Structured products

CCRO and S&P form liquidity working group

The US Committee of Chief Risk Officers (CCRO) has established a working group along with rating agency Standard & Poor’s (S&P) to define the most effective metrics integral to assessing the liquidity demands of energy supply and wholesale marketing…

Mooney quits Trafigura to launch Merrill fund of funds

David Mooney, formerly head of power and gas trading at Trafigura in London, has left the Swiss commodity trading house to join Merrill Lynch. Mooney will join Merrill in mid-June as a managing director where he will be charged with evaluating commodity…

Energy clearing in Catch 22 situation, says Fitch

Denise Furey, New York-based senior director of global power at rating agency Fitch believes that the clearing of OTC energy derivative contracts is in something of a ‘Catch 22’ predicament. “We need standardization of contract documentation to get to…

S&P places focus on energy merchant liquidity risk

Rating agency Standard & Poor’s is to issue new liquidity adequacy guidelines for US energy merchants, which are particularly vulnerable to large and sudden liquidity demands related to collateral calls.

Fair weather future

Judging from the success of the weather risk market in the Asia-Pacific region,the Chicago Mercantile Exchange couldn’t have picked a more opportune timeto launch Japanese weather futures. By Paul Lyon

Isda raises Basel-linked concerns

Bankers have been preparing for the implementation of the Basel II Capital Accordfor a number of years. But Isda says that it is still concerned about the effectthe Accord may have on the commodities markets. By Paul Lyon

Icap will not pay Prebon’s £2m damage claim

Icap has no intention of recognising rival broker Prebon’s £2 million claim for damages after a dispute over the employment of three Icap coal brokers, according to its director of corporate affairs Mike Sheard.

Erasing Enron

Enron’s story may finally be drawing to a close. Jeffrey Skilling has finally been indicted and the company’s creditors have begun receiving ballots to vote on a plan of reorganisation. By Paul Lyon

Nybot in Nymex sights, but IPE rumours are put on ice

Nymex is rumoured to be interested in acquiring Ice. Here, in an exclusive interviewwith Energy Risk, Nymex president Bo Collins suggests the exchange may also besetting its sights elsewhere. By James Ockenden

Calpine scraps $2.3 billion loan and junk bond sale

San Jose-based Calpine last month cancelled a $2.3 billion secured term loan and secured notes offering. Its wholly owned subsidiary, Calpine Generating (CalGen) Company (formerly Calpine Construction Finance Company II ) cancelled its offerings due to…

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Flexible bonds

A depressed power market means major firms face an uphill struggle to refinancetheir debt. But a commodity hedge has given US energy giant Calpine Corp considerableflexibility in its $800 million bond issue. By James Ockenden

FirstEnergy to blame for US blackout, say reports

Utilities in Ohio – chiefly FirstEnergy – were at fault for the US blackout in August, conclude separate reports from a US-Canadian task force and Michigan regulators. But the midwest system operator does not escape blame. By Joe Marsh

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon

Arnie’s energy plan faces opposition

Californian governor-elect Arnold Schwarzenegger is facing stiff opposition and awkward questions over his energy deregulation plans. In particular, one consumer group is concerned about the implications of his meeting with formerEnron chairman Ken Lay…

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

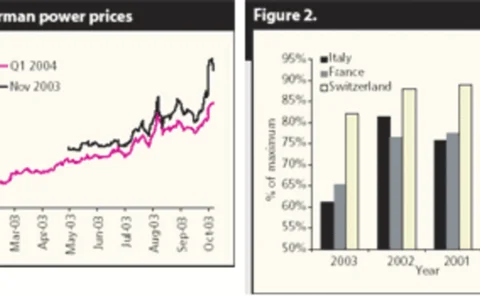

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002