Risk management

Hedging ahead

Continuing our series of tutorials on risk management tools, Dan Rowe looks at how physical positions can be hedged with exchange-traded futures and options contracts

Growing quietly

The liberalised German markets now allow large industrial end-users to manage their energy price risk. But, while the competition to manage their exposures is large, these firms are playing their cards close to their chests, reports Joel Hanley

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

Knowing your limits

Value-at-risk limits are widely used risk management instruments. But issues over the allocation of Var limits remain, says Brett Humphreys

Not just a quick fix

Real options are an accepted risk management technique in the energy sector. Kevin Foster takes a look at how are they being used and what factors are affecting their development and implementation

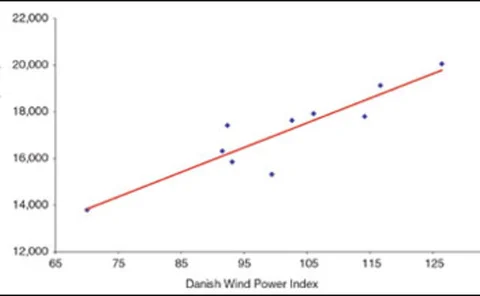

When the wind doesn’t blow

In light of the increased interest in investing in renewable energy following the publication of the EU renewables directive in September, David Pethick, Rebecca Calder and Chris Clancy suggest a method of reducing wind risk

Going OTC with forwards and swaps

Continuing our series of risk management tutorials, this month Dan Rowe look at swaps and forward contracts in the over-the-counter market

Airlines tackle price turbulence

Industry woes force airlines to get serious about improving efficiencies, including implementing new hedging and procurement tools, as Don Stowers discovers

A hedge by any other name

It is one of the most commonly used phrases in risk management parlance, but what exactly is meant by the term ‘hedge’? Here we propose a new definition. By Brett Humphreys

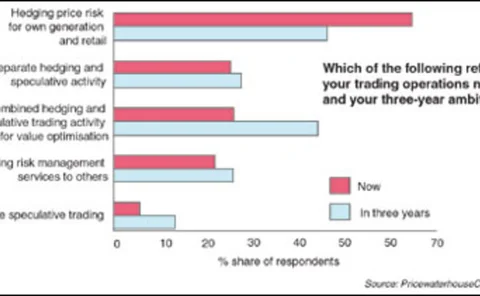

Trading software: tailored to maturity

It is critical that an energy company looking to acquire risk management and trading software be aware of its current as well as future needs. By Fred Cohen and Satyan Malhotra

In the right direction

In this, the second of a two-part series on advanced options, we look at the concept of directional strategies and consider various methods of employing them. By Doug Coyne

Advancing the option idea

Continuing our series of tutorials on risk management tools, here, in the first of a two-part article, we look at the workings of advanced option strategies. By Doug Coyne

Janine McArdle

Managing director, Aquila Europe