Energy

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

EU adopts linking directive...

The European parliament has given the thumbs-up to the so-called linking directiveallowing companies within member states to benefit from emissions projects outsideof the EU. By James Ockenden and Paul Lyon

Governments face carbon allocation legal action

European governments face legal action from industry if they fail to provide carbon allocation plans by the end of the year, according to Peter Vis of the climate change unit of the European Commission.

EU adopts linking directive for emissions trading

The European parliament today voted to adopt the directive linking the European Union emissions trading scheme to other trading systems and CO2 reduction projects. The parliament agreed on a text for the linking directive earlier this month.

Crude protection

Oil producers are divided over the value of hedging oil prices. Are investorslooking for high returns and high risk, or more stable revenues? And how muchdoes hedging actually boost an oil producer’s value? By Joe Marsh

European companies outline concerns over emissions trading

Corporates are expressing concern at the ramifications of the European UnionEmissions Trading Scheme – just as EU member states finalise their nationalallocation plans. By Paul Lyon

Norway's Statoil sets up emissions trading unit

Norwegian energy company Statoil has formed a unit for trading carbon dioxide emissions. The Oslo-based firm said: “The Norwegian emissions trading regime will govern Statoil’s involvement in the purchase and sale of carbon quotas.”

Deutsche asks SEC to clarify guidelines

Deutsche Bank claims the SEC’s guidelines for estimating oil reserves are outdated. And Shell, unsurprisingly,also believes that the SEC should clarify its reserve rules. By Joe Marsh

Statoil and Alex Kvaerner swap chief executives

Helge Lund has joined Norwegian energy company Statoil as chief executive, replacing acting CEO Inge Hansen. Hansen replaces Lund as CEO of one of three divisions of newly restructured Norwegian industrial group Aker Kvaerner.

Nybot in Nymex sights, but IPE rumours are put on ice

Nymex is rumoured to be interested in acquiring Ice. Here, in an exclusive interviewwith Energy Risk, Nymex president Bo Collins suggests the exchange may also besetting its sights elsewhere. By James Ockenden

Bank of America settles for $17.85m in weather derivatives lawsuit

For four years, Bank of America has been seeking recompense for a weather derivatives deal written by the now-defunct CWWIA. Finally, the bank has settled its case. By Paul Lyon

Taking the slow road

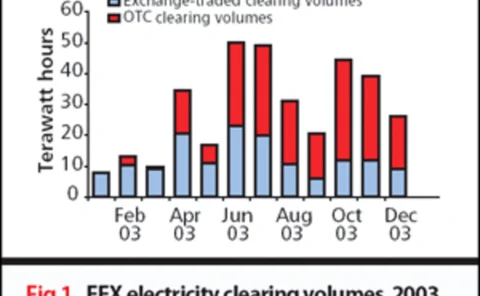

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch’s energy trading business. He has now pleaded guilty to a $43 million fraud. Paul Lyon reports

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

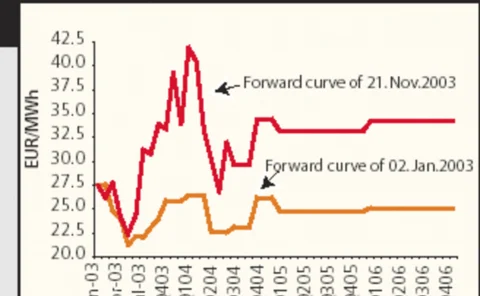

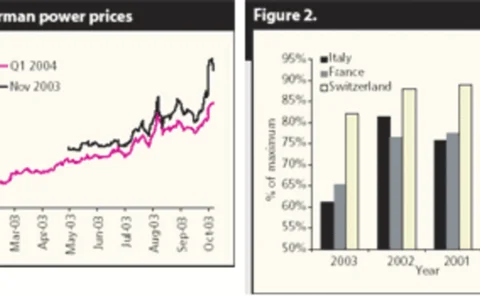

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon