Structured products

Power asset prices plummet

The energy price boom may be over, but bargain hunters beware: the predicted sale of US generation assets is yet to occur. Kevin Foster reports

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

Project risk: improving Monte Carlo value-at-risk

Cashflows from projects and other structured deals can be as complicated as we are willing to allow, but the complexities of Monte Carlo project modelling need not complicate value-at-risk calculation. Here, Andrew Klinger imports least-squares valuation…

US retreat hits European trading

The retreat of US energy firms from energy trading has reportedly hit European volumes hard. But volumes aside, James Ockenden finds that the withdrawal may bring a fundamental change in the market. With additional reporting by Eurof Thomas

Exchanges gradually gain pace

After much talk of new trading solutions for German power, only one platform – EEX – has made significant progress, although the new clearing solution from Clearing Bank Hannover seems to be picking up steam. James Ockenden reports

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

Structured finance caught off-balance

Efforts by energy and finance professionals to stress the difference between legitimate off-balance-sheet entities and Enron’s opaque devices have had little impact, as US regulators rush to clean up structured finance. Maria Kielmas reports

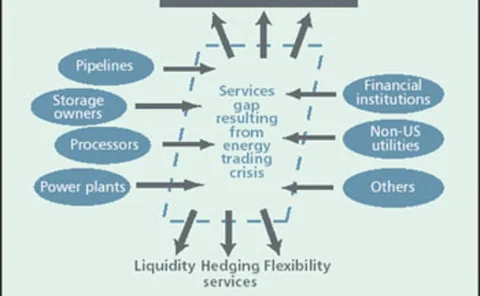

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

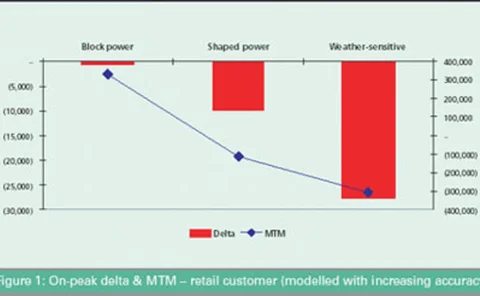

Making sense of the new power market

Bank of America’s Rogers Herndon and David Mooney examine expectations in the energy and power markets before and after the collapse of Enron and outline their predictions for the future

Tools for the trade

Ken Nichols examines the mechanisms available for incorporating credit risk management into an energy company’s portfolio

Avoiding over-exposure

Eurof Thomas finds the European energy market is increasing its focus on credit risk mitigation in the wake of Enron’s demise

Higher or lower?

Kevin Foster looks at how credit rating agencies assign a rating to companies in the energy sector and what kind of factors are taken into account

A whole new ball game

Enron’s bankruptcy has changed the playing field for credit risk in the energy sector. Kevin Foster reports on the renewed significance of assessing credit quality

Heeding the warning signs

Following the Enron bankruptcy, the use of bond-spread analysis has become increasingly important. Mark Williams looks at how firms can benefit from it

Clearing the way?

The German over-the-counter market has been growing quickly in recent years, but a series of shocks has sparked fears of credit risk exposure. Can trading regain recent highs and save the OTC market from credit-wary traders, asks Joel Hanley

Controlling power

Maggi Shippy-Ksionsk and Stefan Ulreich explain how portfolio risk management gives a company control over its energy procurement

At the heart of Europe

As the rest of Europe has still to get fully to grips with cross-border energy trading in a liberalising environment, Germany, Austria and Switzerland are providing an example of a workable regional electricity market, says Eurof Thomas

Two hubs or one?

Independent traders are desperate for a hub that will provide real liquidity and help force the Ruhrgas-dominated German natural gas market to open to competition. Peter Joy reports