Market risk

Keep it simple, stupid

Do you prefer sophistication or simplicity? Neil Palmer takes a look at optimisation methods in energy modelling and asks if energy quants aren’t sometimes being a little too heavy-handed

Belgian power exchange to launch early 2006

The Belgian day-ahead electricity market is due to start in early 2006 on the Belgian power exchange (Belpex) in a link-up with Dutch power exchange APX and French energy exchange Powernext. This is the first time three power exchanges will be linked…

Some brokers taking wrong approach to freight, says senior broker

Inter-dealer brokers could be taking the wrong approach by entering the freight derivatives market through joint ventures with physical shipping brokers rather than directly broking physical freight, says a senior energy broker.

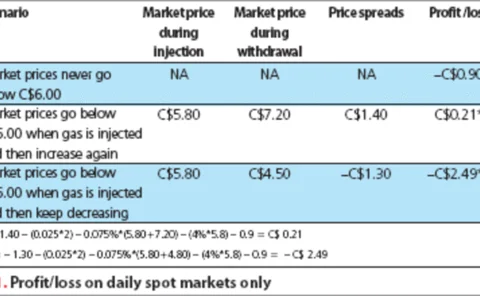

Storage strategies

Companies are increasingly realising they can use natural gas storage to add value to their bottom line. TransCanada’s Farzan Nathoo weighs up the strategies available for optimising value through storage

Struggling for growth

All three Canadian energy exchanges – NGX, Watt-Ex and NetThruPut – are finding it slow-going with their expansion plans. Meanwhile the rivalry between NGX and Watt-Ex is growing. Joe Marsh reports

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Banking on tankers

Logical Information Machines’ Sandy Fielden provides an analyst’s perspective of new opportunities for freight risk management with a specific focus on the crude (dirty) tanker trade from the Caribbean to the US Gulf

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

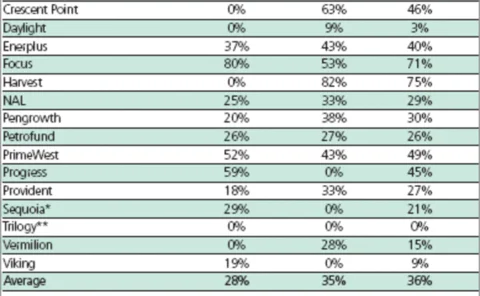

Trusts gain traction

Canadian oil and gas companies are rushing to convert to royalty trusts, despite the stigma some attach to them. This is good news for the energy-hedging market, but some still have reservations about the trust sector. By Joe Marsh

Editor

"With oil prices at record highs, energy is set to remain key in strategic decision making"

Training the tiger

Derivatives are finally beginning to gain wider acceptance in Taiwan, but senior executives remain wary, associating them with the collapse of Barings and, more recently, China Aviation Oil’s huge trading losses, finds David Hayes

GFI launches oil and gas broking in London

Inter-dealer broker GFI has opened a London desk to broke crude and gas oil derivatives, including options, the company announced yesterday.

European Commission to examine energy-sector competition

The European Commission (EC) today launched an inquiry into competition in natural gas and electricity markets, in response to concerns from consumers and new market entrants about the development of wholesale markets and limited consumer choice.

Trayport connects with IPE

London-based trading systems provider Trayport has entered into an independent software vendor partnership with London’s International Petroleum Exchange.

Nymex to form Dubai oil futures exchange

The New York Mercantile Exchange (Nymex) and Dubai Holding are to form the Dubai Mercantile Exchange (DME) to trade sour crude and fuel oil in early 2006, the New York exchange announced today.

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

Nord Pool names new head of financial markets, launches new contract

Oslo-based electricity exchange Nord Pool has made two new appointments and is about to launch a new contract for hedging the power price difference between the German and Nordic power markets.

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

Editor

"The FFA market offers enough arbitrage opportunities to have a hedge-fund manager in clover"