Risk management

A look in the rear view

Utilities and regulators often disagree over the purpose of energy price risk management. Manitoba Hydro's recent experience with backtesting its hedging strategy is a case in point

Any fool can do it

Some quant techniques are easier than you might think. In the second part of his set of ten tips and tricks for aspiring energy quants, Neil Palmer shows why..

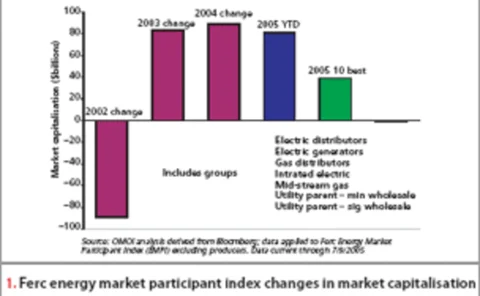

2005 in review

The energy markets were a dynamic place to be in 2005, with high volatility and an explosion of new players hitting the scene. Inevitably, though, it wasn't all smooth sailing. Energy Risk looks back over the highs and lows of 2005, from the launch of…

Coal turns a corner

Asian coal-trading is still proving a tough nut to crack. But the underlying market is developing, and a growing need for better risk management suggests it is only a matter of time before a paper market takes off

Utilities shift towards longer-term hedging

US and Canadian regulated utilities are increasingly looking to put on longer-term hedges, even more than three years out in some cases. Such was one of the findings of an informal survey of the audience at a utility risk-management conference in Chicago…

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

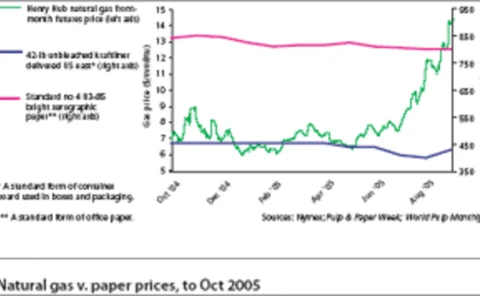

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

Top tips and dirty tricks

You don't have to be a genius to work as a quant - though it helps - but you do have to know a few tricks of the trade. So where should aspiring energy quants start? Neil Palmer offers some suggestions

A matter of principal

Developing term structure models can be tricky, as unknown factors and non-observable variables can affect futures prices. But principal components analysis is useful in tackling these problems. Here, Delphine Lautier uses PCA to pin down price movements…

Credit in the limelight

Today's business climate is pushing credit risk higher up the risk management agenda, as our Energy Credit Risk conference in New York showed. Stella Farrington reviews the event

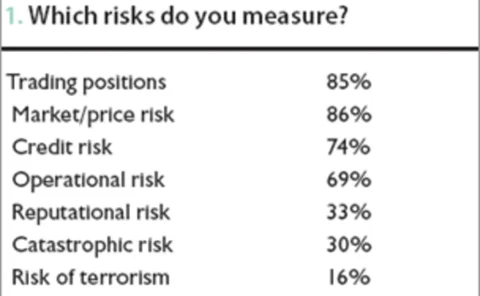

Top of the agenda

Energy Risk's inaugural risk management survey reveals what you consider the biggest challenges, greatest fears and chief problems facing risk managers today, and what changes you would like to see in the future

The right of refusal

Traders have learned that giving away free financial options can be costly. However, free options can take many forms. Brett Humphreys and Tamara Weinert discuss the value of a risk management option that can easily be given away

Decisions, decisions

Where next for the price of a barrel of oil? It’s an important question for producers and consumers, for whom managing oil price risk has never been more crucial. Oliver Holtaway finds that the answer to that question is not necessarily ‘up’.

Doctor’s orders

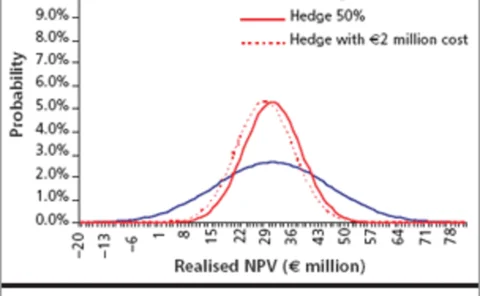

Should you try to hedge a physical asset by simply selling its expected output? Neil Palmer shows how, in some scenarios, either under- or over-hedging could make more sense

The hedging effect

The effect of hedging on a project’s net present value can be difficult to determine. Brett Humphreys shows how different types of hedging affect the distribution and the expected return of a project

Taking the screen test

Screen trading is spreading faster than ever in the energy markets and market dynamics are changing as a result. Do interdealer brokers in the market see this advance as a threat or an opportunity? Stella Farrington finds out

Raising the standard

Growth in energy trading has led to a need for better standardisation of contracts and integration of exchanges and trading hubs. But more needs to be done to simplify and streamline the trading process, says Wolfgang Ferse

Amerex's Prokop joins Energy Data Hub board

The Energy Data Hub has appointed Mike Prokop, senior vice president at energy brokerage Amerex, to its board of directors.