Market risk

A slow recovery

Recent research carried out by Fitch Ratings says the energy merchant sector has made great strides towards solving its near-term liquidity woes. But there is much work still to be done, finds Paul Lyon

Tech for gas turmoil

An adaptable straight-through processing system is crucial if natural gas marketparticipants are to stay profitable despite continuing price volatility, saysOpenLink International’s Jean-Claude Riss

Gas prices hit fertiliser industry

North American fertiliser producers are struggling for survival, thanks to the high cost of natural gas. Some have turned to hedging and pre-purchasing their gas, but such measures may not be sufficient. Paul Lyon reports

Russian roulette

European and US oil companies are tipped to be big investors in Russia’s oil market. But while rewards could be great, any decision to invest in thecountry will be fraught with difficulties. Paul Lyon reports

Competing at the highest level

BP is fast becoming as well known for its risk management services as it is as a global energy company.

Lands of confusion

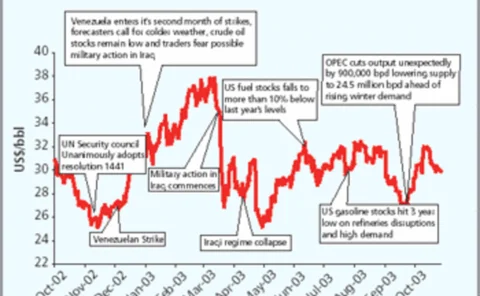

Oil production uncertainties in Iraq and political doubts in Russia and Venezuelaare keeping crude prices well above historical averages. MariaKielmas reports

Opec keeps a tight grip

The latest production quota cut by the Organisation of Petroleum Exporting Countries has forced prices up, but will crude oil producers in Europe and elsewhere co-operate to help them stay up? EricFishhaut examines the situation

Upstream sector gets flexible

The oil exploration and production sector is transforming its thinking and trying to become more flexible by using portfolio management models, finds Maria Kielmas

Trading crude blows

Banks and oil majors alike are building up their oil derivatives operations, vying to attract the same corporate client base. But the oil companies do notseem unduly concerned about the competition, finds Paul Lyon

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Profiting from gas prices

Rachel Jacobson of energy information and software provider Fame looks at how natural gas prices are likely to rise and what firms can do to protect against them

Eyeing the pricing

US energy regulators are keeping an ever-more-watchful eye on gas and power price reporting – but are they finally flexing their muscles appropriately? Paul Lyon reports

The great gas price divide

US natural gas prices may be volatile, but is there a real need to worry? Some participants blame the New York Mercantile Exchange for price spikes and worry about the future, while others see no problem with the market’s health. By Paul Lyon

The politics of betting

Using markets to forecast political events may not be as strange an idea as it seemed in July, when a terrorism futures scheme collapsed. But there is still scepticism as to whether such an approach would be ethical or effective. By Maria Kielmas

Rothschild enters oil risk sector

Heading the senior team is Martin Fraenkel, previously managing director of JPMorgan Chase's global commodities group in London. Fraenkel has recruited hissenior team from outside Rothschild. KamalInvestment bank Rothschild has entered the oil risk…

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

To store or not to store

Here we describe the optimal operation and valuation of gas storage based on a real option methodology. Using Zeebrugge gas prices as a practical example, Cyriel de Jong and Kasper Walet clarify the optionality in gas storage, analyse its valuation and…

Gas supply problems persist

Natural gas prices are likely to remain high, as the Bush administration’s efforts to open up new sources of supply continue to face opposition. Kevin Foster reports

US gas squeeze hits power

Tight natural gas supplies in the US are adding to worries over reliability of electricity supplies, says Richard McMahon of the Edison Electric Institute

Power to the European gas markets

Interesting developments in theEuropean gas markets mean that 2003proving to be a good year.Luca Baccarini, managing director ofGaselys and market expert, looksforward to profitable times

Chicago Mercantile Exchange to list European weather contracts

The Chicago Mercantile Exchange (CME) has started offering European weather derivatives, referenced on five cities’ temperatures.

Barrier to entry

Bank of America and UBS are still trying to overcome obstacles that could prevent them entering physical power trading in the US. Federal Energy Regulatory Commission regulations represent the biggest obstacle. Paul Lyon reports