Oil & refined products

Francis Van Der Velde

Francis Van Der Velde of Brussels-based Fuel Purchasing & Consulting is more aware than most of the pain airlines are suffering

How long will the shopping spree last?

China appears set on a programme of foreign energy asset acquisition. Maria Kielmas looks into the implications for the energy industry

BP Singapore chooses Oilspace’s Oilwatch

Global energy major BP’s Singapore division is implementing Oilspace’s Oilwatch, a web-based portal for real-time, aggregated energy prices, news and analytics. BP Singapore is rolling out the service across the Asia-Pacific region.

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

Marginal improvements

Despite reduced production in the wake of hurricane Katrina, no new US refineries are in the pipeline. Instead, refiners are operating at full tilt as they come under pressure to expand capacity. By Catherine Lacoursiere

Don’t blame Opec

As well as urging Opec to open up international access to its reserves, politicians in large oil-consuming nations should be encouraging investment in new refinery capacity, writes David Hufton

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

The cream of the crop

The employment market for oil and energy traders has been from one extreme to the other in a short space of time – especially in oil. Andy Webb looks at where the recruitment market is headed next

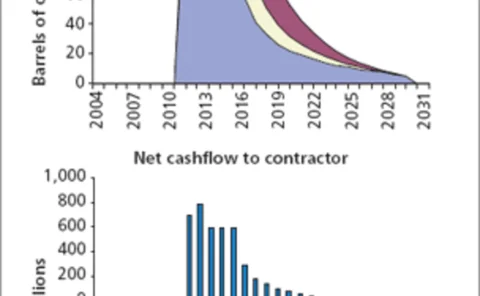

The risks of E&P

After two years of soaring oil prices, oil majors are still building low oil-price forecasts into future investment plans. Is this sound risk management, or are they being too risk averse? By Stella Farrington

Nymex pit opens in London

Some 76 individuals and 12 companies showed up to trade Brent and gas oil futures on the first day of trade at the New York Mercantile Exchange’s London trading floor today (Monday).

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

The scandal in Sudan

A fragile peace may at last have come to Sudan after 21years of civil war, but a bitter and unresolved dispute over oil exploration acreage in the south of the country couldendanger that peace. Report by Maria Kielmas

Seasonal surprises

Understanding how price relationships fluctuate on a seasonal basis is critical for risk managers. During 2005, two of the longest lasting seasonal patterns in the US oil markets have been turned on their heads. Sandy Fielden explains the patterns and…

Icap to acquire United Fuels International

Interdealer broker Icap is to acquire the majority of the assets of United Fuels International, a leading US-based energy broking business with 2004 turnover of $24 million.

GFI buys Starsupply

Interdealer broker GFI Group has agreed to acquire Starsupply Petroleum, a leading broker of oil products and related derivative and option contracts.

Lufthansa continues to save through fuel hedging

German airline Lufthansa has reported a increase in operating expenses of only 1.3% despite a big surge in fuel prices, partly thanks to its fuel-hedging strategy.

Calpine to sell US oil and gas assets for $1bn

Calpine Corp is to sell all its US oil and gas exploration and production assets for $1.05 billion to Rosetta Resources, a newly formed subsidiary of the California-based energy company.

Banking on tankers

Logical Information Machines’ Sandy Fielden provides an analyst’s perspective of new opportunities for freight risk management with a specific focus on the crude (dirty) tanker trade from the Caribbean to the US Gulf

Editor

"With oil prices at record highs, energy is set to remain key in strategic decision making"

GFI launches oil and gas broking in London

Inter-dealer broker GFI has opened a London desk to broke crude and gas oil derivatives, including options, the company announced yesterday.

Trayport connects with IPE

London-based trading systems provider Trayport has entered into an independent software vendor partnership with London’s International Petroleum Exchange.

Nymex to form Dubai oil futures exchange

The New York Mercantile Exchange (Nymex) and Dubai Holding are to form the Dubai Mercantile Exchange (DME) to trade sour crude and fuel oil in early 2006, the New York exchange announced today.

UBS expands energy group and starts trading oil in Canada

UBS Commodities Canada moved into larger Calgary offices in May to accommodate its expanding energy-trading team, including a shift into crude oil. The firm, part of investment bank UBS, has hired its first crude oil trader, its first options trader and…