Risk management

Phillip Fletcher

Phillip fletcher , a partner at Milbank, Tweed, Hadley & McCloy, has seen nothing but change in his 15 years with the law firm, he tellsJames Ockenden

The credit charge

Brett Humphreys describes a simple method for charging traders for the credit risk embedded in a contract, using an example based on an oil purchase agreement. Such a charge creates proper incentives for traders with regard to credit risk

Enterprise-wide risk management

Market and regulatory requirements mean EWRM is fast becoming essential. Now is the time for implementation www.kpmg.com

Competing at the highest level

BP is fast becoming as well known for its risk management services as it is as a global energy company.

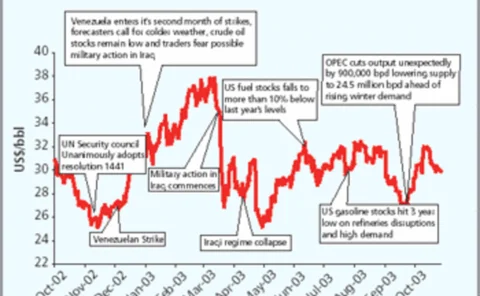

The politics of betting

Using markets to forecast political events may not be as strange an idea as it seemed in July, when a terrorism futures scheme collapsed. But there is still scepticism as to whether such an approach would be ethical or effective. By Maria Kielmas

Rothschild enters oil risk sector

Heading the senior team is Martin Fraenkel, previously managing director of JPMorgan Chase's global commodities group in London. Fraenkel has recruited hissenior team from outside Rothschild. KamalInvestment bank Rothschild has entered the oil risk…

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals

Pieter Verberne

Pieter Verberne, Amsterdam PowerExchange’s (APX) chief operatingofficer, is a busy man. The Dutchexchange is finalising the technologyupgrading of its recent acquisitions, naturalgas exchange Enmo and Automated PowerExchange, both based in the UK. It is…

Enron files complaint against six of its former banks

Houston-based Enron last month filed a court complaint against six of its former banks, claiming they gave bad financial advice that contributed to its demise in late 2001. As a bankrupt company, Enron is required to try to recover as much as it can for…

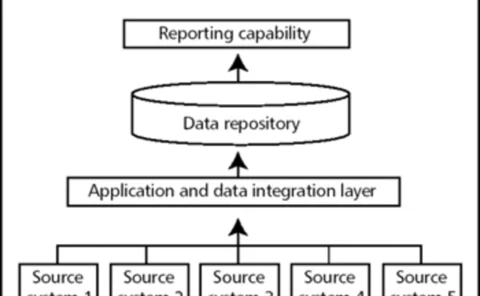

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Hedge out on the highway

US haulage firms seem to be making little use of risk management tools to mitigate high fuel prices. But parcel carriers are taking the initiative, finds Kevin Foster

Allegheny reduces trading exposure with contract sale

Maryland-based Allegheny Energy has reduced its exposure to energy trading by selling an energy supply contract to a subsidiary of Goldman Sachs for $405 million.

Taiwan’s growing risk appetite

Relying on imports for most of its energy requirements and constrained by the government’s view that risk management is gambling, how can Taiwan tackle the challenge of price risk in its growing energy sector? By David Hayes

Royal Bank of Canada reaches agreement over Enron case

The Royal Bank of Canada (RBC) has reached a settlement agreement with Enron, the Enron creditors’ committee and Dutch firm Rabobank, resolving aspects of a share transaction known as ‘Cerberus’. The transaction also involved the use of total return…

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

Correction – Allegro: The following text should have been included in the software vendor directory in last month’s (July) issue.

Allegro Development has provided energy firms with transaction and risk management software solutions for almost 20 years. Founded in 1984, Allegro provides an industry-leading set of customisable energy software components for companies including…

How to be top of the class

Brett Humphreys discusses the attributes that combine to create a best-in-class market risk management division within an energy company

Vincent Annunziata

During his time as a senior commodities trader and risk analyst, Vincent Annunziata noticed an alarming trend: like any other trading outfit, his company was prone to human error. He was working for Phibro – formerly the commodities trading division of…

UK energy brokers form association

Nine brokers operating in the over-the-counter energy markets in the UK formed the London Energy Brokers’ Association (LEBA) in July.

People Swaps

ABN Amro hires global energy trading head Dutch bank ABN Amro has hired Jonathan Arginteanu to the newly created positionof senior vice-president and deputy head of global energy trading operationsin New York. He was previously head of rival bank BNP…

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

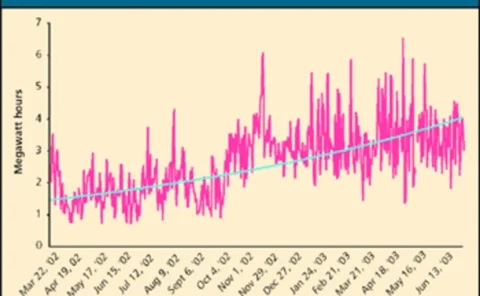

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

Valuing exploration and production projects

Lukens Energy Group’s Hugh Li sets out an option method for valuing exploration and production projects, using a practical example

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates