Regulation

The end of an era?

Latin American governments are hiking taxes and forcing changes to contracts with oil and gas investors in a marked departure from the economic liberalisation of the 1990s. But reality may prompt a rethink, writes Maria Kielmas

Integrating energy data

Knowledge is power, and having the latest information on the marketplace is of paramount importance. Eric Fishhaut looks at why centralising information can have a big impact on tactical management and developing strategies

Air India starts fuel hedging

Air India has become the first airline in India to hedge its jet fuel price risk, using commodity derivatives contracts at the end of February for the first time.

Nymex's death knell to floor?

The New York Mercantile Exchange's decision to introduce side-by-side electronic and open-outcry trading heralds the beginning of the end for its floor trade, many market participants believe

Coping with setbacks

Most risk managers and employees in energy companies are familiar with the concepts of market risk and credit risk, but operational risk is receiving more attention in corporate boardrooms these days, writes Sandy Fielden

Commodities Count 2006

The recent swell in energy market participants means the battle for dominance has never been fiercer, but the increased competition means ever-more sophisticated product offerings, finds Stella Farrington

Duke Energy to adopt Cinergy trading approach

Following the transfer of its energy derivatives portfolio to Barclays Capital, Duke Energy is targeting a lower-risk trading strategy pioneered by Cinergy, the company it is buying

New GlobalView head makes u-turns on hubs

Contrary to reports in September, new GlobalView chief Steve Gott says he remains committed to the Energy Data Hub and ConfirmHub ventures. Following a management overhaul, it seems it is business as usual

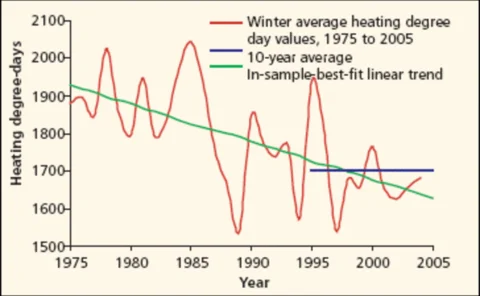

What drives natural gas?

Natural gas prices in the US are at an all-time high. The Gulf Coast hurricanes and record summer heat have taken their toll, and business is feeling the effect. Studying and applying seasonality can often protect aganst the volatility of these markets,…

SocGen opens Calgary office, launches Canadian energy-services partnership

SG Corporate & Investment Banking (SG CIB) has partnered with Calgary-based energy-sector investment dealer FirstEnergy Capital Corp to jointly offer energy-financing services to the firms’ Canadian clients. SG CIB, part of French bank Société Générale,…

National Bank of Canada reunites heavy hitters for energy push

National Bank of Canada (NBC) has expanded its energy derivatives team in Calgary with three new managing directors, with the aim of attracting more utility and energy-consumer customers.

Refco raises further concerns

As the Refco bankruptcy case rumbles on, investors are wondering if more could have been done to prevent it, and in future, are likely to seek better assurances over the security of funds in segregated customer accounts

Bear Stearns and Calpine form energy marketing and trading company

Investment bank Bear Stearns and California-based power company Calpine Corp have formed an energy marketing and trading venture focused on physical natural gas and power trading and related structured transactions.

Baiting the hook

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Nymex, Icap to launch gas, crude oil daily settlement derivatives

The New York Mercantile Exchange (Nymex) and inter-dealer broker Icap are to launch an electronic market in same-day over-the-counter (OTC) options on prompt-month settlement prices for crude oil and natural gas. Starting on Monday (July 18), the…

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh