Risk management

Risk management key for freight, says Baltic Exchange chief

Baltic Exchange chief executive Jeremy Penn has stressed the importance of risk management at a forum of freight derivatives brokers and traders this week.

LCH.Clearnet launches OTC clearing for freight derivatives

LCH.Clearnet has launched an OTC clearing service for the forward freight agreements (FFAs).

Trading routes open

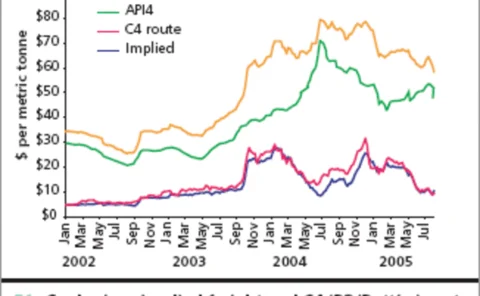

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

Coal facing changes

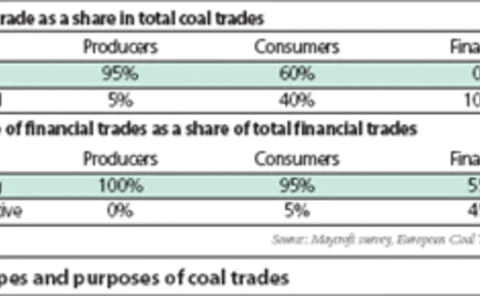

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Pieces of a puzzle

To get enterprise-wide risk management to work, a firm needs to piece together the right models, processes and software – and the right attitude. US utility Allegheny Energy has done just that, finds Oliver Holtaway

Understanding Sam

The Samuelson Effect – backwardation in the term structure of forward volatility – can lead to valuation inaccuracies. In capturing the Samuelson Effect in energy derivatives valuation, analysts have tried both historical approaches and those that rely…

Hoodwinked!

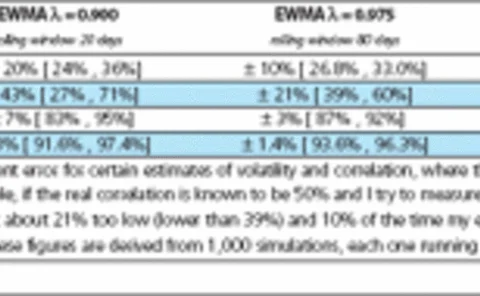

Have you got a good grip on your view of volatility and correlation? Neil Palmer shows that, thanks to ever -present measurement errors, even the steadiest markets can throw up big surprises

Great expectations?

Risk and expectation are two sides of the same coin. But could you quantify your own risk appetite? explores some ways to put a price tag on those hazards you can’t avoid Neil Palmer

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

Chris Bowden

With energy prices skyrocketing, risk management is now a necessity, not an option, says energy risk pioneer Chris Bowden . By Stella Farrington

Delivering the goods

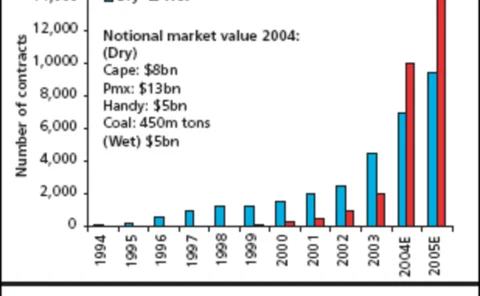

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports

BNP Paribas strengthens energy derivatives team

French bank BNP Paribas has strengthened its commodity derivatives team in New York, London and Singapore, particularly on the energy side.

Nymex, Icap to launch gas, crude oil daily settlement derivatives

The New York Mercantile Exchange (Nymex) and inter-dealer broker Icap are to launch an electronic market in same-day over-the-counter (OTC) options on prompt-month settlement prices for crude oil and natural gas. Starting on Monday (July 18), the…

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Keep it simple, stupid

Do you prefer sophistication or simplicity? Neil Palmer takes a look at optimisation methods in energy modelling and asks if energy quants aren’t sometimes being a little too heavy-handed

Some brokers taking wrong approach to freight, says senior broker

Inter-dealer brokers could be taking the wrong approach by entering the freight derivatives market through joint ventures with physical shipping brokers rather than directly broking physical freight, says a senior energy broker.

Struggling for growth

All three Canadian energy exchanges – NGX, Watt-Ex and NetThruPut – are finding it slow-going with their expansion plans. Meanwhile the rivalry between NGX and Watt-Ex is growing. Joe Marsh reports

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh