Market risk

Danish state-owned energy company signs up to Allegro

The Danish State-owned energy company, Dansk Olie og Naturgas (Dong), has signed up to use Allegro Development’s trading and risk management software for its natural gas operations.

IPE hires Fredrik Voss

Fredrik Voss, one-time chief executive of the UK power Exchange, is to join the London-based International Petroleum Exchange (IPE), as director of market development.

OTC weather trades fall; exchange trades rise

The weather derivatives market is shifting from an over-the-counter (OTC) market to an exchange traded one, according to the 2004 Weather Risk Management Association (WRMA) survey.

Nymex fires opening shots for ICE

Nymex has made a $150 million cash bid for the Atlanta based Intercontinental Exchange (ICE), and would also pay $67 million for shareholders of the International Petroleum Exchange (IPE), according to a senior Nymex official. The bid, which includes…

Entergy and Koch consider selling energy trading business

New Orleans-based Entergy Corporation and Wichita’s Koch Industries today said they are considering selling their energy trading business Entergy-Koch Trading (EKT).

Covering all the bases

Abstract: Many articles have discussed constructing models for either spot or forward prices. Yet none cover the whole process of constructing a joint model for both. Here, Andreas Huber and Monika Krca develop a multi-factor model that captures both the…

CFTC director resigns

Michael Gorham has resigned from his post at the US Commodity Futures Trading Commission (CFTC), effective June 30. Gorham was recruited by CFTC chairman James Newsome to become the first director of the Commission's Division of Market Oversight (DMO) in…

Long wait to market

Plans to create a small natural gas exchange in Russia highlight the complicationsof gas sector reform – arriving at realistic tariffs, finding new reservesand organising transport to name a few. Maria Kielmas reports

Natural gas storage swaps catch on

London-based GFI has brokered its first over-the-counter (OTC) swap based on US natural gas inventory data, between Houston-based hedge fund Centaurus and another unnamed hedge fund. Centaurus also traded a second such swap on the same day, with an…

Trayport alliance to offer streamlined trading

Trayport, the software company behind trading platform GlobalVision, has entered into an alliance with Excelergy Corporation to offer a flexible package combining Excelergy’s trading and retail solutions with Trayport’s front-end energy trading platform.

CCRO and S&P form liquidity working group

The US Committee of Chief Risk Officers (CCRO) has established a working group along with rating agency Standard & Poor’s (S&P) to define the most effective metrics integral to assessing the liquidity demands of energy supply and wholesale marketing…

Managing manipulation

Sharon Brown-Hruska, commissioner of the Washington, DC-based Commodity FuturesTrading Commission, talks to Paul Lyon about the need for sensible, rather thanover-bearing, energy derivatives regulation

Spring loading

Abstract: In May’s Expert Series, LesClewlow and Chris Strickland discussedthe use of Monte Carlo simulation in energy risk management and introduced aseries of models that they argued were suitable for the simulation of energy-and weather-dependent…

The fuel of the future?

Could coal as a source of electricity generation be back on the monitors of many US utilities? Logical Information Machines’ Sandy Fielden looks at the reasons behind higher coal prices in the country and considers whether coal can really compete in the…

Ken Gustafson

Shell Trading is enjoying the influx of new energy market players. JamesOckenden talks to Ken Gustafson , head of its deal structuring unit in Houston

US puts trust in Canadian finance

Canadian income trusts have been trading at all-time highs. Now that the Canadiangovernment is allowing bigger players onto the market, interest from US energyfirms in such vehicles is growing. By Catherine Lacoursiere

Baltic Exchange forms asset derivatives advisory group

The London-based Baltic Exchange has formed an independent advisory group to enhance the emerging market for ship vessel asset derivatives. The group consists of key users, derivative brokers and physical panellists and will act as an information…

Houston happenings

Regulatory pressures, asset valuation and price reporting were just a few of the topic areas covered at Energy Risk’s USA conference in Houstonlast month. Here Paul Lyon rounds up some of the conference highlights

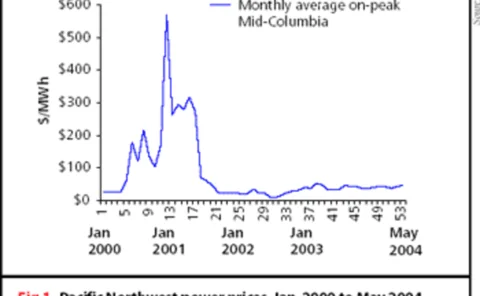

Northwest in excess

The Bonneville Power Administration’s power buyback scheme to tackle electricity shortages in the US Pacific Northwest in 2001 has worked rather too well. The region was left with bankrupt aluminium producers and a surplus of power that is not proving…

Hedging on the fly

In the first of a series of articles profiling energy users and their risk managementstrategies, we take a look at Texas-based Southwest Airlines, one of the mostactive hedgers in the aviation industry. By Joe Marsh

IPE puts back relaunch of power futures

London’s International Petroleum Exchange (IPE) has put back its relaunch date for UK electricity futures – it will now start listing them by the end of September. The exchange had originally intended to launch the contracts around the end of this month.

BoA’s head of energy trading lands at hedge fund

Julian Barrowcliffe, formerly global head of energy trading for Bank of America in New York, has joined Vega Asset Management – a New York-based hedge fund with $11 billion under management. In his new role Barrowcliffe will manage a commodities trading…

TXU and CSFB form energy trading company

Dallas-based TXU has entered into a joint partnership with Credit Suisse First Boston (CSFB) to create an independent entity to market and trade power, natural gas and other energy-related commodities in North America.