Enterprise risk

Editor's letter

It's that time of year again - the Energy Risk awards! As well as honouring the deserving winners, our awards write-ups offer a selection of case studies which chart the latest developments, innovative thinking and strategies in this dynamic sector.

Taking stock of SOX

Sarbanes Oxley has wide-ranging implications for US power companies on how they use, and record their use of, market data, writes Sandy Fielden

Joined-up risk assessment

The nature of risk is changing. Energy companies, well-skilled in managing market risk and operational risks, may now need to adopt a new stance towards risk management, write Rohit Bhapkar, Roland Rechtsteiner and John Stroughair

GlobalCoal wins injunction against Icap

The Court of Appeal in London today awarded GlobalCoal an interim injunction against Icap Energy in a dispute over an alleged breach of GlobalCoal’s product licence agreement (PLA), pending trial. GlobalCoal may now seek damages.

Air India starts fuel hedging

Air India has become the first airline in India to hedge its jet fuel price risk, using commodity derivatives contracts at the end of February for the first time.

Stella Farrington

Stella Farrington talks to thierry daubignard about what prepared him for life as the new CEO of Gaselys

Leading the energy software revolution

The ETRM software industry is enjoying a long-awaited boom, meaning exciting developments are in store for energy trading and risk management, writes Stella Farrington

E.ON bids $35 bn for Endesa

German power and gas company E.ON has announced a $35 billion (29.1 billion euro) bid for Spain’s largest power company Endesa.

FPL/Constellation merger could be tip of iceberg

High gas prices look set to usher in a wave of fresh consolidation in the utility sector, as companies strive to save costs

Possible CME move for Nymex muddies the waters

The Chicago Mercantile Exchange's potential bid for a stake in the New York Mercantile Exchange could further heighten tensions at Nymex over the agreed deal with General Atlantic. That's if the CME comes up with a concrete proposal

Nuclear fusion R&D

In 50 years, nuclear fusion may be a major source of energy, but until then extensive research and development is needed. To justify the current and future R&D expenditure, a cost-benefit analysis designed specially for this sector is required. David…

Package deals

Banks have been choosing off-the-shelf fully integrated systems for energy trading and risk management. But some feel the available software still falls short

Rights and resources

Doing business in a country with a poor human rights record can be costly, thanks to the changing landscape of corporate liability and human rights. Maria Kielmas reports

New GlobalView head makes u-turns on hubs

Contrary to reports in September, new GlobalView chief Steve Gott says he remains committed to the Energy Data Hub and ConfirmHub ventures. Following a management overhaul, it seems it is business as usual

CFO Burns to leave Mirant after Chapter 11

Michele Burns, who has overseen the recent Chapter 11 restructuring of US energy marketer Mirant, will leave the company once it has emerged from bankruptcy.

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

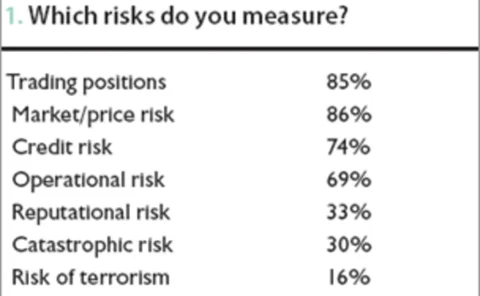

Top of the agenda

Energy Risk's inaugural risk management survey reveals what you consider the biggest challenges, greatest fears and chief problems facing risk managers today, and what changes you would like to see in the future