Structured products

Sovereign solutions

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

China Aviation Oil chief arrested

Chen Jiulin, the suspended chief executive of China Aviation Oil, has been arrested on his return to Singapore early Wednesday as investigations begin into the company’s huge trading losses.

BarCap launches commodity-linked credit product

Fixed-income investors can now make use of a credit instrument that provides access to commodities as an asset class, says Barclays Capital. The investment bank has launched Apollo, a collateralised commodity obligation (CCO), which uses derivatives…

AsiaRisk Awards

Here we feature two outstanding winners from our sister publication AsiaRisk’s Annual Awards, published in October. Thanks largely to Macquarie Bank, alternative investments are gaining a real foothold in Australia, while Westpac has been instumental in…

Merrill Lynch sees oil staying high in 2005

The oil price, which has roughly doubled since the start of 2000, and risen by over 60% this year, is likely to remain historically high in 2005 due to a structural shift in the market, said Robin Batchelor, co-fund manager of Merrill Lynch’s World…

Weather wisdom with risk management

Mark Tawney from Swiss Re spells out the implications of not keeping an eye to the weather

China Aviation Oil hid US$390m derivative loss in struggle to survive

China Aviation Oil’s trading unit, China Aviation Oil (Singapore) Corp (CAOSCO) hid an initial US$390 million loss while its directors sought “white knights” to save it from liquidation, it emerged yesterday as the company announced an estimated US$550…

Calpine trades up

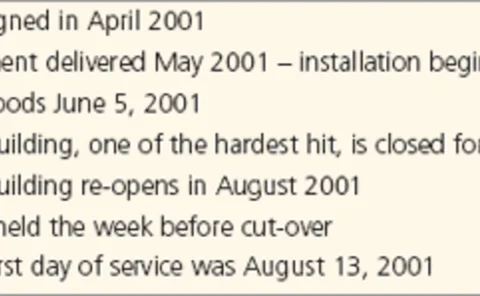

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

Ten years at the top

A decade of commodity rankings has seen many players come and go – but as James Ockenden finds, the top two investment banks, Morgan Stanley and Goldman Sachs, have been solid all the way

Nymex names head of new strategy department

John D’Agostino will head up a new department at the New York Mercantile Exchange, which will focus on strategic options for expansion and growth. The exchange has promoted D’Agostino to vice-president of strategy and business development from manager…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

Bilateral collateral

Until recently, there was little legal protection from foreign investment risk.But the past few years have seen the rise of the bilateral investment treaty(BIT). Matthew Saunders shows how BITs can benefit the energy sector

Nymex ends open-outcry trading of PJM monthly power futures

The New York Mercantile Exchange (Nymex) will move daytime trading of the PJM monthly electricity futures contract to ClearPort, its internet-based system, from the open-outcry trading floor on November 1.

Shell completes sale of refined products pipelines

Shell Oil Products US has sold its major refined oil products pipeline systems to asset acquisition companies for $1 billion. Oklahoma-based Magellan Midstream Partners has paid $490 million for the mid-continent system, while Pennsylvania-based Buckeye…

Edison Mission Energy sells stake in NZ utility

California-based Edison Mission Energy has completed the sale of its 51.2% stake in New Zealand-based Contact Energy to Origin Energy New Zealand. Origin paid NZ$1.1 billion ($739 million) in cash and assumed NZ$535 million ($359 million) in debt to take…

Allegheny Energy to sell Illinois power plant

Pennsylvania-based Allegheny Energy is to sell a power plant in Manhattan, Illinois for $173 million to a private investment firm that specialises in energy assets. ArcLight Capital Partners has agreed to buy the 672-megawatt (MW) Lincoln Generating…

Oneok gets new $1bn financing and agrees to buy US gas co

Oklahoma-based energy company Oneok has obtained a five-year, $1 billion credit line from a group of banks to fund asset purchases. The company has also agreed to buy pipeline operator Northern Plains Natural Gas Company from asset acquisition company…

Atmos Energy gets go-ahead to buy TXU gas ops for $1.9bn

Texas-based natural gas company Atmos Energy is set to buy the gas distribution and pipeline operations of TXU Gas, the largest gas utility in Texas, on October 1. TXU Gas will still exist as part of TXU Corp, a non-regulated retail electricity provider …

Aquila completes $330m refinancing and pays off $430m loan

Kansas City-based energy company Aquila has made further moves to reduce its debt with two new 364-day unsecured financings: a $110 million revolving credit facility and a $220 million term loan facility. The company borrowed the full amount under the…

Dominion forward-sells shares to obtain equity on demand

Virginia-based energy company Dominion has forward-sold 10 million shares of its common stock in a block trade to JP Morgan Securities. The deal was done in connection with a forward-sale agreement between Dominion and investment bank Merrill Lynch. It…

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports