Regulation

European Commission to examine energy-sector competition

The European Commission (EC) today launched an inquiry into competition in natural gas and electricity markets, in response to concerns from consumers and new market entrants about the development of wholesale markets and limited consumer choice.

New carbon brokerage targets non-power-sector SMEs

Three senior players in the European emissions trading market have launched Carbon Capital Markets, a broker-dealer service that targets small to medium-sized companies (SMEs) outside the power sector.

Sharon Brown-Hruska

The CFTC’s Sharon Brown-Hruska believes in minimal market interference, even, as she tells Joe Marsh , when it comes to hedge funds

ABN Amro expands commodity-trading team, opens Singapore office

Dutch bank ABN Amro has made several commodity trading and marketing hires in London and New York, and opened an office in Singapore.

Standard challenges

Early signs suggest European energy companies may, like their US counterparts,have problems complying with a new derivatives-accounting standard. But theydo have newguidelines to help interpret the rules. By Joe Marsh

Peaking patterns

Weather is increasingly affecting power market dynamics, with prices as variableas the temperatures. But the volatility has spawned a growing variety of methodsofmanaging peak load demand. By Catherine Lacoursiere

TFS continues expansion with Arc Oil purchase

Connecticut-based broker TFS is in fierce expansion mode: yesterday it announced its purchase of oil broker Arc Oil, an oil broker headquartered in Houston. This follows TFS’s recent opening of a Houston office and re-entering US coal and emissions…

All bases covered

In 1997, Norwegian energy firm Statoil implemented an enterprise-wide risk management system with the help of Goldman Sachs. Eight years on, few energy companies can rival its approach. Joe Marsh discovers why

IPE-ECX carbon futures contract faces fierce competition

London’s International Petroleum Exchange (IPE) and the Amsterdam-based European Climate Exchange (ECX) are set to offer CO 2 futures contracts under the EU Emissions Trading Scheme (ETS).

Turbulent times

The new Renewable Sources Act obliges German utility companies to buy all the wind power generated in the country on any one day. And it is adding a new volatility to the German power market. By Stella Farrington

Germany’s closed shop

Despite six years of liberalisation, Germany’s gas market is still virtually closed to outside competition. Writing from Germany, Stella Farrington looks at whether new regulation is finally about to bring change

Hanging on at the top

This year’s User Choice Awards demonstrate that quality counts. In a fast-changing market, the top vendors and packages have managed to stay ahead of the pack. But the winners cannot rest easy. With IT budgets deflated, it’s a competitive market, and…

Merrill Lynch starts building coal desk

Matt Schicke, former director of coal trading at Michigan-based DTE Energy, has joined Merrill Lynch to build a US coal trading desk from its Houston office. As vice-president, he is initiating steps to trade coal, said Merrill spokeswoman Terez Hanhan.

OpenLink may launch web-based version of Endur

OpenLink may launch a web-based version of Endur, its energy trading and risk management system, according to Matt Frye, Houston-based managing director of the software company.

Nymex confirms plans to launch in London

The New York Mercantile Exchange (Nymex) today announced plans to open an open-outcry Brent futures floor in London. "It's our intention to move to London as soon as possible," Nymex president James Newsome told reporters in London.

A good bet for 2005

2005 is forecast to be a tough year for many hedge funds, but the saturation of some of their traditional markets could prove a boon to the energy sector, finds Stella Farrington

Caught short

Given the difficulty China Aviation Oil is having closing its remaining illiquid positions, its derivative trading losses may be greater than first thought. James Ockenden and Stella Farrington report

Sovereign solutions

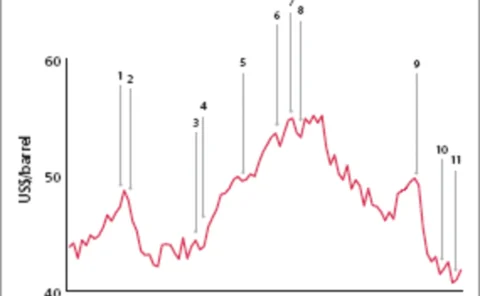

As we saw last month, most governments prefer stabilisation funds over hedging to protect against oil price risks. But multilateral institutions such as the World Bank advise otherwise. By Maria Kielmas

Mirant settles price-reporting charges

A subsidiary of Atlanta-based energy company Mirant has settled charges with the US Commodity Futures Trading Commission (CFTC) of false reporting of natural gas prices. The commission found that Mirant Americas Energy Marketing (MAEM) traders made false…

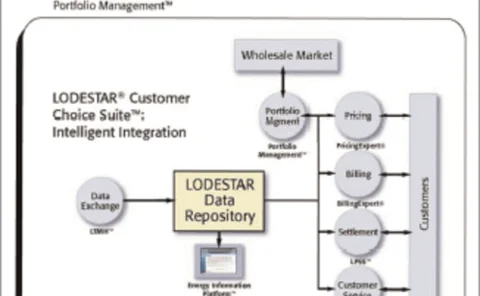

Strengthen your portfolio performance

Reduce costs and minimise exposure withLODESTAR® Portfolio ManagementTM

London to be world carbon market centre

The UK’s early move into carbon emissions trading means London is now well placed to become a world centre for the emerging carbon market, UK Environment Minister Elliot Morley said Wednesday.

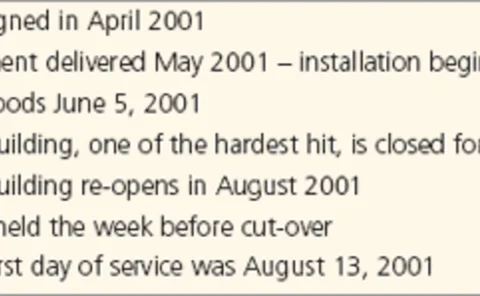

Calpine trades up

US power company Calpine installed a new trading floor this year due both to its own growth and its aim to provide more companies with energy services. Joe Marsh reports

CFTC allows US firms to trade on EEX

The US Commodity Futures Trading Commission has permitted US companies to trade power derivatives on the European Energy Exchange with immediate effect, EEX said Thursday.

Energy users demand trading oversight

The debate continues over whether speculative traders are distorting energy prices, following a letter sent by the Industrial Energy Consumers of America (IECA) to Congress last week. “Energy markets have changed drastically, and regulatory oversight,…