Oil & refined products

Oil price falls despite Opec cut

Oil prices fell Friday afternoon despite a decision by the Organisation of Petroleum Exporting Countries (Opec) to rein in current oversupply, effectively taking 1 million barrels a day off the market.

China Aviation gets six week breather

China Aviation Oil (CAOSCO) has been granted a six week extension by the High Court of Singapore to its deadline to submit its scheme of arrangement restructuring plan, due today. The new deadline is January 21, 2005.

Satya Capital sues China Aviation Oil

Indonesian firm Satya Capital Limited is suing China Aviation Oil (Singapore) Corp and it parent company China Aviation Oil Holding Company for over $28 million for an alleged breach of a share purchase agreement, CAO (Singapore) Corp said late Wednesday.

Back in power

As George W. Bush settles back into the White House for his second term, experts analyse the influence his energy and foreign policies may have on the energy industry both domestically and abroad. By Stella Farrington

Ten years of trading

As an analyst and software designer who has spent the past ten years working closely with energy markets, Sandy Fielden had no problem identifying what had the most impact on his world in that time – technology. A regular Energy Risk contributor for some…

The Energy Risk Team

The Energy Risk team of 2004 (above) wishes to thank its loyal readers, advertisers, sponsors and contributors for supporting the magazine through 10 years of tremendous market development. James Ockenden looks back over its history

Evolution in energy

The price of oil has undoubtedly been the top story in the energy sector overthe past year or so, but examined over a period of 10 years, the picture looksmore stable. If there’s one trend that has changed the energy markets inthe past decade, it has to…

Benchmark in limbo

The development of a spot market for crude oil in the 1980s eventually led to oil futures trading and the need for benchmark pricing. With oil prices fluctuating wildly in the region in tandem with markets across the globe, theneed for price transparency…

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

Saudi to up oil output to 12.5 million b/d

Saudi Arabia’s total oil production capacity is now at 11 million barrels a day (b/d) and plans are in place to increase it to 12.5 million b/d, Saudi Arabia’s Minister of Petroleum and Mineral Resources, Mr Ali Al-Naimi, said Monday.

IPE members approved to trade on Ice OTC markets

The International Petroleum Exchange’s (IPE) registered brokers and local traders can now trade on IntercontinentalExchange’s (Ice) over-the-counter markets for their own accounts.

Gazprom completes Rosneft merger, appoints head of new company

Sergei Bogdanchikov will retain his job as chief executive of Gazpromneft, the new company formed yesterday by the merger of Russian gas monopoly Gazprom and state oil company Rosneft. He was previously head of Rosneft.

A slice of the IPE

The fate of the Nymex Brent contract launched this month in Ireland – an undisguised attempt to grab business from the IPE – will be determined by Christmas, say Dublin floor traders. By Stella Farrington

A slow squeeze

The oil price may have eased recently, but it remains high. What impact is this having on the global economy? Concerns remain for the long-term future of crude supply. Joe Marsh reports

A surprising future

High oil prices are not triggering as large an upturn in oil exploration as was first expected, with many questioning how long the current situation will last. But high prices are having some rather unexpected effects. By Maria Kielmas

Ex-citations

Cutting Edge is one of the most popular sections in Energy Risk – the only energy magazine to run a full referee service for the academic community. The number of papers submitted has blossomed since our first paper three years ago. Here, Anusha Roy ,…

Playing monopoly

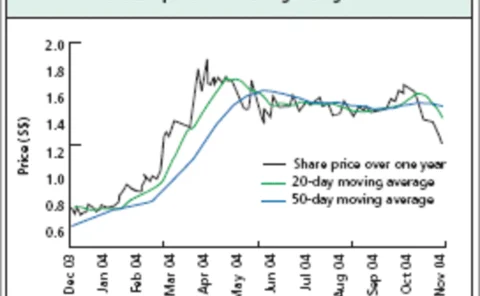

China Aviation Oil is well placed to benefit from China’s economic boom – thanks to its powerful jet-fuel supply monopoly. Yet there are still opportunities for those willing to develop new markets, finds James Ockenden

Kinder Morgan to buy more refined products terminals

US pipeline operator Kinder Morgan Energy Partners is to buy nine refined-products terminals from Georgia-based Charter Terminal Company and Charter-Triad Terminals for $75 million in cash and assumed liabilities. The deal is expected to close later this…

Nymex European launch imminent

Nymex aims to launch an open outcry exchange in Europe, most likely initially in Dublin using Nybot’s Finex facilities, according to president James Newsome.

Driving up the price

Nowhere has the spiralling cost of petroleum been more acutely felt than in the US, where the car is king. The rise is, of course, directly related to high crude oil prices, pushed ever higher by threats to production arising from worldwide political…

Shell completes sale of refined products pipelines

Shell Oil Products US has sold its major refined oil products pipeline systems to asset acquisition companies for $1 billion. Oklahoma-based Magellan Midstream Partners has paid $490 million for the mid-continent system, while Pennsylvania-based Buckeye…

Grain versus cane

Since Nybot listed a new futures contract for ethanol in May, the product hasemerged as a critical ingredient in US refining. Gasoline traders may find themselvesworrying about crop reports as much as they monitor Opec meetings and Nymex crude. Sandy…