Structured products

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Former Swiss Re weather experts launch hedge fund

Weather risk veterans Mark Tawney and Bill Windle, who left global reinsurer Swiss Re on July 7, are starting a hedge fund, named Takara, Energy Risk has learned. Weather trader Bill MacLauchlan departed Swiss Re at the same time, for personal reasons.

Nymex, Icap to launch gas, crude oil daily settlement derivatives

The New York Mercantile Exchange (Nymex) and inter-dealer broker Icap are to launch an electronic market in same-day over-the-counter (OTC) options on prompt-month settlement prices for crude oil and natural gas. Starting on Monday (July 18), the…

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

Calpine to sell US oil and gas assets for $1bn

Calpine Corp is to sell all its US oil and gas exploration and production assets for $1.05 billion to Rosetta Resources, a newly formed subsidiary of the California-based energy company.

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Nymex to form Dubai oil futures exchange

The New York Mercantile Exchange (Nymex) and Dubai Holding are to form the Dubai Mercantile Exchange (DME) to trade sour crude and fuel oil in early 2006, the New York exchange announced today.

Evolution to open Calgary office in July

Energy broker Evolution Markets will open an office in Calgary, the centre of the Canadian energy-trading markets, in early July.

New carbon brokerage targets non-power-sector SMEs

Three senior players in the European emissions trading market have launched Carbon Capital Markets, a broker-dealer service that targets small to medium-sized companies (SMEs) outside the power sector.

Just a seasonal swing?

US natural gas market volatility is keeping trading volume high. But is this just a seasonal phenomenon or part of a long-term trend? Catherine Lacoursiere reports

Sharon Brown-Hruska

The CFTC’s Sharon Brown-Hruska believes in minimal market interference, even, as she tells Joe Marsh , when it comes to hedge funds

CME to launch more weather contracts

The Chicago Mercantile Exchange (CME) is set to list weather derivatives contracts for more cities in the US and Europe and to introduce two new types of weather contracts - probably by early July. Demand for CME weather contracts is fast increasing: as…

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

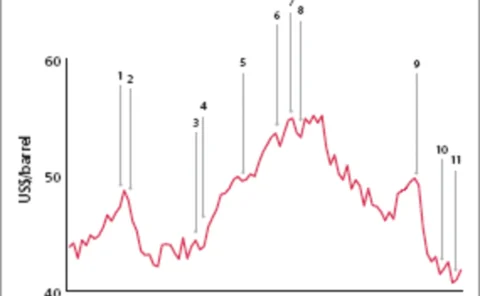

Battle for Brent rages on as open outcry closes at IPE

Open outcry at London’s IPE had its last day on Thursday, yet the debate over whether the screen can adequately replicate an oil market rages on, with IPE and Nymex both taking a punt on opposing beliefs.

Nord Pool hires ex-Natsource brokers, eyes power spread contract

Nordic power exchange Nord Pool has hired brokers from the Oslo office of energy broker Natsource, which would fit with rumours that Natsource is closing its Scandinavian business. Natsource president Jack Cogen declined to comment.

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Powernext selects Trayport for emissions trading, awaits CO 2 allocation

French electricity exchange Powernext will use software supplier Trayport’s Global Vision platform for CO 2 emissions trading, but is still waiting to start the spot emissions market it first announced in January.

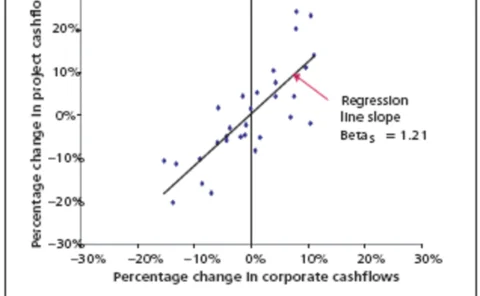

The sum of its parts

One can view a corporation’s individual projects as a portfolio of options – useful risk management tools to be used if their risk/return ratios are better than that of the firm as a whole. But how to work out the equity cost of capital at this…

Nymex confirms plans to launch in London

The New York Mercantile Exchange (Nymex) today announced plans to open an open-outcry Brent futures floor in London. "It's our intention to move to London as soon as possible," Nymex president James Newsome told reporters in London.

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

TriOptima trims six companies' oil swap portfolios

TriOptima, a Swedish company dedicated to reducing over-the-counter swap portfolios, has expanded its service into energy. The company has terminated its first group of multilateral OTC oil derivative swaps, with six companies eliminating unnecessary…

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report