Market risk

Pieter Verberne

Pieter Verberne, Amsterdam PowerExchange’s (APX) chief operatingofficer, is a busy man. The Dutchexchange is finalising the technologyupgrading of its recent acquisitions, naturalgas exchange Enmo and Automated PowerExchange, both based in the UK. It is…

Switching off to save cash

High electricity price volatility over the European summer has raised awareness of interruptible power contracts, finds James Ockenden

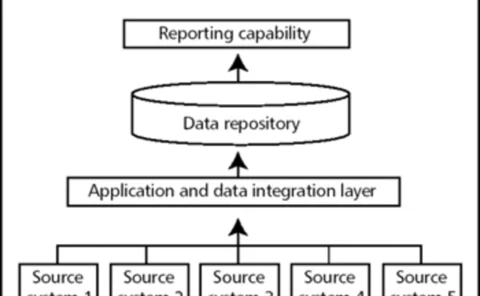

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Hedge out on the highway

US haulage firms seem to be making little use of risk management tools to mitigate high fuel prices. But parcel carriers are taking the initiative, finds Kevin Foster

Allegheny reduces trading exposure with contract sale

Maryland-based Allegheny Energy has reduced its exposure to energy trading by selling an energy supply contract to a subsidiary of Goldman Sachs for $405 million.

People swaps

BOC’s Mortimer to join European energy users’ body Hugh Mortimer, commercial manager at UK industrial group BOC, has been invited to join the board of the International Federation of Industrial Energy Consumers Europe (IFIEC). He will replace David…

Taiwan’s growing risk appetite

Relying on imports for most of its energy requirements and constrained by the government’s view that risk management is gambling, how can Taiwan tackle the challenge of price risk in its growing energy sector? By David Hayes

Water faces rising costs

UK water utilities are expecting rising electricity and environmental costs as they and their regulator prepare for the next five-year price review. Maria Kielmas reports

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

WRMA to campaign on data and against normalisation

Lynda Clemmons, president of the US Weather Risk Management Association (WRMA), is to sit on an American Meteorological Society (AMS) panel to address issues in the weather industry involving weather data and public-private partnerships.

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

Both sides of the fence: a statistical and regulatory view of electricity risk

Ernst Eberlein and Gerhard Stahl analyse price series of 25 energy spot rates simultaneously using Lévy models. This model class allows the capture of stochastic behaviour of these financial instruments. The implications of this analysis will form the…

Isda and EEI collaborate on Power Annex

The New York-based International Swaps and Derivatives Association (Isda) and US trade body the Edison Electric Institute (EEI) published a North American Power Annex to the Isda Master Agreement in August.

Warming to the exchanges

Weather derivatives may not be the most widely traded product on exchanges, but new initiatives and strong trading volume at the Chicago Mercantile Exchange bode well for the development of a mature exchange-traded market. Paul Lyon reports

Joining up the markets

The Amsterdam Power Exchange has recently developed a market-coupling system. This spot market system supports international trading – linking two independent markets based on area-based elasticity curves, it also allows flexible block orders

Gas hubs jockey for position

The Bunde-Oude natural gas hub on the German-Dutch border is the most likely candidate to become the Henry Hub of Europe, according to a survey of European natural gas experts conducted by Maycroft Consultancy Services

The derivatives burden

Former International Petroleum Exchange official Chris Cook looks at the issues raised at a debate on the future of the European energy markets at the end of London’s Derivatives Week event. The regulatory burden on firms took centre stage

Correction – Allegro: The following text should have been included in the software vendor directory in last month’s (July) issue.

Allegro Development has provided energy firms with transaction and risk management software solutions for almost 20 years. Founded in 1984, Allegro provides an industry-leading set of customisable energy software components for companies including…

How to be top of the class

Brett Humphreys discusses the attributes that combine to create a best-in-class market risk management division within an energy company

Vincent Annunziata

During his time as a senior commodities trader and risk analyst, Vincent Annunziata noticed an alarming trend: like any other trading outfit, his company was prone to human error. He was working for Phibro – formerly the commodities trading division of…

The search for spot

Strong demand for US liquefied natural gas is accelerating the development of an active global spot market and pricing benchmarks, as Catherine Lacoursière discovers

UK energy brokers form association

Nine brokers operating in the over-the-counter energy markets in the UK formed the London Energy Brokers’ Association (LEBA) in July.

From a gas crunch to a crisis

In this month’s Market Focus, GlobalView Software takes a look at the factors contributing to the current US natural gas crunch, which is drawing the attention of major political and financial figures