment and contribution to energy markets makes them a foundation of this business. Introduced by James Ockenden

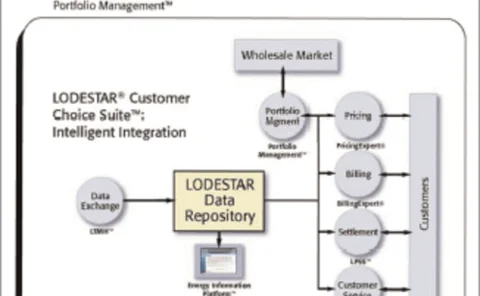

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Ending the acrimony

Most utilities support hedging to mitigate price volatility, but are not sure how to communicate the benefits of hedging to their customers. Tim Simard of RiskAdvisory offers suggestions for improving the rate-hearing process

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

Volatility conspiracy

The concept of volatility is universally used by quantitative analysts. But is it a concrete idea or a false friend? And does it even exist? Energy quant Neil Palmer takes a look at its mysteries

Energy traders urged to pre-register for risk poll

Energy traders wishing to take part in Energy Risk/Risk’s 12th annual Commodity Rankings can now pre-register to vote to avoid missing important voter updates and deadlines in the magazines’ annual survey of the energy business.

BNP beefs up energy team

BNP Paribas has expanded its energy derivatives team in London with four significant hires.

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Taking cover

US energy companies are increasingly taking out terrorism cover, even though none has yet made a claim. This is partly because the cost of policy premiums is falling. But this trend may be under threat. Joe Marsh reports

Agree to disagree

Volatility in the dry freight market has led to the use of derivatives such as forward freight agreements and the development of other innovative products. But will they have a lasting impact on the energy markets? By Hann Ho

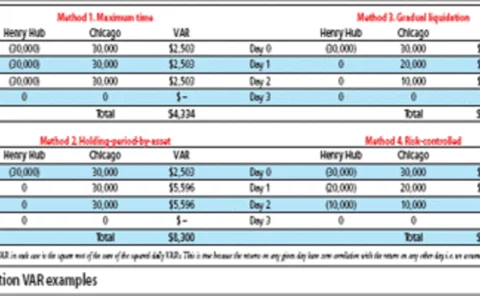

Risky liquidations

It is all too easy to go for the simplest solution when liquidating an energy portfolio of different positions. Brett Humphreys discusses some of the problems with appropriately calculating the VAR associated with liquidating a portfolio

A popular punt

Experts remain bullish about the flow of new money into catastrophe cover. But an influx of hedge funds backed increasingly by institutional capital has led to worries of a “domino effect”. By Maria Kielmas

Missing links

For utility companies with income streams linked to inflation, using inflation derivatives to match assets with liabilities easily and relatively cheaply must be the easy option? If only it were that simple. By John Ferry

Nymex to launch two new coal swap futures

The New York Mercantile Exchange (Nymex) will launch two new coal futures contracts – one for eastern coal and one for western coal – on its ClearPort trading platform on October 31.

Bilateral collateral

Until recently, there was little legal protection from foreign investment risk.But the past few years have seen the rise of the bilateral investment treaty(BIT). Matthew Saunders shows how BITs can benefit the energy sector

Found in translation

While risk managers have become focused on value-at-risk and similar risk metrics,these may not be the best way of communicating risk to stakeholders. BrettHumphreys discusses how to improve communications

Earnings at risk

The structure of a typical energy portfolio often contains a different assetand contract mix from the simple derivatives instruments in a more standard portfolio.This requires a different approach to risk. Here, Les Clewlow and ChrisStrickland make the…

RBS offers freight derivatives

Royal Bank of Scotland (RBS) has started offering shipping derivatives, in the form of forward freight agreements (FFAs) linked to the transport costs of bulk commodities to its client base.

Refco hires OTC energy broking team

The European arm of New York-based financial services firm Refco has hired two brokers to form an over-the-counter (OTC) energy derivatives team. Glen Ward and Andrew Riddell join Refco Overseas in London from US broker Amerex’s London office.

DTE Energy Trading opts for Amerex STP solution

DTE Energy Trading, a subsidiary of Detroit-based DTE Energy, has implemented Amerex Energy’s straight-through processing (STP) product, Xcheck - a web-based trade confirmation system that replaces the manual process of generating, transmitting and…

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

Worth 1,000 words

There’s little point in spending time and money on extensive risk analysisif your audience is likely to switch off when you show your results. BrettHumphreys shows that sometimes, risk managers need to be able to telltheir stories well