Risk management

Pulp friction

In the latest of Energy Risk’s series of profiles featuring energy users’ riskmanagement and hedging strategies, Paul Lyon talks to Swedish pulp and papercompany SCA about how it deals with its sizeable energy exposures

SunGard acquires ASP pioneer Kiodex

SunGard has acquired New York based Kiodex, a supplier of web-based risk management, financial reporting, FAS 133 compliance and market data solutions for companies exposed to commodity price risk.

Southern Company promotes finance and risk execs

Atlanta-based energy company Southern Company has promoted Kim Greene to senior vice-president of finance and Mark Lantrip to vice-president of financial planning and enterprise risk management.

Energi E2 chooses KWI for multi-commodity trading

Danish energy production and trading company Energi E2 today signed up for K2, the integrated energy trading and risk management system from London-based KWI. Energi E2 will use the software for multi-commodity trading, with the aim of reducing its…

Tractebel opts for PowerCosts

Tractebel Energy Marketing, a subsidiary of energy company Tractebel, has signed up to use risk trading technology provided by PowerCosts Inc (PCI).

LCH Clearnet launches OTC clearing for UK gas and power

London-based clearing house LCH Clearnet today launched its new clearing service for over-the-counter (OTC) contracts for UK national balancing point natural gas and UK peak and baseload power contracts.

ABN continues BNP raid

ABN Amro has hired five senior energy derivatives executives, two of whom join from BNP Paribas. The move comes just three months after the Dutch bank poached Wayne Harburn and Vincent Chevance from French rival BNP. The pair now serve as global head of…

User Choice winners revealed

Energy Risk's first User Choice Awards have been a tremendous success, with over 450 valid votes showing which vendors and data providers are the preferred suppliers to the energy industry in 2004.

RWE Trading names Senior replacement

Brian Senior, Swindon-based managing director and head of UK energy at RWE Trading, will step down at the end of the year, and Peter Kreuzberg, head of risk management at parent company RWE, will replace him.

All systems go

More than 450 of you voted and voiced your concerns in Energy Risk’s inaugural User Choice Awards. Below we show which suppliers you voted for as top of their field in the energy business this year

Viva lost vegas

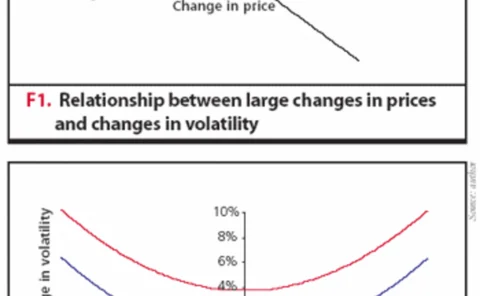

Brett Humphreys discusses the problems of calculating true value-at-risk on aconcentrated options portfolio – in particular, the various pitfalls thatcan befall a risk manager in ignoring vega risk – and considers ways ofhandling these issues

A decent exposure

Most energy companies have a portfolio of over-the-counter energy derivativesthat could have significant credit exposures. In this paper, RafaelMendible examines the credit exposure of these derivatives, its relationto volatility,and its relation to…

Building load links

In the third article in this series, Les Clewlow , ChrisStrickland and MichaelBooth show how the Monte Carlo techniques used in previous articles can accuratelyhighlight the crucial relationship between price and load – a complex correlationaffecting the…

BNZ enters energy trading

The Bank of New Zealand (BNZ) has launched an energy risk management desk. The plan is to target the bank’s corporate client base who need hedging solutions for their energy, base metals and agricultural commodities exposures, said Wayne Jolly, BNZ’s…

Top energy software vendors to be revealed

Energy traders have just one day left to vote in the biggest ever poll of energy technology users, the Energy Risk User Choice Awards 2004.

CME appoints lead market maker for fertiliser futures

Chicago Mercantile Exchange (CME ) yesterday said that Agriliance will be the lead market maker for the exchange’s new fertiliser contracts traded on Globex, the exchange’s electronic trading platform. Minnesota-based Agriliance markets crop nutrients,…

Industrials lack price risk skills, says risk advisor

Outsourcing of price risk management will be a major growth area over the next few years, as industrial companies lack the skills required to manage their commodity risk, according to Chris Bowden, chief executive of price risk services firm Utilyx.

Technology upload

There has been a recent upswing in the fortunes of energy risk software industry. And that is reflected in this year’s expanded technology vendor guide, making it the definitive guide to energy software and technology available

The troubleshooter

After struggling for a year with a difficult Triple Point installation, US energycompany Cinergy brought in energy IT veteran Joel McKnight. Nine months on, implementationand integration is complete. By Joe Marsh

Simulating Excellence

Of the numerous risk management problems that can be solved with a computer,there are few that cannot be solved using Microsoft Excel. BrettHumphreys discusseshow it can be used to construct Monte Carlo simulations

King of convenience

The need for Sarbanes-Oxley certification has boosted sales of internet servicerisk systems, says web pioneer Martin Chavez of Kiodex. By James Ockenden

Bucking the trend

Openlink’s founder Coleman Fung talks to James Ockenden about the decisionsthat have promoted his company to one of the leading risk management solutionproviders

Montréal Exchange and Oxen to offer energy clearing

The Canadian Derivatives Clearing Corporation (CDCC) - a wholly owned subsidiary of the Montréal Exchange (MX) - and the Alberta Watt Exchange, an Alberta-based energy exchange wholly owned by digital commodity exchange operator Oxen, are to provide…