Market risk

Price wars

Ferc is preparing to analyse the results of its survey on energy price reporting.But the American Public Gas Association is concerned that a voluntary reportingscheme cannot guarantee reliable indexes. By Paul Lyon

Thomas Brooks

Thomas Brooks, president of Constellation Power Source, outlines his contributionto the Constellation Group’s success. By Joe Marsh

Reliably informed

Pat Wood, chairman of US interstate energy regulator the Federal Energy RegulatoryCommission, talks to James Ockenden about reliability, regulation, and wherenext for the competitive market in the US

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

ESB wins Esso price battle

Esso and Ireland’s Electricity Supply Board entered into a seemingly straightforward15-year contract for the sale and purchase of natural gas in 1999. But the contracthas raised the issue of how to define ‘market price’. By James Ockenden

The right charge

Savvy firms now accept risk is inevitable. Those that use their risk capitalefficiently outperform those that don’t. Brett Humphreys looks at alternativeinvestments to find out what the right risk-adjusted return on capital chargesmight be

Energia selects SunGard’s Entegrate ZaiNet

Energia, part of the Viridian Group, has selected SunGard’s Entegrate ZaiNet for the straight-through processing and risk management of its physical and financial power and gas contracts.

Dollar distress

Scottish Power has announced a £400 million cash windfall through its currencyhedging programme. Others have not been so lucky – but everyone is nowwaking up to currency trading. By James Ockenden

The matrix

Abstract: Portfolio-wide risk management requires a model that accounts correctlyfor the volatility of, and the correlations between electricity forward products.In this paper Kjersti Aas and KjetilK°aresen discuss a joint model for electricityforward…

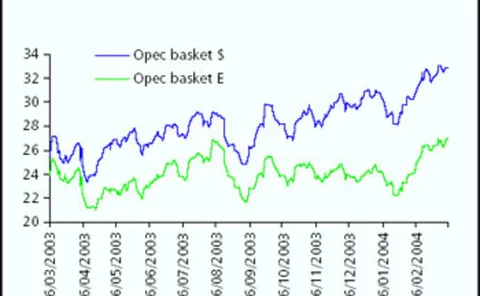

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

Using a square peg

Hedging load exposures is a complex issue, and plumping for hedging the expectedvolume is unlikely to be the best solution. Brett Humphreys and RahulGill showthat sometimes, the best hedge of a shaped position is an over-hedge

ESB wins Esso price battle

A high court judge has rejected claims by Esso it should be allowed to raise the price of gas supplied to Ireland’s Electricity Supply Board (ESB) on the basis of prices reported in the Heren Report .

Skating on thin Ice

Profits at the Intercontinental Exchange fell by more than half last year thanksto a contraction in over-the-counter revenues. Yet the exchange reports recordvolumes for its IPE business. Paul Lyon analyses the results

A fertile future

The CME is hoping its introduction of fertiliser futures will protect the industryfrom fluctuations in the price of natural gas – a vital ingredient in mostnitrogen fertilisers. But is it a case of too little too late? By Paul Lyon

Trading places

Canada’s energy landscape is being reshaped. The NGX has changed handsand looks set to expand. Meanwhile, an Ontario government report warns more workneeds to be done to secure future power supplies. By Paul Lyon

Louise Kitchen

Growth potential is what makes Louise Kitchen tick, and she relishes the chanceto build up UBS’s energy trading team. By James Ockenden

New clearing system for Nordic market

Nord Pool Clearing, the clearing organization for the Nordic power exchange Nord Pool, has launched a new clearing system for the electricity derivative market. OM Technology is the system provider.

De Vitry elected to Isda board

Benoit de Vitry, London-based global head of commodities and emerging markets rates at Barclays Capital, has been elected to the board of the International Swaps and Derivatives Association (Isda).

Welcome to the Energy Risk awards 2004

The fourth annual Energy Risk awards recognise excellence and innovation in the field of risk management. And to mark the ever-changing face of the industry, Energy Risk has added three new awards this year.

RMS releases updated Climetrix weather trading system

Risk Management Solutions (RMS), a California-based provider of products and services for the management of natural hazard risk, today released version 4.0 of its Climetrix weather derivatives trading and risk management system.