Risk management

CCRO data hub update to follow Energy Risk USA conference

The US-based Committee of Chief Risk Officers (CCRO) will give a presentation in Houston next Wednesday, May 11, on the energy data hub it is developing. The session will follow the last presentation of the Energy Risk USA 2005 conference and will take…

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

Tentative steps

Algeria’s state-owned oil company Sonatrach is about to become the first oil and gas company within Opec to roll out an independent risk management programme to cover its crude oil and gas sales. Stella Farrington reports

Icap-Hyde hires Toyne to head tanker FFA broking

Icap-Hyde, a London-based joint forward freight and shipping derivatives-broking venture between broker Icap and shipping broker JE Hyde, has added to its team. Simon Toyne has joined as director of tanker forward freight agreements (FFAs), responsible…

An energetic debate

Enterprise-wide risk measurement and management, regulatory issues and pricing and hedging strategies were the hot topics this year at Energy Risk Europe in Amsterdam. James Ockenden and Joe Marsh report

Answers in the wind

Project valuation means making calculated assumptions that aren’t always accurate. Brett Humphreys discusses the assumptions that may be embedded within a valuation and how these assumptions can affect the final value

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

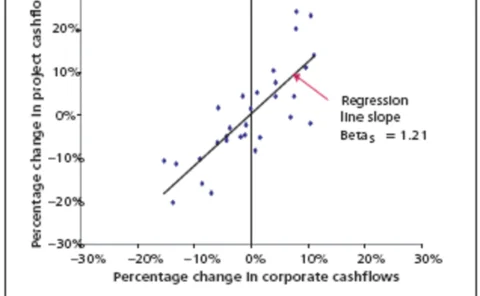

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

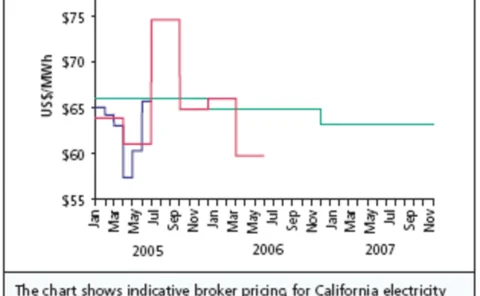

Shopping for curves

More regulation requires more accurate valuation of forward trades – and a need for more reliability in the forward curve tool. Sandy Fielden presents an informal survey of the data choices available to energy risk managers in the US natural gas and…

A solid foundation

MotherRock, the energy hedge fund set up by former Nymex president Bo Collins, recently chose Kiodex’s ASP-based risk management software. Joe Marsh explores the trade-off between web-based and installed systems

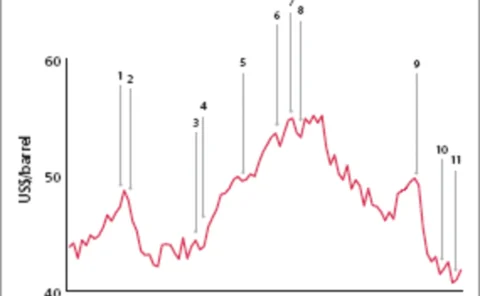

Calgary’s oil patch

Some Canadian oil and gas producers got their fingers burnt last year as oil prices soared and hedging programmes resulted in big losses. What will their strategies be in 2005? Catherine Lacoursiere reports

The swap terminator

Multilateral swap cancellations look set to become commonplace in the energy sector, thanks to a service from TriOptima, which has just terminated its first round of oil swaps for six firms. Joe Marsh reports

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Correlation: the horror!

The murky world of correlation, with its many pitfalls, represents a black hole in the minds of some energy market professionals. But, says Neil Palmer , you needn’t be afraid of the dark

Smoke without fire

The market for US financial coal swaps may be starting to show a little potential, but some major obstacles still remain before it catches alight – not least a widely accepted price index. By Joe Marsh

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

Risk Management Inc signs four utility clients

Risk Management Inc (RMI), a Chicago-based energy consultancy and brokerage, has signed up four new utility customers for its energy risk management and hedging services. The City of Glendale Water & Power and Pasadena Water & Power, both in California,…

Double exposure

Continuing our series on applications of Monte Carlo simulation to applied problems in energy risk management, Les Clewlow , Chris Strickland , Oleg Zakharov, and Scott Browne look at potential future exposure and the analogous measure of expected credit…

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

Pay as you go

It is going to be a hard day at the office for Joe Risk Manager. The risk management committee might welcome his new risk charge system, but how would the traders take it? By Brett Humphreys and David Shimko

Fitch to buy Algorithmics

Fitch Group, parent of credit rating agency Fitch Ratings, is to acquire New York-based risk management software provider Algorithmics. The purchase, valued at $175 million, is expected to close in January, said Fitch today.

China Aviation Oil ceases oil derivatives trading

China Aviation Oil (Singapore) Corp has ceased all oil derivative trading activities after announcing a $550 million trading loss and seeking court protection from creditors last week, the company said late Wednesday.