Regulation

EEX to launch spot carbon contract

German-based electronic exchange European Energy Exchange (EEX) is to launch a spot contract to trade EU carbon emissions allowances in January 2005.

European emissions trading on track

The EU emissions trading scheme is on track to start in January 2005, with the European Commission having approved 16 out of 25 of the EU member National Allocation Plans that lie at the heart of the scheme, said Peter Vis, acting head of the Industrial…

BP pays $100,000 to settle wash trading charges

The energy round-trip trading scandal continues to rumble on, as BP America today paid $100,000 to the US Commodity Futures Trading Commission (CFTC) to settle charges of illegal wash trading. A wash or round-trip trade is one that produces neither a…

Dynegy to buy Sithe Energies from Exelon

Dynegy is set to reduce the effect of some of its loss-making tolling and financial swap contracts, buy power plants in the northeast US and acquire a supply agreement to increase stable cashflow and service debt.

OGE Energy gets $550m credit line

OGE Energy Corp has arranged two new revolving credit facilities totaling $550 million with a 16-bank group led by Wachovia Securities and JP Morgan Securities. The facilities replace $400 million of existing credit lines due to expire this year.

Nymex names head of new strategy department

John D’Agostino will head up a new department at the New York Mercantile Exchange, which will focus on strategic options for expansion and growth. The exchange has promoted D’Agostino to vice-president of strategy and business development from manager…

18 EU states urged to implement energy law

Most European Union countries have not transposed the internal-market electricity and natural gas directives into national law, according to the European Commission. The commission today sent formal letters to 18 of the 25 EU member states asking them to…

A legal rollercoaster

US-based Polygon wants to see a better restructuring deal for British Energy’sshareholders. But the hedge fund faces a struggle to prevent the UK nuclear powergenerator from delisting. Joe Marsh reports

Pressure on Puhca

The US General Accounting Office is to investigate whether the SEC has been lax in its oversight of the Public Utility Holding Company Act. How will this affect firms subject to Puhca requirements? By Paul Lyon

Texan retail therapy

Certain large Texas electricity suppliers want to reduce debt following significantlosses. So their retail divisions are trying harder than ever to squeeze moreprofits from a fiercely competitive retail market. JoeMarsh reports

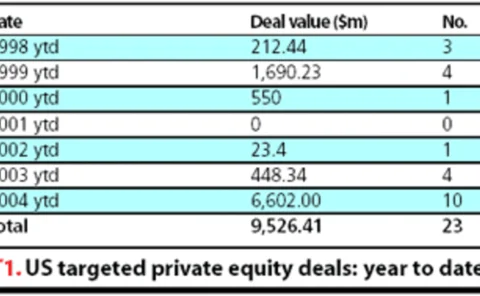

Buyouts are back

Private equity funds have been making bold inroads into energy markets in the past year – the number of deals has doubled since 2003, and the acquisitions are getting bigger. CatherineLacoursiere reports

CCX and IPE team up to offer EU emissions contracts

The Chicago Climate Exchange (CCX) and the International Petroleum Exchange (IPE) today signed an agreement to list cash and futures contracts in European Climate Exchange carbon financial instruments (ECX CFIs) on the IPE. Greenhouse gas emissions…

Merrill Lynch snaps up Entergy-Koch Trading

Investment bank Merrill Lynch is set to acquire the energy trading businesses of Entergy-Koch Trading (EKT), a joint venture between New Orleans-based Entergy Corp and Koch Industries in Kansas. Energy Risk reported in June that the bank was a top…

Former Enron executive pleads guilty

John Forney, a former Enron executive, yesterday pleaded guilty toone count of conspiracy to commit wire fraud for the purpose of manipulatingCalifornia's electricity market during the 2000-2001 Westernenergy crisis, the US Attorney's Office for the…

Calpine sets up $250m credit facility

California power company Calpine has entered into a $250 million letter of credit facility with Deutsche Bank, which expires in October 2005. The San José-based company expects this new credit enhancement structure to widen its spark spreads and increase…

Looking to the east

Can power market operators in the new EU member states in eastern Europe gainthe liquidity they need to challenge either bilateral electricity contracts orthe established exchanges? Joe Marsh reports

Putin’s endgame

The geopolitical premium on oil prices is rising as Russia pursues its ‘oligarchs’. Catherine Lacoursiere reports on the wider effects of Russian oil giant Yukos’ collapse

APGA supports Ferc decision to fine three companies

The American Public Gas Association (APGA) has applauded the US Federal Energy Regulatory Commission (Ferc) for its decision to fine three energy companies $8.1 million for sharing natural gas storage inventory data with their customers and affiliates. …

Edison Mission sells off foreign power assets, posts Q2 loss

California-based Edison Mission Energy is to sell its remaining foreign generation assets to London-based generator International Power and Japanese trader Mitsui & Co for $2.3 billion. International Power will take a 70% stake and Mitsui a 30% stake of…

Shell agrees $150 million fine over reserves scandal, releases interim results

Royal Dutch/Shell Group looks set to pay $150 million in civil penalties and spend $5 million on developing an internal compliance programme, following its recent overstatement of reserves. The energy giant has agreed in principle with the UK Financial…

Brown-Hruska to serve as CFTC acting chairman

Sharon Brown-Hruska has been appointed by US president George Bush to serve as acting chairman of the Commodity Futures Trading Commission (CFTC). Brown-Hruska was previously a CFTC commissioner and will take over the duties of outgoing chairman, James…

BNP closes revolving credit facility for Sempra Energy Trading

French bank BNP Paribas has closed a $1 billion multicurrency secured revolving credit facility for four borrowers forming part of Sempra Energy Trading, the commodity-trading unit of San Diego-based Sempra Energy.

Edison needs "broad EDF shoulders" says exec

A senior executive at Italian utility Edison has said the company would benefit from a takeover by a larger European utility, possibly Electricité de France (EDF). “Edison is too small in the long run to always remain independent,” he says. “So we need…

Shell appoints governance advisers

Energy major Royal Dutch/Shell Group yesterday appointed investment banks Citigroup and Rothschild as financial advisers to the steering committee reviewing its structure and governance.