Oil & refined products

Finian O’Sullivan

If anyone knows how to keep an oil company showing healthy profit, it’s FINIANO’SULLIVAN , chief executive of Burren Energy. EithneTreanor meets him

The future of the floor

There have been many reports and studies comparing open-outcry and electronictrading and advocating one platform or the other.With the IPE putting all ofits eggs in the electronic basket last month, it is a great time to analyse thesituation and ask the…

RWE Trading reorganises coal, oil and freight ops

Alex Thistlethwayte has joined RWE Trading, part of German utility RWE, as head of a new department, Global Commodities Trading. He was previously director of oil trading at Deutsche Bank in London and has also traded natural gas at BP. The move is part…

TFS continues expansion with Arc Oil purchase

Connecticut-based broker TFS is in fierce expansion mode: yesterday it announced its purchase of oil broker Arc Oil, an oil broker headquartered in Houston. This follows TFS’s recent opening of a Houston office and re-entering US coal and emissions…

Expect oil at $150 in a decade, Soros colleague warns

Jim Rogers, co-founder with George Soros of the Quantum Fund, has predicted oil will be at $150 within the next 10 years.

Battle for Brent rages on as open outcry closes at IPE

Open outcry at London’s IPE had its last day on Thursday, yet the debate over whether the screen can adequately replicate an oil market rages on, with IPE and Nymex both taking a punt on opposing beliefs.

Nymex to launch gas oil futures in Dublin

The New York Mercantile Exchange (Nymex) has said it will launch a northwest Europe gas oil futures contract in Dublin on Friday April 8.

Nymex launches gas oil futures in Dublin

The New York Mercantile Exchange (Nymex) has said it will launch a northwest Europe gas oil futures contract in Dublin on Friday April 8.

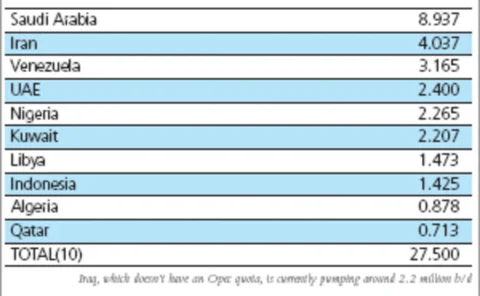

Has Opec lost control?

Minutes after Opec tried to cool scorching oil prices by announcing a hike in its output target, oil surged to record highs. Has Opec lost control, and is there anything it can do to bring prices down? Stella Farrington finds out

The battle for Brent

Open-outcry the IPE is over, but the debate over whether the screen can adequately replicate an oil market rages on, writes Stella Farrington

Enter the scrum

A surprise Opec headline can throw the market into a tailspin, but gathering the news can be even more frenetic. In March, one scrum even resulted in broken bones. Stella Farrington writes from Iran

A star rises in the east

Iran’s ministry of petroleum has given the green light to launch a new petroleum exchange in the country. Mohammad Asemipour, adviser to Iran’s oil ministry and a key architect of the project, talks to Stella Farrington

Petroleum price surges

Oil prices once again are on the rise, with some analysts predicting ‘super-spikes’ in the near future to match the price rises of the 1970s. Eric Fishhaut summarises some of the key changes, and looks at how traders can make use of the volatility in the…

A complicated option

Why does the New York Mercantile Exchange not list average-price WTI crude options as a contract on its ClearPort electronic platform? Internal politics could be the main obstacle. Joe Marsh reports

Ethanol

The production of ethanol – a component of gasoline – is growing fast, which has led to the imminent launch of two ethanol futures contracts and a joint production venture involving Sempra Energy. By Joe Marsh

Opec split over increasing oil production

Ministers of the Organisation of Petroleum Exporting Countries (Opec) arriving in the Iranian city of Esfahan Tuesday sent out mixed messages over the expected outcome of Wednesday’s meeting.

Greenpeace protesters storm IPE

Open-outcry trade in Brent and gas oil futures at London’s International Petroleum Exchange was halted for over an hour on Wednesday afternoon after 50 to 60 protesters from environmental group Greenpeace stormed the building.

Merrill Lynch starts building coal desk

Matt Schicke, former director of coal trading at Michigan-based DTE Energy, has joined Merrill Lynch to build a US coal trading desk from its Houston office. As vice-president, he is initiating steps to trade coal, said Merrill spokeswoman Terez Hanhan.

China Aviation report "escalating", ready soon

Global consulting firm PricewaterhouseCoopers (PWC) has denied reports that claim a draft investigation report into the China Aviation Oil (CAO) trading scandal has been released to Singapore stock exchange SGX and to CAO itself.

Nymex confirms plans to launch in London

The New York Mercantile Exchange (Nymex) today announced plans to open an open-outcry Brent futures floor in London. "It's our intention to move to London as soon as possible," Nymex president James Newsome told reporters in London.

Layers of intrigue

The Yukos saga – up to now largely confined to the political and legal arenas – recently took a step closer to the physical oil markets with a $6 billion oil deal between China and Russia. By Stella Farrington

Crude imitation

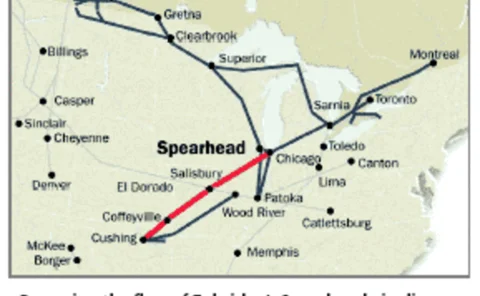

Hedging Canadian heavy crude oil is difficult: unlike Canadian light crude, ithas no closely matching price benchmarks. Trading basis differentials is onesolution, but help may be at hand from another quarter. By JoeMarsh

A hard nut to crack

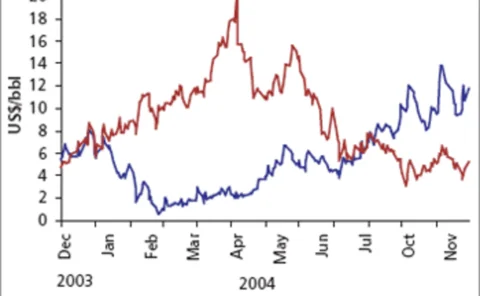

This year has proved profitable for US oil refiners, but it could have been even better, had they not posted losses from forward product sales. Are refining companies learning from their trading mistakes? Joe Marsh reports

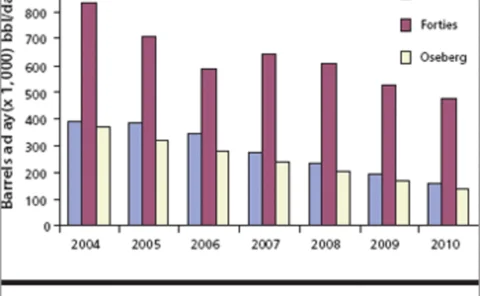

Blending the rules

The speed of decline of North Sea crude raises fresh concerns over the suitability of the North Sea as a benchmark, and to worries over the value of long-dated derivatives contracts. By Stella Farrington