Feature

Top tips and dirty tricks

You don't have to be a genius to work as a quant - though it helps - but you do have to know a few tricks of the trade. So where should aspiring energy quants start? Neil Palmer offers some suggestions

Off to a flying start

Aviation is one of the fastest growing sectors in terms of carbon emissions, but a move by the European Commission to include airlines in the EU's Emissions Trading Scheme has alarmed some in the industry

Credit in the limelight

Today's business climate is pushing credit risk higher up the risk management agenda, as our Energy Credit Risk conference in New York showed. Stella Farrington reviews the event

Playing power games

Thanks to increasing consolidation, it seems the country-specific energy exchange will soon be a thing of the past in Europe. But is this level of competition premature?

The right of refusal

Traders have learned that giving away free financial options can be costly. However, free options can take many forms. Brett Humphreys and Tamara Weinert discuss the value of a risk management option that can easily be given away

How long will the shopping spree last?

China appears set on a programme of foreign energy asset acquisition. Maria Kielmas looks into the implications for the energy industry

Carbon complexities

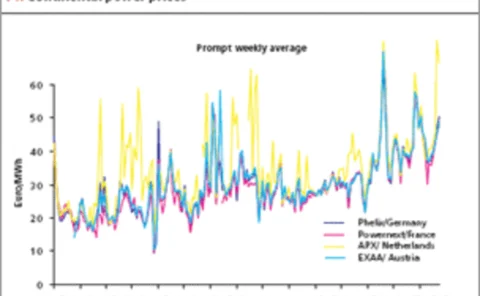

The EU ETS adds price complexity to European energy markets and the trend towards pan-European markets means far more complex models will be needed to model carbon risk, writes Bjorn Brochmann

UKPX to launch carbon spot contract on Climex

London-based energy exchange UKPX will co-operate with Dutch emissions exchange New Values to launch a UKPX spot contract for carbon emissions certificates.

Decisions, decisions

Where next for the price of a barrel of oil? It’s an important question for producers and consumers, for whom managing oil price risk has never been more crucial. Oliver Holtaway finds that the answer to that question is not necessarily ‘up’.

Marginal improvements

Despite reduced production in the wake of hurricane Katrina, no new US refineries are in the pipeline. Instead, refiners are operating at full tilt as they come under pressure to expand capacity. By Catherine Lacoursiere

Don’t blame Opec

As well as urging Opec to open up international access to its reserves, politicians in large oil-consuming nations should be encouraging investment in new refinery capacity, writes David Hufton

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

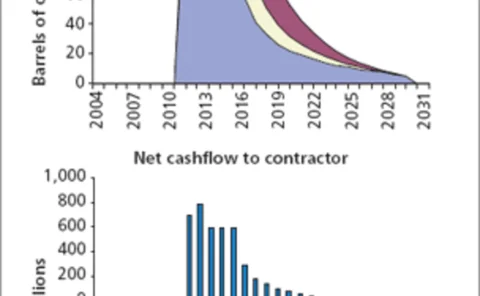

The risks of E&P

After two years of soaring oil prices, oil majors are still building low oil-price forecasts into future investment plans. Is this sound risk management, or are they being too risk averse? By Stella Farrington

Buyer and seller beware

As a busy M&A period looms in the US utility sector, a wave of power plant sales seems likely. But those looking to hedge the fuel supply to these assets will find it tricky, given the current volatile gas prices. By Joe Marsh

Shelter from the storm

Energy companies are showing increased interest in hurricane derivatives, a specialist product that can provide an additional layer of protection on top of insurance. Joe Marsh reports

Doctor’s orders

Should you try to hedge a physical asset by simply selling its expected output? Neil Palmer shows how, in some scenarios, either under- or over-hedging could make more sense

A glimpse of freedom

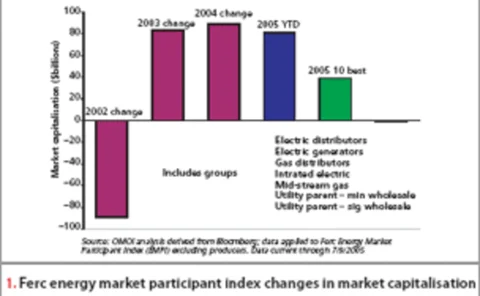

Merger and acquisition activity in the US utility sector, previously kept in check by the Public Utility Holding Company Act, could be set to swell with the repeal of this act in February, some analysts believe. By Oliver Holtaway

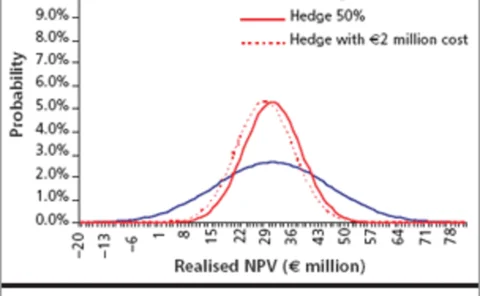

The hedging effect

The effect of hedging on a project’s net present value can be difficult to determine. Brett Humphreys shows how different types of hedging affect the distribution and the expected return of a project

Finance and faith

Islamic shari’a law may prohibit interest, but far from discouraging investment, shari’a-compliant structured project finance looks set to grow – particularly in the energy arena, as Maria Kielmas reports

Taking the screen test

Screen trading is spreading faster than ever in the energy markets and market dynamics are changing as a result. Do interdealer brokers in the market see this advance as a threat or an opportunity? Stella Farrington finds out

Raising the standard

Growth in energy trading has led to a need for better standardisation of contracts and integration of exchanges and trading hubs. But more needs to be done to simplify and streamline the trading process, says Wolfgang Ferse

Exceptions to the rule

Norwegian independent power portfolio managers are concerned that an impending EU directive may split the country’s power market and put them at a disadvantage. Oliver Holtaway reports from Oslo