Market risk

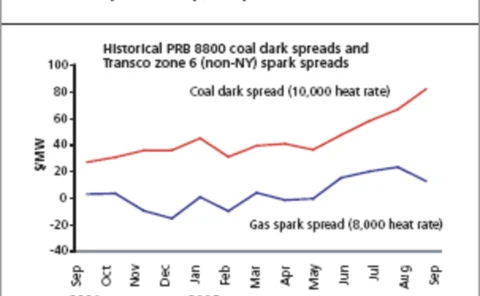

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

National Bank of Canada reunites heavy hitters for energy push

National Bank of Canada (NBC) has expanded its energy derivatives team in Calgary with three new managing directors, with the aim of attracting more utility and energy-consumer customers.

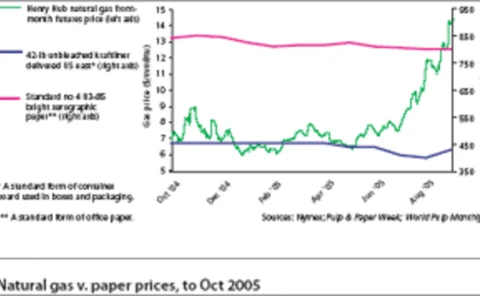

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

Top tips and dirty tricks

You don't have to be a genius to work as a quant - though it helps - but you do have to know a few tricks of the trade. So where should aspiring energy quants start? Neil Palmer offers some suggestions

A matter of principal

Developing term structure models can be tricky, as unknown factors and non-observable variables can affect futures prices. But principal components analysis is useful in tackling these problems. Here, Delphine Lautier uses PCA to pin down price movements…

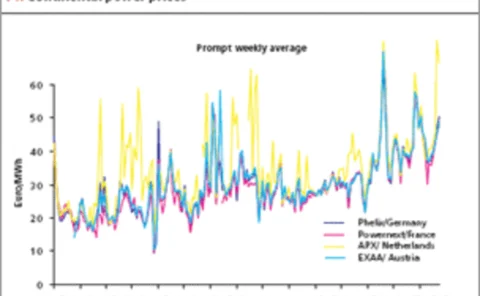

Playing power games

Thanks to increasing consolidation, it seems the country-specific energy exchange will soon be a thing of the past in Europe. But is this level of competition premature?

Congestion charges

As the US' premier regional transmission organisation, PJM Interconnection's pricing and transmission congestion models must be foolproof. Sandy Fielden describes how they work and the associated risk management mechanisms available to participants

The right of refusal

Traders have learned that giving away free financial options can be costly. However, free options can take many forms. Brett Humphreys and Tamara Weinert discuss the value of a risk management option that can easily be given away

Regulating Germany

Matthias Kurth was appointed Germany's first energy regulator in June of this year. The decisions he makes as the new Federal Network Agency president will be felt throughout European energy markets. He speaks to Oliver Holtaway

Francis Van Der Velde

Francis Van Der Velde of Brussels-based Fuel Purchasing & Consulting is more aware than most of the pain airlines are suffering

How long will the shopping spree last?

China appears set on a programme of foreign energy asset acquisition. Maria Kielmas looks into the implications for the energy industry

Carbon complexities

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann

Energy trading helps JP Morgan post record results

Energy-trading revenues played a big role in bringing JP Morgan a 2005 third-quarter net profit of $2.5 billion, up from $1.4 billion in 2004. This was on the back of third-quarter net revenues of $15.6 billion, up from $13.6 billion in the same period…

Endex lists Belgian power forwards

Dutch electricity exchange Endex started listing Belgian power forwards today. Belgian utility Electrabel and German utility Essent did the first trade today, a November baseload contract.

BP Singapore chooses Oilspace’s Oilwatch

Global energy major BP’s Singapore division is implementing Oilspace’s Oilwatch, a web-based portal for real-time, aggregated energy prices, news and analytics. BP Singapore is rolling out the service across the Asia-Pacific region.

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

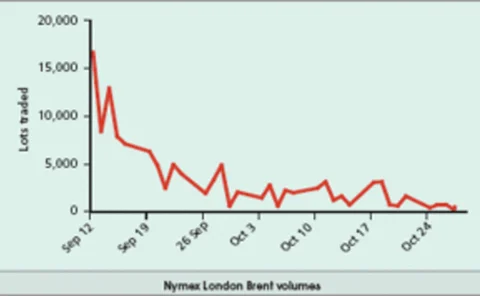

Decisions, decisions

Where next for the price of a barrel of oil? It’s an important question for producers and consumers, for whom managing oil price risk has never been more crucial. Oliver Holtaway finds that the answer to that question is not necessarily ‘up’.

Don’t blame Opec

As well as urging Opec to open up international access to its reserves, politicians in large oil-consuming nations should be encouraging investment in new refinery capacity, writes David Hufton

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next