Risk management

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

Backwardation and contango change indicators for seasonal commodities

In the first part of this two-part article, Svetlana Borovkova introduced two indicators for detecting changes between backwardation and contango market states. Here, in the second part, she applies the indicators to seasonal commodities and introduces a…

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

Avoiding STP failure

Entertaining as a Matrix-style spectre of a world governed by computers might be, for many involved in planning straight-through processing, seamless computing is the goal that every organisation should be trying to achieve, says Trayport’s Elliot Piggot

Running a smooth operation

Due to internal control scandals, process failures and the Sarbanes-Oxley Act, energy firms must keep an ever-closer eye on internal operations. Openlink’s Philip Wang and freelance author Jack King lay the basis for an operational risk framework

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

A clear answer to credit problems

US firm PA Consulting is working with a number of major US energy companies to set up a one-off trade netting scheme. Kevin Foster investigates the proposals

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

Enron will not centralise risk management

Failed energy trader Enron plans to package together the majority of its internationalassets into a company known as InternationalCo, the shares of which will be distributedto its creditors.

ABN Amro makes global OTC oil and gas drive...

Dutch bank ABN Amro last month started to offer its clients oil and gas hedgingservices, as part of its financial markets business which incorporates debt capitalmarkets, structured lending and risk management activities.

Energy firms turn to overlay

Energy companies face a tough future over pension provisions – a problem that could well exacerbate credit deterioration. Paul Lyon finds that innovative use of currency overlay could provide some form of refuge

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

Kiodex adds more energy forward curves

Kiodex, an energy risk management technology company based in New York, willadd five new forward curves to its global market data offering, it told delegatesat EPRM’s May congress in Houston.

Ferc calls for risk manager vigilance

The director of the office of market oversight and investigations (OMOI) at theUS Federal Energy Regulatory Commission (Ferc), has urged energy risk managersto alert his office to any suspicious market practices.

CROs seen as vital for restoring confidence

Chief risk officers (CROs) have a vital role in helping shape the future of thetroubled energy sector and should report directly to their company’s boardif investor confidence is to be rebuilt in the industry. Vincent Kaminski, seniorvice-president of…

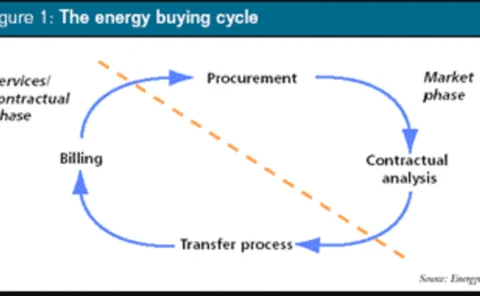

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

People swaps

Chappel replaces McCarthy as Williams CFO US energy major Williams has hired Donald Chappel (pictured) as senior vice-presidentand chief financial officer (CFO). He succeeds Jack McCarthy, who retired atthe end of 2002 after 10 years as CFO. Before this…

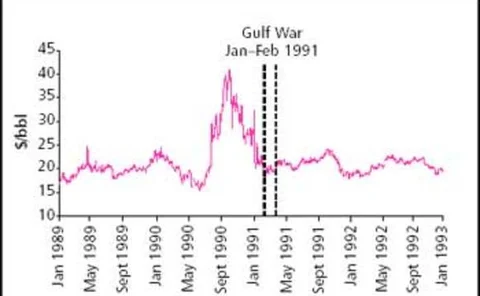

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done