Feature

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

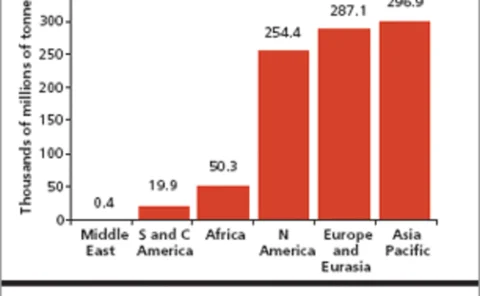

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

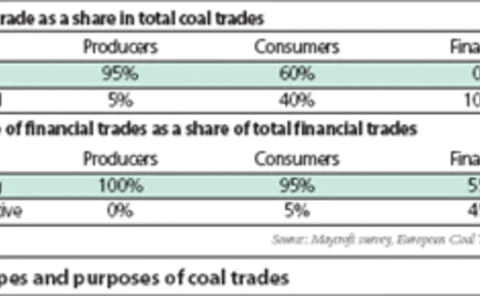

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

The scandal in Sudan

A fragile peace may at last have come to Sudan after 21years of civil war, but a bitter and unresolved dispute over oil exploration acreage in the south of the country couldendanger that peace. Report by Maria Kielmas

Pieces of a puzzle

To get enterprise-wide risk management to work, a firm needs to piece together the right models, processes and software – and the right attitude. US utility Allegheny Energy has done just that, finds Oliver Holtaway

Hoodwinked!

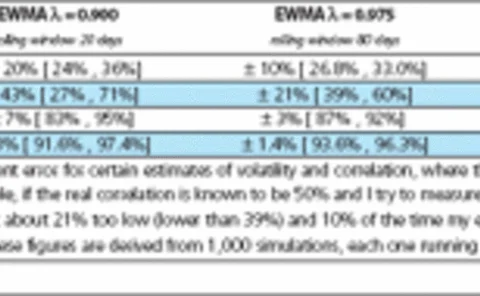

Have you got a good grip on your view of volatility and correlation? Neil Palmer shows that, thanks to ever -present measurement errors, even the steadiest markets can throw up big surprises

● Accounting standards ● Nordic energy

This month’s Energy Risk debate covers the topical issues of accounting standards, followed by an expert question and answer panel on the influential Nordic energy region

Getting a head-start

North American Energy Credit and Clearing may have gained an advantage by being the first to clear over-the-counter physical electricity contracts. But it still has to prove that it is reliable and efficient. Joe Marsh reports

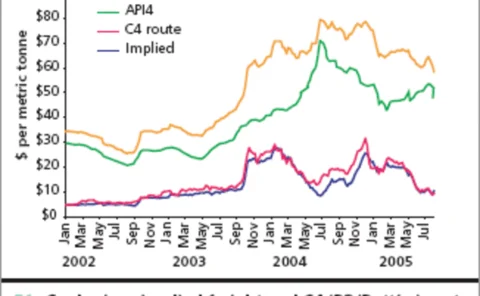

A revival of the coal business

The boom in world coal prices has not been sustained in 2005.Two industry experts, Alexandre Kervinio and Christopher Connelly, of Société Générale, look at the reasons why

The cost of power

The market in European Union emissions allowances is taking off, largely thanks to Nord Pool

GFI buys Starsupply

Interdealer broker GFI Group has agreed to acquire Starsupply Petroleum, a leading broker of oil products and related derivative and option contracts.

Great expectations?

Risk and expectation are two sides of the same coin. But could you quantify your own risk appetite? explores some ways to put a price tag on those hazards you can’t avoid Neil Palmer

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Growing up fast

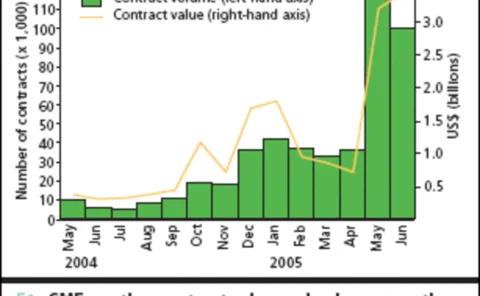

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

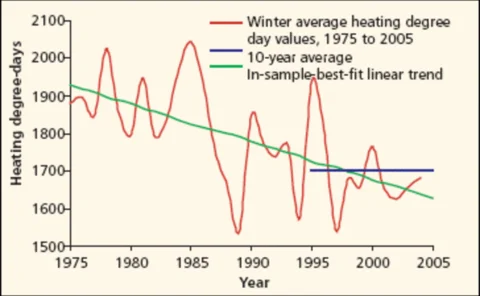

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Editor

"Although end-users seem slow to enter the weather space, hedge funds already see it as a hotspot"

Blowing hot and cold

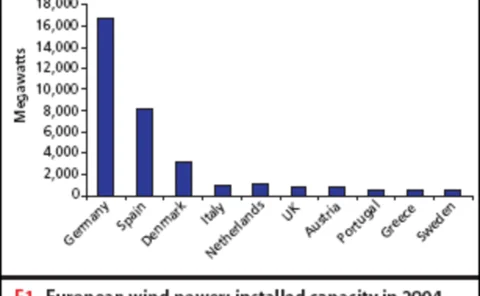

Across Europe, government enthusiasm and support for wind energy will dictate the ability for wind project sponsors to refinance project loans via the bond market. Jan Willem Plantagie of Standard & Poor’s explains

Weatherproofing the VAR

The weather derivatives market shares some similarities with other markets, but applying existing models can sometimes have disastrous results. Brett Humphreys and Eric Raleigh discuss how weather derivatives differ from financial derivatives and how we…

Growing up fast

Weather trading is seeing strong volume growth in the US, largely due to the influx of hedge funds into the market. Why such a big increase in interest, and what sort of strategies are the funds adopting? By Joe Marsh

Pipelines and politics

The latest in a long line of disputes over natural gas supplies from Russia is raising concern among utility customers and investors that future supplies to the West may be disrupted. But is this a long-term problem? Oliver Holtaway reports