Structured products

Commodities Count 2006

The recent swell in energy market participants means the battle for dominance has never been fiercer, but the increased competition means ever-more sophisticated product offerings, finds Stella Farrington

Duke Energy to adopt Cinergy trading approach

Following the transfer of its energy derivatives portfolio to Barclays Capital, Duke Energy is targeting a lower-risk trading strategy pioneered by Cinergy, the company it is buying

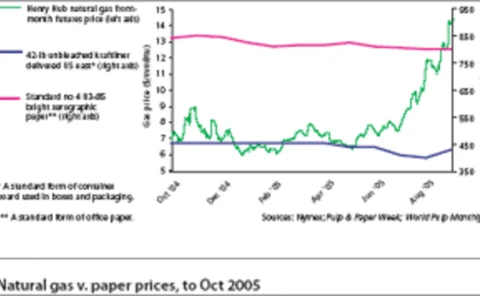

What drives natural gas?

Natural gas prices in the US are at an all-time high. The Gulf Coast hurricanes and record summer heat have taken their toll, and business is feeling the effect. Studying and applying seasonality can often protect aganst the volatility of these markets,…

SocGen opens Calgary office, launches Canadian energy-services partnership

SG Corporate & Investment Banking (SG CIB) has partnered with Calgary-based energy-sector investment dealer FirstEnergy Capital Corp to jointly offer energy-financing services to the firms’ Canadian clients. SG CIB, part of French bank Société Générale,…

BarCap takes on Duke trading book

Barclays Capital will acquire and manage the bulk of Duke Energy North America’s (DENA) power and gas derivatives contracts, as part of parent Duke Energy Corp’s takeover of US utility Cinergy.

Weather fund Pyrenees closes, traders set up weather desk at Sempra

Weather hedge fund Pyrenees Capital Management closed at the end of October, a year after its launch, and two of the company’s three staff have moved to energy trader Sempra Commodities to set up a new weather desk.

Utilities shift towards longer-term hedging

US and Canadian regulated utilities are increasingly looking to put on longer-term hedges, even more than three years out in some cases. Such was one of the findings of an informal survey of the audience at a utility risk-management conference in Chicago…

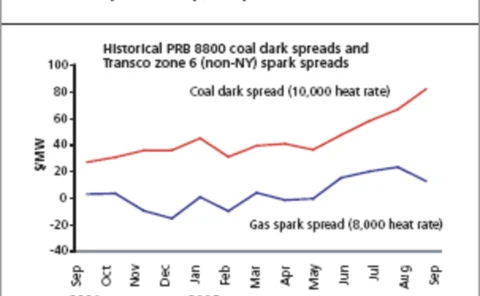

Counting on coal

NRG Energy's move to buy Texas Genco seems a wise one for a company with strong dark-spread exposure, but it has its risks, despite the target company being backed by an active hedging programme. Joe Marsh reports

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

Papering over the cracks

High energy prices are forcing pulp-and-paper makers to take action against falling profits, yet most companies are still shying away from energy price hedging. But that situation may be slowly changing. Joe Marsh reports

Nymex plans to sell 10% stake to private equity firm

The New York Mercantile Exchange (Nymex) has signalled its intention to sell a 10% equity stake to General Atlantic, a US-based private equity firm, for $135 million.

Bear Stearns and Calpine form energy marketing and trading company

Investment bank Bear Stearns and California-based power company Calpine Corp have formed an energy marketing and trading venture focused on physical natural gas and power trading and related structured transactions.

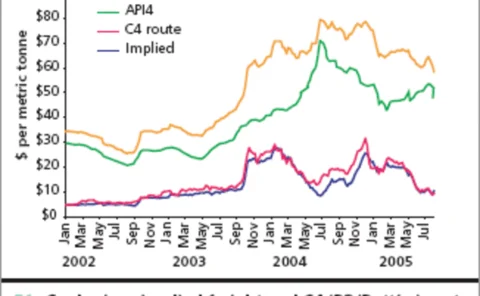

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

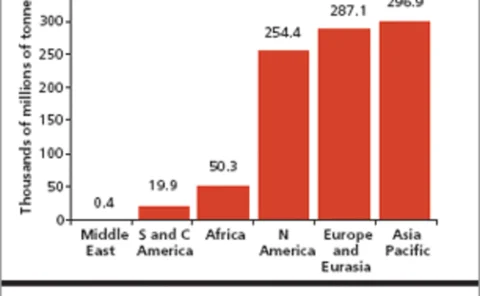

King coal still fired up

Despite the soaring cost of emissions reduction credits, the EU emissions trading scheme has yet to dampen utilities’ demand for coal. But, finds Oliver Holtaway, it may affect their long-term investment decisions

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

Coal facing changes

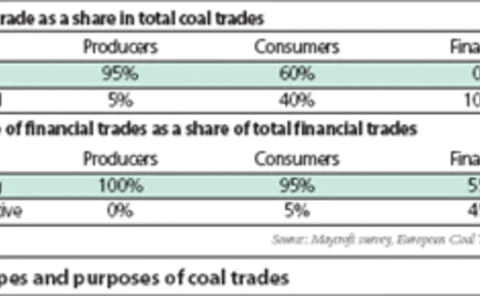

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Evolution expands US west coast emissions brokerage ops

Energy broker Evolution Markets has expanded its environmental market operations for the western US with the hire of Laura Meadors, an expert in environmental market design and analysis. She is based in the San Francisco office, which opened in February…

Baiting the hook

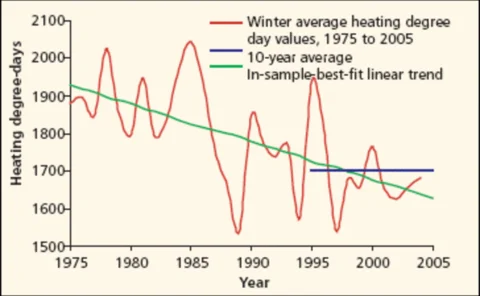

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available