Energy

LNG: handling flexibility risk

Even though the euphoria about the global liquefied natural gas market has dissipated, experts still forecast significant long-term growth. But in a buyer’s market the supplier has to understand the new risks. Maria Kielmas reports

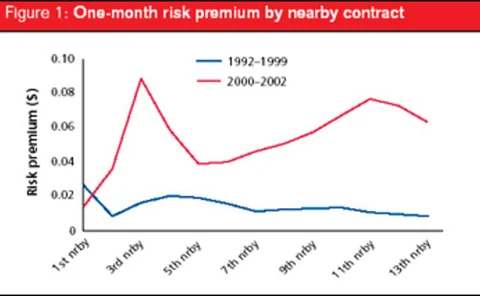

How to gain from risk premia

Brett Humphreys examines historic data for the natural gas market and finds smart traders could make money from hidden risk premia

Confusion over a barrel

The latest efforts to stem price manipulation have left crude oil market participants wondering which contracts they should be trading and who will lead the pricing? Joel Hanley reports

A towering success

There is more to the Malaysian oil and natural gas giant Petronas than its impressive headquarters. One of Asia’s biggest energy players is finding new ways of branching out, as Joel Hanley discovers

Green risks for the black stuff

The impact of environmental risk on oil companies may be substantial, says a new report by the World Resources Institute. What will the effect be on the oil majors’ stock prices? James Ockenden reviews the report

Brent changes promise stability

The recent change in Platts’ definition of Brent crude oil follows much debate about the price assessment of North Sea Brent crude. Software vendor Logical Information Machines takes a historic view in a search for the reasons behind the move

After the swashbucklers

Oil exploration today is about taking as few risks as possible, meaning the smaller independent firms are losing out to the energy majors, as Maria Kielmas discovers

Market mind games

The year has seen surprisingly high oil prices, which has caught many forecasters unaware given widespread predictions of slow growth. Maria Kielmas reports

High oil and gas prices enhancing credit quality

The ‘war premium’ is propping up oil and gas prices and oil firms’ balance sheets. But debt levels and quality of assets are still king. Catherine Lacoursière reports

Exchanges eye weather

New exchanges are entering the weather risk arena despite Liffe’s failure to successfully market its European weather futures. But while the US exchanges appear bullish, European entrants are treading cautiously. Paul Lyon reports

Getting a grip on the market

Innogy, a US energy company, is well placed to take advantage of the rewards that weather trading can offer. Eurof Thomas finds out the secret of its success

Aquila’s troubles could break emerging markets risk

Confusion at the weather derivatives operations of energy giant Aquila is having a knock-on impact on the development of weather products in emerging markets around the world. Paul Lyon reports

A change in atmosphere

The overall condition of the weather derivatives market is in flux, but there are still plenty of financial institutions who don’t mind a mixed forecast. By Navroz Patel, with additional reporting by Paul Lyon

Canada opens new pastures

Alberta’s Agricultural Financial Services Corp came to Aon with a special need to hedge precipitation risk, and Aon rose to the challenge. The transaction uses a unique index. Catherine Lacoursiere reports

European info squall to clear

At last, weather data is starting to become available in the European market, spurring growth in the weather derivatives market there. Paul Lyon reports

Tools for the trade

Ken Nichols examines the mechanisms available for incorporating credit risk management into an energy company’s portfolio

Higher or lower?

Kevin Foster looks at how credit rating agencies assign a rating to companies in the energy sector and what kind of factors are taken into account

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Growing quietly

The liberalised German markets now allow large industrial end-users to manage their energy price risk. But, while the competition to manage their exposures is large, these firms are playing their cards close to their chests, reports Joel Hanley

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

At home and abroad

Given its location at the centre of Europe, Germany is the key to any future pan-European energy market. But some of its leading companies have their eyes on markets beyond continental Europe, reports Robin Lancaster

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

Two hubs or one?

Independent traders are desperate for a hub that will provide real liquidity and help force the Ruhrgas-dominated German natural gas market to open to competition. Peter Joy reports