Risk management

Demystifying credit risk

Satyan Malhotra, Fred Cohen and Rafael Cavestany formulate an analysis for the measurement of credit risk in the energy industry

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Heeding the warning signs

Following the Enron bankruptcy, the use of bond-spread analysis has become increasingly important. Mark Williams looks at how firms can benefit from it

Proper procedures

Rajiv Arora examines the processes necessary for effectively measuring, managing and hedging credit risks

Finding a solution to the credit problem

Peter Stockman of Accenture outlines what energy companies can do, internally, to manage credit more effectively and addresses the potential benefits of participating in a multilateral netting solution for the industry

Utilities renegotiate to survive

For the past 10 years, Argentina’s privatised utilities have been icons of successful energy sector reform. But with the country’s deepening crisis, they face increased difficulties. What can investors do to mitigate such risks, asks Maria Kielmas

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

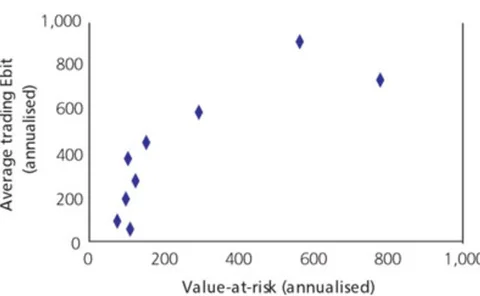

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Banks take shelter in derivatives

While some banks have found the weather derivatives market a non-starter, others are doing deals worth more than $100 million. Eurof Thomas reports

Quantifying technical analysis

In the last of our series of tutorials on risk management tools, Richard Weissman provides an overview of technical analysis for the energy business

At the end of the tail

When fat tails are present, extreme value theory provides a framework for estimating value-at-risk at higher confidence levels with greater accuracy than traditional Var methods. Naveen Andrews and Mark Thomas explain

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers

Building blocks for complex probability distributions

Brett Humphreys demonstrates how to construct more accurate return distributions and use them to price options

Counterparty concerns

Following the California crisis and the fall of Enron, energy firms are finally paying more attention to credit risk. Here Fred Cohen, Satyan Malhotra and Rafael Cavestany present some overarching issues senior management must address in implementing an…

Dealing with price risk

FAME Information Services outlines the main issues currently affecting power prices and looks at how companies should be covering themselves against the risks posed by the continuing process of deregulation

Navigating a troubled road

Don Stowers finds the online energy trading market place as competitive as ever, with several new platforms ready to enter the fray