Oil & refined products

Trading crude blows

Banks and oil majors alike are building up their oil derivatives operations, vying to attract the same corporate client base. But the oil companies do notseem unduly concerned about the competition, finds Paul Lyon

Refining systems for oil trading

The increasing complexity of the crude oil business – on both the physical and financial side – means companies in the sector need fast-changingand flexible software to manage their operations. CliveDavidson reports

Oil prices cause ripples in chemicals market

The chemicals market has been hit by the effects of high oil prices. Higher feedstock prices have brought higher end-product prices. Fame Information Services looks at styrene prices and the soaring costs of feedstocks, particularly in the ethylene market

Detecting market transitions: from backwardation to contango and back

Svetlana Borovkova looks at detecting market transitions between backwardation and contango states using the forward curve. In this first part of a two-part article, she introduces two change indicators, which she applies to oil futures prices. Next…

Seeking a boost for crude

Venezuela’s internal conflict and the intended removal of Saddam Hussein from Iraq have meant both countries are seeking deals with international investors to boost oil production. But are the potential legal problems worth the trouble? By Maria Kielmas

The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

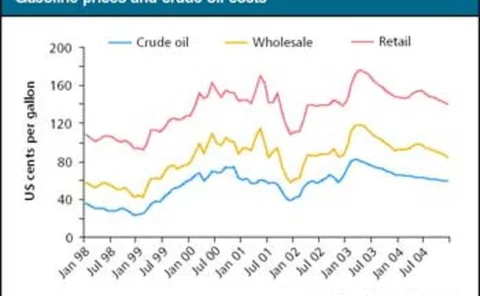

Pumping up prices

Gasoline prices in the US hit all-time highs in March, and the price is expected to remain high throughout the summer. Kevin Foster looks at the contributing factors

US energy prices: in line for a fall?

A combination of concerns in the second half of January 2003 has boosted US oil and natural gas prices to levels not seen since the winter of 2000/2001. Will the higher prices stick? Logical Information Machines examines cause and effect

Crude oil takes a double hit

Mark Powell of GlobalView Software looks at how crude prices are being affected by the impending war with Iraq and the general strike in Venezuela

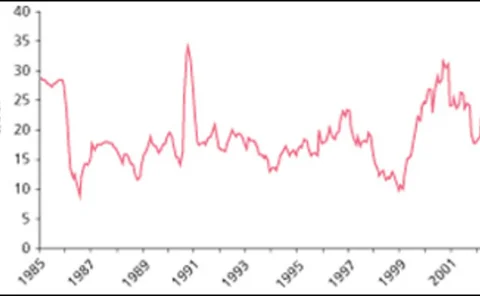

Fighting oil volatility

Oil cartel Opec froze its production output level at its last meeting in September. With war in Iraq on the cards, Shifa Rahman reports on the future of oil volatility

Confusion over a barrel

The latest efforts to stem price manipulation have left crude oil market participants wondering which contracts they should be trading and who will lead the pricing? Joel Hanley reports

A towering success

There is more to the Malaysian oil and natural gas giant Petronas than its impressive headquarters. One of Asia’s biggest energy players is finding new ways of branching out, as Joel Hanley discovers

Brent changes promise stability

The recent change in Platts’ definition of Brent crude oil follows much debate about the price assessment of North Sea Brent crude. Software vendor Logical Information Machines takes a historic view in a search for the reasons behind the move

After the swashbucklers

Oil exploration today is about taking as few risks as possible, meaning the smaller independent firms are losing out to the energy majors, as Maria Kielmas discovers

Market mind games

The year has seen surprisingly high oil prices, which has caught many forecasters unaware given widespread predictions of slow growth. Maria Kielmas reports

Comeback in the old USSR

Russia is on the verge of becoming the world’s leading energy superpower, but a lack of investment looks set to hamper its development. Joel Hanley reports