Market risk

A fact of life?

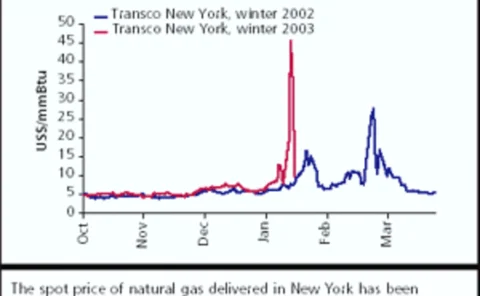

Can the price risks associated with abnormally cold winter temperatures and theirimpact on short term energy demand be predicted ahead of time? Logical InformationMachines’ Sandy Fielden investigates recent freezing temperatures in Boston,Massachusetts

String theory

Abstract: The complete understanding of forward price dynamics is a fundamentaltopic in commodity markets, and there have been many studies on the relationshipbetween spot and forward commodity prices. Here, GiorgioCabibbo and StefanoFiorenzani offer a…

Rethinking regulation

Market manipulation and inaccurate pricing led to the reregulation of Ontario’s electricity market. But at the right price, the Canadian province may see a revival of competition, reports CatherineLacoursière

Cautious comeback

Global consultancy PricewaterhouseCoopers says the slump in global merger andacquisition deal activity in the energy sector may have bottomed out and confidencecould be starting to return. By Joe Marsh

The big picture

Focusing only on measuring VAR and stress tests limits the role of the risk manager.And there are great benefits from a wider view of what risk management can achievefor a company. By Brett Humphreys

The cost of good data

The US-based Committee of Chief Risk Officers plans to propose voluntary standardsfor energy price reporting later this year, in the hope of ruling out any needfor mandatory standards. Joe Marsh reports

Golden procurement

The new energy procurement rules are designed to boost reliability and injectsome confidence back in to California’s ailing power market. But not allagree that they will keep California’s lights on. By CatherineLacoursière

Nybot in Nymex sights, but IPE rumours are put on ice

Nymex is rumoured to be interested in acquiring Ice. Here, in an exclusive interviewwith Energy Risk, Nymex president Bo Collins suggests the exchange may also besetting its sights elsewhere. By James Ockenden

Bank of America settles for $17.85m in weather derivatives lawsuit

For four years, Bank of America has been seeking recompense for a weather derivatives deal written by the now-defunct CWWIA. Finally, the bank has settled its case. By Paul Lyon

Calpine scraps $2.3 billion loan and junk bond sale

San Jose-based Calpine last month cancelled a $2.3 billion secured term loan and secured notes offering. Its wholly owned subsidiary, Calpine Generating (CalGen) Company (formerly Calpine Construction Finance Company II ) cancelled its offerings due to…

New entrant set to supply gas in UK

A new natural gas marketer, HydroWingas, received European Commission approval in early February to supply gas in the UK. The 50-50 joint venture between Norwegian energy, aluminium and chemicals group Norsk Hydro and German gas company Wingas says it…

Bob Anderson

Former chief risk officer with El Paso, Bob Anderson now heads the Committeeof Chief Risk Officers full time. By James Ockenden

Innovation of the year & Exchange of the year

Winner: Nymex

House of the year – electricity

Winner: EDF Trading

Energy risk manager of the year

Winner: BP

Risk manager of the year – retail

Winner: Reliant Energy Solutions

Storms ahead

Weather traders in Europe are celebrating the issuance of an innovative catastrophe bond by EDF. Meanwhile, US traders are concerned over attempts to regulate weather risk contracts as insurance, rather than derivatives. By Paul Lyon

Storage strategies

Abstract: Salt-dome storage facilities are a flexible way to take advantage of arbitrage opportunities in the natural gas market. Kislay Sinha and colleagues at Arizona Public Service discuss the valuation of a storage asset, examine ways of capturing…

Trading techniques

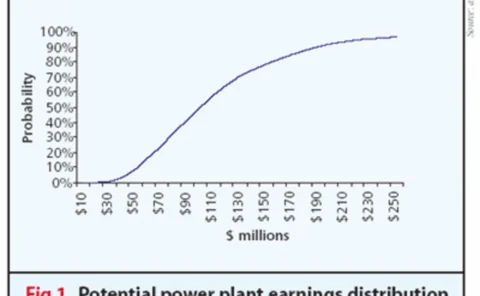

Abstract: A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit…

Taking the slow road

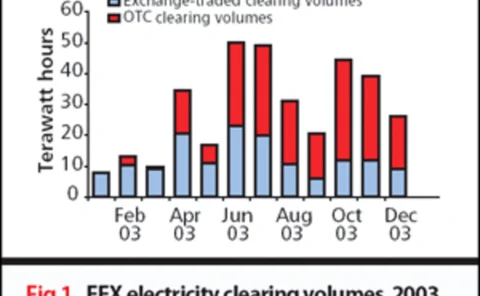

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Upwardly mobile

As energy prices creep upward, many factors are driving the markets. The upward trend and increased volatility is continuing as the markets evolve and mature. But are these markets operating efficiently and accurately, or are they being manipulated, as…