Energy

Russian roulette

European and US oil companies are tipped to be big investors in Russia’s oil market. But while rewards could be great, any decision to invest in thecountry will be fraught with difficulties. Paul Lyon reports

Competing at the highest level

BP is fast becoming as well known for its risk management services as it is as a global energy company.

Lands of confusion

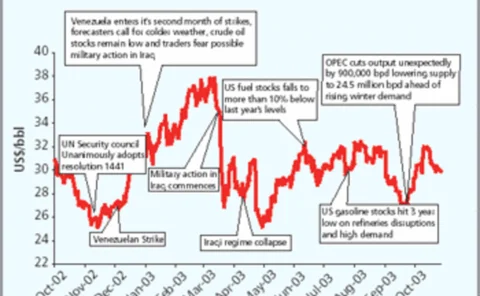

Oil production uncertainties in Iraq and political doubts in Russia and Venezuelaare keeping crude prices well above historical averages. MariaKielmas reports

Opec keeps a tight grip

The latest production quota cut by the Organisation of Petroleum Exporting Countries has forced prices up, but will crude oil producers in Europe and elsewhere co-operate to help them stay up? EricFishhaut examines the situation

Upstream sector gets flexible

The oil exploration and production sector is transforming its thinking and trying to become more flexible by using portfolio management models, finds Maria Kielmas

Trading crude blows

Banks and oil majors alike are building up their oil derivatives operations, vying to attract the same corporate client base. But the oil companies do notseem unduly concerned about the competition, finds Paul Lyon

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Profiting from gas prices

Rachel Jacobson of energy information and software provider Fame looks at how natural gas prices are likely to rise and what firms can do to protect against them

Eyeing the pricing

US energy regulators are keeping an ever-more-watchful eye on gas and power price reporting – but are they finally flexing their muscles appropriately? Paul Lyon reports

The great gas price divide

US natural gas prices may be volatile, but is there a real need to worry? Some participants blame the New York Mercantile Exchange for price spikes and worry about the future, while others see no problem with the market’s health. By Paul Lyon

To store or not to store

Here we describe the optimal operation and valuation of gas storage based on a real option methodology. Using Zeebrugge gas prices as a practical example, Cyriel de Jong and Kasper Walet clarify the optionality in gas storage, analyse its valuation and…

Gas supply problems persist

Natural gas prices are likely to remain high, as the Bush administration’s efforts to open up new sources of supply continue to face opposition. Kevin Foster reports

US gas squeeze hits power

Tight natural gas supplies in the US are adding to worries over reliability of electricity supplies, says Richard McMahon of the Edison Electric Institute

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

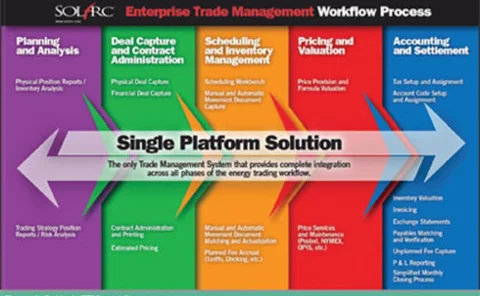

Capturing value from energy supply and trading

Companies that plan to engage in energy trading need to invest in the right personnel, processes and information management tools if they intend to be successful, says David Dunkin, SolArc’s Chief Strategic Executive

Making sense of the new power market

Bank of America’s Rogers Herndon and David Mooney examine expectations in the energy and power markets before and after the collapse of Enron and outline their predictions for the future

Trading natural gas futures with weatherfutures at the CME

Craig Jimenez and Mirant’s Vishu Kulkarni discuss how the burgeoning relationship between the natural gas futures market and the weather futures market is providing opportunities for traders, hedgers and speculators alike

Clearer waters for ratings

Despite a credit ratings crisis in the energy markets, the prognosis for natural gas companies looks stable, finds Shifa Rahman

Gas storage and power prices: inextricably linked

While much has been made of the effect of natural gas storage on gas prices, very little thought has been given to its impact on the price of electricity. John Hopper, president of Falcon Gas Storage Company, analyses the situation

Looking to the long term

After years of public debate, the European Commission, energy companies and governments of gas-producing countries all seem to agree that long-term gas contracts are here to stay. So why is it still such a big issue, asks Maria Kielmas