Energy

The ETS law is an ass

Consultant Chris Cook offers a sceptical view of the development of European emissions trading, and suggests a new global energy solution based on an alternative to the financial market paradigm

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

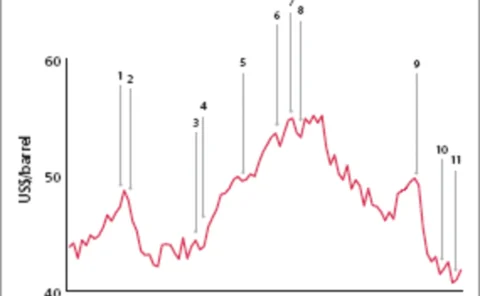

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

EnBW starts reporting CO 2 trades to EEX

EnBW Trading today became the eighth company to report its carbon emission trades to the European Energy Exchange (EEX) for the exchange’s CO 2 price index. EnBW Trading is a subsidiary of Karlsruhe-based German utility EnBW Energie Baden-Württembergin.

Oil price falls despite Opec cut

Oil prices fell Friday afternoon despite a decision by the Organisation of Petroleum Exporting Countries (Opec) to rein in current oversupply, effectively taking 1 million barrels a day off the market.

China Aviation Oil ceases oil derivatives trading

China Aviation Oil (Singapore) Corp has ceased all oil derivative trading activities after announcing a $550 million trading loss and seeking court protection from creditors last week, the company said late Wednesday.

Satya Capital sues China Aviation Oil

Indonesian firm Satya Capital Limited is suing China Aviation Oil (Singapore) Corp and it parent company China Aviation Oil Holding Company for over $28 million for an alleged breach of a share purchase agreement, CAO (Singapore) Corp said late Wednesday.

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

Mirant settles price-reporting charges

A subsidiary of Atlanta-based energy company Mirant has settled charges with the US Commodity Futures Trading Commission (CFTC) of false reporting of natural gas prices. The commission found that Mirant Americas Energy Marketing (MAEM) traders made false…

Back in power

As George W. Bush settles back into the White House for his second term, experts analyse the influence his energy and foreign policies may have on the energy industry both domestically and abroad. By Stella Farrington

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

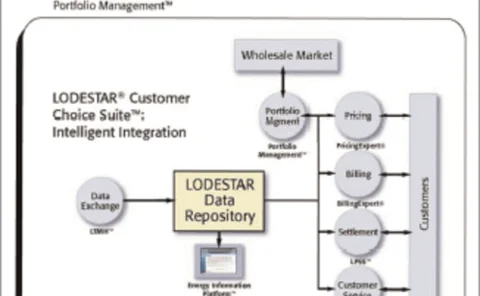

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

Balanced buying

Yijun Du and Xiaorui Hu present a general framework for applyingmodern portfolio theory to optimal natural gas procurements.They showthat successful natural gas procurement involves determining the optimalallocation between fixed-price and floating-price…

UK traded gas market: What with liquidity?

The last two months have been a difficult time for UK gas traders; but Philippe Vedrenne and Marc Lansonneur from Gaselys say conditions will improve, leaving a market that may be stronger than ever

Trading techniques

A majority of merchant power plants built during the last few years in the US are combined-cycle units fired by natural gas. This article discusses asset-backed trading strategies for a merchant single-block power plant, showing how unit dispatches can…

Ending the acrimony

Most utilities support hedging to mitigate price volatility, but are not sure how to communicate the benefits of hedging to their customers. Tim Simard of RiskAdvisory offers suggestions for improving the rate-hearing process

Changing of the guard

Changes to the European gas market may further attract financial players, and tighten the rules in case of physical supply disruptions. Meanwhile changes in the UK gas market may lead to clearing at the hub. By James Ockenden

Getting physical

Asset-backed trading strategies usually employ a combination of physicalpositions, which are subject to physical risk; and financial hedgingintruments, which are not. Here, Steve Leppard shows how value-at-risk,applied to this combined risk scenario, can…

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

London to be world carbon market centre

The UK’s early move into carbon emissions trading means London is now well placed to become a world centre for the emerging carbon market, UK Environment Minister Elliot Morley said Wednesday.

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

Static emissions price “does not reflect fundamentals”

The European emissions trading market, with its static price over the last four to five weeks, “is not a good market,” and does not reflect fundamentals, said Chris Rowland, managing director of utilities research at Dresdner Kleinwort Wasserstein.