Energy

Fortis to enter energy trading with Xenon

Fortis Financial Services, the market trading affiliate of Fortis Bank, has selected Sakonnet Technology's Xenon trading and risk management application for its new energy trading activities in New York.

Banks make first Isda emissions trade

Investment banks Dresdner Kleinwort Wasserstein and Fortis Bank have made the first ever trade of European Union emission allowances (EUAs) using an annex to the International Swaps and Derivatives Association (Isda) Master Agreement.

Tepco hedges weather

The Tokyo Electric Power Company (Tepko) has entered into weather derivatives contracts with both Tokyo Gas Company and Osaka Gas Company. The deals have been finalised in a bid to limit the effect on Tepco’s earnings from summer temperature conditions,…

WRMA elects new president

The Weather Risk Management Association (WRMA) today said that its vice president, Brian O’Hearne, has stepped up to serve as the association’s president. O’Hearne is also president and chief executive of Kansas City-based GuaranteedWeather.

Europe unprepared for emissions trading

The European Emissions Trading Scheme (ETS) will not begin on time, and will fail to deliver the promised results, according to a survey by Ernst & Young.

Danish state-owned energy company signs up to Allegro

The Danish State-owned energy company, Dansk Olie og Naturgas (Dong), has signed up to use Allegro Development’s trading and risk management software for its natural gas operations.

OTC weather trades fall; exchange trades rise

The weather derivatives market is shifting from an over-the-counter (OTC) market to an exchange traded one, according to the 2004 Weather Risk Management Association (WRMA) survey.

Nymex fires opening shots for ICE

Nymex has made a $150 million cash bid for the Atlanta based Intercontinental Exchange (ICE), and would also pay $67 million for shareholders of the International Petroleum Exchange (IPE), according to a senior Nymex official. The bid, which includes…

Long wait to market

Plans to create a small natural gas exchange in Russia highlight the complicationsof gas sector reform – arriving at realistic tariffs, finding new reservesand organising transport to name a few. Maria Kielmas reports

Amerada Hess forms LNG division

US energy company Amerada Hess has formed a joint venture with an affiliate of New York-based Poten & Partners, to be known as Hess LNG. The joint venture will be based at Amerada's New York headquarters and will pursue investments in liquefied natural…

Baltic Exchange forms asset derivatives advisory group

The London-based Baltic Exchange has formed an independent advisory group to enhance the emerging market for ship vessel asset derivatives. The group consists of key users, derivative brokers and physical panellists and will act as an information…

Nymex president to quit

Bo Collins, president of The New York Mercantile Exchange (Nymex), will leave the exchange at the end of this month. Nymex said the decision not to renew his contract was by made by "mutual agreement."

BoA’s head of energy trading lands at hedge fund

Julian Barrowcliffe, formerly global head of energy trading for Bank of America in New York, has joined Vega Asset Management – a New York-based hedge fund with $11 billion under management. In his new role Barrowcliffe will manage a commodities trading…

Where gas is keener

Fearing its competitiveness is slipping, the Canadian natural gas industry islobbying for pipeline rates of return and tax policies on a par with the US.By Catherine Lacoursière

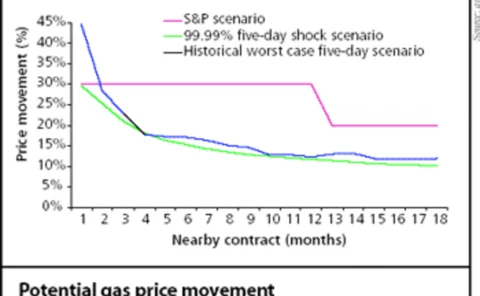

A poor standard

Rating agency Standard & Poor’s has recently released guidelines totest liquidity that could be an efficient probe into company finances. BrettHumphreys looks at how S&P has arrived at its calculations, asks if the liquiditymeasures are too conservative…

A natural standard

In the first part of a two-part series, Agnes Bizet and KevinWulwik highlightthe main issues to consider when trading under Isda’s European Gas Annex,including a close look at default events

Customerservice

Gas trading technology vendors are finding that continued market volatility is attracting clients keen to manage their exposures. But new entrants are forcing them to pick a model and stick with it. By Paul Lyon

Made in America

Bank of America has arguably built one of the most successful North American gas trading desks. Here Paul Lyon talks with Eric Nobileau, the bank’s global head of commodity sales

Wine bar hedges weather

UK-based Corney and Barrow Wine Bars has entered into a group wide weather derivative hedge with XL Trading Partners, the Connecticut-based weather risk management company.

Nymex introduces trading in western electricity futures

The New York Mercantile Exchange (Nymex) is to introduce trading in four western electricity futures contracts, based on Dow Jones Electricity Indexes, on its ClearPort electronic platform beginning with the June 4 trading session, which starts at 3:15…

Price reporting is improving, says CCRO director

Confidence in the energy markets is returning partially thanks to an improvement in the price reporting practices of energy companies, according to Robert Anderson, executive director of the US-based Committee of Chief Risk Officers (CCRO).

Nymex to clear contracts on OTC oil and gas options

The New York Mercantile Exchange (Nymex) and broker Icap are set to launch an electronic market in options on oil and gas inventory statistics. The over-the-counter options will be offered through an auction process and cleared by Nymex.

Fair weather future

Judging from the success of the weather risk market in the Asia-Pacific region,the Chicago Mercantile Exchange couldn’t have picked a more opportune timeto launch Japanese weather futures. By Paul Lyon