Market risk

The risks of E&P

After two years of soaring oil prices, oil majors are still building low oil-price forecasts into future investment plans. Is this sound risk management, or are they being too risk averse? By Stella Farrington

BEAU TAYLOR

Beau Taylor , global head of energy at JP Morgan, plans to turn the bank from a niche participant into a dominant player in the energy markets. By Joe Marsh

Buyer and seller beware

As a busy M&A period looms in the US utility sector, a wave of power plant sales seems likely. But those looking to hedge the fuel supply to these assets will find it tricky, given the current volatile gas prices. By Joe Marsh

Doctor’s orders

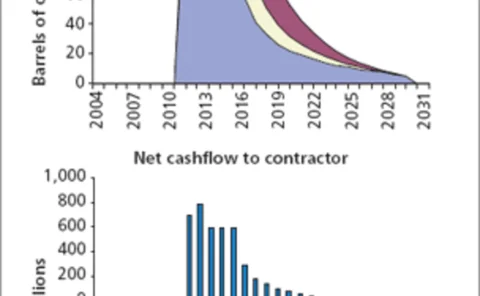

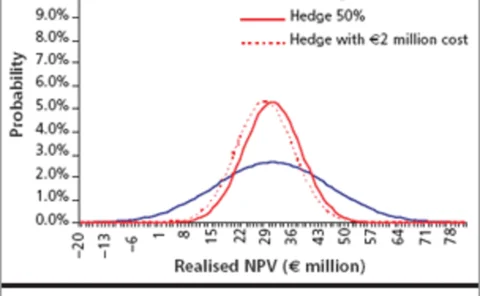

Should you try to hedge a physical asset by simply selling its expected output? Neil Palmer shows how, in some scenarios, either under- or over-hedging could make more sense

The hedging effect

The effect of hedging on a project’s net present value can be difficult to determine. Brett Humphreys shows how different types of hedging affect the distribution and the expected return of a project

Taking the screen test

Screen trading is spreading faster than ever in the energy markets and market dynamics are changing as a result. Do interdealer brokers in the market see this advance as a threat or an opportunity? Stella Farrington finds out

Raising the standard

Growth in energy trading has led to a need for better standardisation of contracts and integration of exchanges and trading hubs. But more needs to be done to simplify and streamline the trading process, says Wolfgang Ferse

Exceptions to the rule

Norwegian independent power portfolio managers are concerned that an impending EU directive may split the country’s power market and put them at a disadvantage. Oliver Holtaway reports from Oslo

Amerex's Prokop joins Energy Data Hub board

The Energy Data Hub has appointed Mike Prokop, senior vice president at energy brokerage Amerex, to its board of directors.

Risk management key for freight, says Baltic Exchange chief

Baltic Exchange chief executive Jeremy Penn has stressed the importance of risk management at a forum of freight derivatives brokers and traders this week.

LCH.Clearnet launches OTC clearing for freight derivatives

LCH.Clearnet has launched an OTC clearing service for the forward freight agreements (FFAs).

Nymex pit opens in London

Some 76 individuals and 12 companies showed up to trade Brent and gas oil futures on the first day of trade at the New York Mercantile Exchange’s London trading floor today (Monday).

Bear Stearns and Calpine form energy marketing and trading company

Investment bank Bear Stearns and California-based power company Calpine Corp have formed an energy marketing and trading venture focused on physical natural gas and power trading and related structured transactions.

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

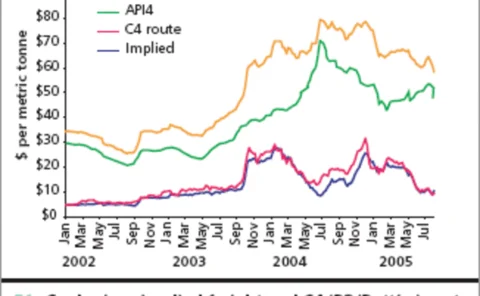

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

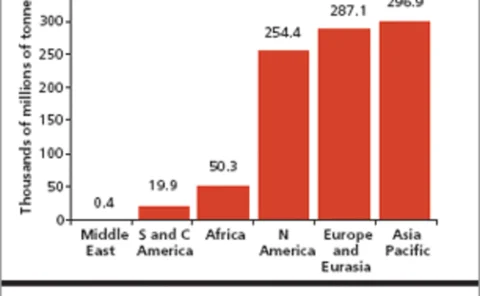

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

Coal facing changes

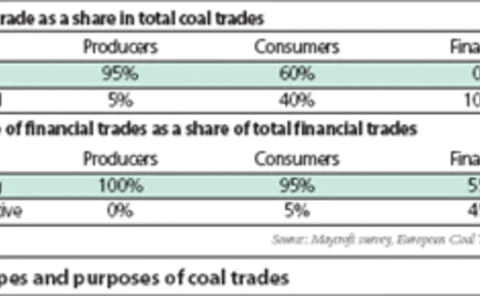

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Seasonal surprises

Understanding how price relationships fluctuate on a seasonal basis is critical for risk managers. During 2005, two of the longest lasting seasonal patterns in the US oil markets have been turned on their heads. Sandy Fielden explains the patterns and…

Understanding Sam

The Samuelson Effect – backwardation in the term structure of forward volatility – can lead to valuation inaccuracies. In capturing the Samuelson Effect in energy derivatives valuation, analysts have tried both historical approaches and those that rely…