The risks of E&P

oil

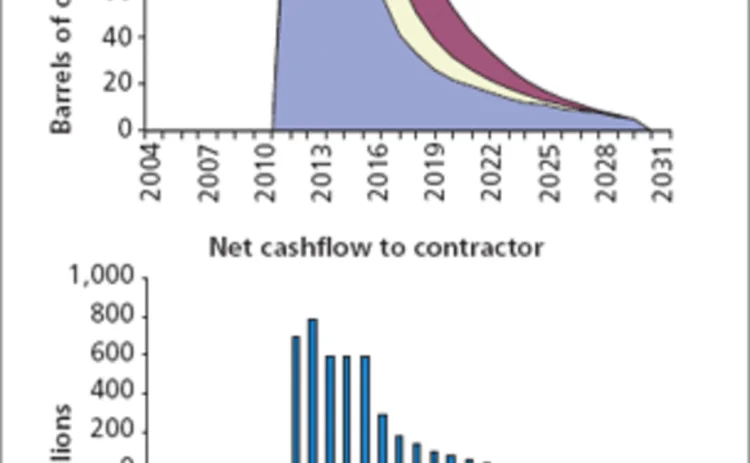

While US crude futures have averaged over $50 a barrel so far in 2005, most oil majors are still using a price estimate of around $25 a barrel for assessing whether a potential new E&P project will be profitable.

As a result, many of today’s potential projects – most of which are in expensive deep water or technically challenging areas

More on Oil & refined products

Energy Risk reaction: Venezuela and oil sanctions

Energy Risk talks to Rob McLeod at Hartree Partners about the energy risk implications of the US’s control of Venezuelan oil

Energy Risk Europe Leaders’ Network: geopolitical risk

Energy Risk’s European Leaders’ Network had its first meeting in November to discuss the risks posed to energy firms by recent geopolitical developments

US shutdown leaves commodity traders without key data

Commodity traders are ‘flying blind’ without Commitment of Traders reports

Energy Risk at 30: Learning from the past

Energy Risk looks back at the seminal events and developments that have shaped today’s energy markets

Why Iran tensions failed to rattle markets

Despite initial fears, traders say risks were signposted and investors had deleveraged after April

Oil and products house of the year: Macquarie Group

Energy Risk Awards: Bank pioneers innovative deals in illiquid markets, taking on esoteric risk

Podcast: should negative oil prices be allowed?

Did negative oil prices signify the market was operating effectively, or that something was wrong?

Podcast: the future of retail investment in oil

Will negative prices and big losses curb retail investors’ appetite for oil futures over the longer term?