Feature

The energy equation

Quantitative analysis in the energy industry is undergoing a crucial transition as it moves out of the role of secondary support to sit at the heart of business decision-making. Stella Farrington looks at its advance

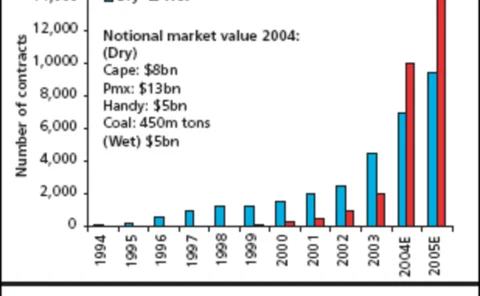

Delivering the goods

There’s huge scope for growth in the freight derivatives market, but to attract more players, existing participants need to adopt more innovative and sophisticated trading practices, participants say. Stella Farrington reports

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Keep it simple, stupid

Do you prefer sophistication or simplicity? Neil Palmer takes a look at optimisation methods in energy modelling and asks if energy quants aren’t sometimes being a little too heavy-handed

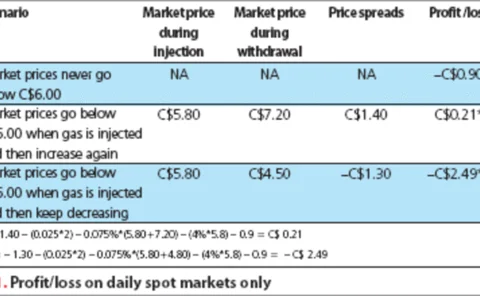

Storage strategies

Companies are increasingly realising they can use natural gas storage to add value to their bottom line. TransCanada’s Farzan Nathoo weighs up the strategies available for optimising value through storage

Struggling for growth

All three Canadian energy exchanges – NGX, Watt-Ex and NetThruPut – are finding it slow-going with their expansion plans. Meanwhile the rivalry between NGX and Watt-Ex is growing. Joe Marsh reports

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

A good time to build

US utilities may need to spend more than $100 billion in the next 25 years on new power plants and transmission capacity. Richard McMahon looks at how utilities are assessing long-term risks and attracting potential investors

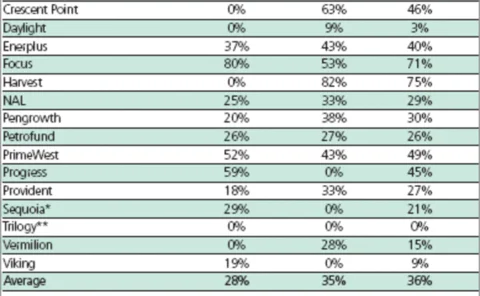

Trusts gain traction

Canadian oil and gas companies are rushing to convert to royalty trusts, despite the stigma some attach to them. This is good news for the energy-hedging market, but some still have reservations about the trust sector. By Joe Marsh

Emissions education

As the European carbon market continues to grow, so too do some unique challenges: not least the gap between retail and wholesale players and the problem of counterparty credit risk. Oliver Holtaway reports

The best of all worlds

Thanks to their varying scale, structure and diversity, European organisations often have very different solutions to risk management. But which system is the most effective? In an exclusive to Energy Risk, the European Energy Risk Forum offers a route…

A calculated gamble

After a promising start, Canadian carbon trading has slowed. The country has much work to do if it wants to get a domestic greenhouse-gas trading market running ahead of the 2008 Kyoto deadline. By Catherine Lacoursiere

Training the tiger

Derivatives are finally beginning to gain wider acceptance in Taiwan, but senior executives remain wary, associating them with the collapse of Barings and, more recently, China Aviation Oil’s huge trading losses, finds David Hayes

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Getting it together

The US Committee of Chief Risk Officers is proposing an energy data hub to improve price transparency in the natural gas market, but index publisher Platts is concerned over some aspects of the initiative. Joe Marsh reports

Staying one step ahead

Picking the right investment opportunities will never be a precise science, but a combination of global forecasting and risk management has enabled US Global Investors to become one of the most successful US mutual funds in the energy space. Its chief…

Shell:powering up

Shell Trading’s core values of honesty, integrity and respect for people define thecompany and how it does business

Strategies for success

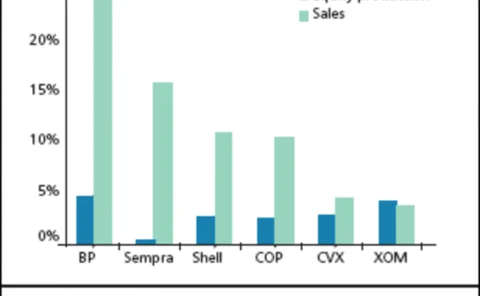

To succeed in the fast-changing US gas market requires an effective hedging and risk-management strategy. Accenture’s Alexander Landia , Paul Equale and Julie Adams look at what firms need to do to win in this key market

The dragon’s revenge

In the second article on the pitfalls of hedging, Neil Palmer considers one of the risks of managing options: dynamic hedging. He shows there is an awful lot that can go wrong in the quest for perfect risk elimination

North AmericanEnergy Forum

Leading energy market players discuss market trends, credit risk management and the future of the energy sector market, with a special focus on Canada

Stateside summit

Adding to the success of Energy Risk Europe in March, last month’s Energy Risk USA conference raised some lively debate. ERM, credit risk and the problems facing quant analysts were among the hot topics. Oliver Holtaway reports