Oil & refined products

Wachovia expands Calypso use to energy

US financial group Wachovia Corp is to expand its use of the Calypso system to include energy derivatives. Wachovia began trading oil and gas in February.

EnCana sells oil and gas assets for $395 million

Canadian exploration & production company EnCana Corp last Thursday sold oil and natural gas assets producing 16,800 barrels of oil equivalent a day (boe/d), to Harvest Energy Trust for US$395 million.

Banc of America Securities hires senior oil analyst

Banc of America Securities (BAS) yesterday hired Daniel Barcelo as a senior equity research analyst covering the global integrated oil sector. He joins the Bank of America subsidiary from rival bank Lehman Brothers and will be based in New York. He will…

Nymex and Shanghai Futures Exchange look to work together

The New York Mercantile Exchange (Nymex) and the Shanghai Futures Exchange (SHFE) have signed a memorandum of understanding to explore potential areas of cooperation which they say could mutually benefit the memberships of both exchanges.

Putin’s endgame

The geopolitical premium on oil prices is rising as Russia pursues its ‘oligarchs’. Catherine Lacoursiere reports on the wider effects of Russian oil giant Yukos’ collapse

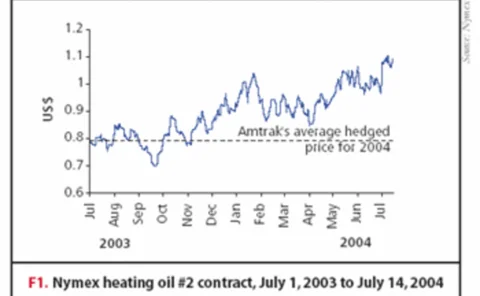

Dealings in diesel

In the latest in a series of articles in which Energy Risk profiles energy users’ risk management and hedging strategies, Joe Marsh talks to US rail company Amtrakabout how it deals with its fuel exposures

At ease with ethanol

Central Illinois Energy, a US farming co-op, is in the process of building anethanol plant. And it has already started to think about hedging, reflectingthe growing sophistication of the US ethanol market. PaulLyon reports

IPE hires Fredrik Voss

Fredrik Voss, one-time chief executive of the UK power Exchange, is to join the London-based International Petroleum Exchange (IPE), as director of market development.

Broker Prebon hires Innogy coal trader

London-based broker Prebon may have failed in its bid to lure three coal traders from fellow broker Icap, but it is continuing to build a coal team. In mid-May, Sharon Millar, who previously traded paper and physical coal at UK utility RWE Innogy, joined…

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Statoil and Alex Kvaerner swap chief executives

Helge Lund has joined Norwegian energy company Statoil as chief executive, replacing acting CEO Inge Hansen. Hansen replaces Lund as CEO of one of three divisions of newly restructured Norwegian industrial group Aker Kvaerner.

Innovation of the year & Exchange of the year

Winner: Nymex

House of the year – oil products

Winner: Koch Supply & Trading

House of the year – crude oil

Winner: Société Générale

Flying high

The US airline industry is struggling due to high jet fuel prices. Accordingly, one trade association is urging the Bush administration to change its oil purchasing strategy. By Paul Lyon

In pursuit of the eurobarrel

The markets say they do not want oil prices in euros. But denominating internationalcrude prices in euros is a political ambition the European Union seems determinedto pursue – starting with Russia. MariaKielmas reports

Life without MTBE

The changeover from the use of MTBE as a gasoline blending component, to ethanol,in New York State and Connecticut on January 1, 2004 is likely to lead to pricevolatility in the oil market and make risk management using the Nymex Unleadedcontract far…

Russian roulette

European and US oil companies are tipped to be big investors in Russia’s oil market. But while rewards could be great, any decision to invest in thecountry will be fraught with difficulties. Paul Lyon reports

Lands of confusion

Oil production uncertainties in Iraq and political doubts in Russia and Venezuelaare keeping crude prices well above historical averages. MariaKielmas reports

Opec keeps a tight grip

The latest production quota cut by the Organisation of Petroleum Exporting Countries has forced prices up, but will crude oil producers in Europe and elsewhere co-operate to help them stay up? EricFishhaut examines the situation

Upstream sector gets flexible

The oil exploration and production sector is transforming its thinking and trying to become more flexible by using portfolio management models, finds Maria Kielmas