Operational risk

Coal on the rocks

Faced with liquidity problems, falling volumes and uncertainty over the accuracy of price data, coal trading has had many of the same difficulties as the natural gas and power sectors over the past year. How can it get back on its feet, asks Kevin Foster

Structured finance caught off-balance

Efforts by energy and finance professionals to stress the difference between legitimate off-balance-sheet entities and Enron’s opaque devices have had little impact, as US regulators rush to clean up structured finance. Maria Kielmas reports

A clear market leader

How will SunGard’s acquisition of rival vendor Caminus change the market for energy risk management software? Kevin Foster reports

Exchanging blows

Conflict in the US and growth in Europe marked another turbulent year for energy exchanges. Kevin Foster casts an eye back over 2002

A decision model for selling park and loan services

The park and loan model is useful for gas storages and pipelines. The concept can be applied to many ‘when to sell’-type decisions. Here, Huagang ‘Hugh’ Li considers selling park and loan services as a financial and statistical decision on revenue and…

Getting stressed

To understand how much value can be lost from a position in the energy markets, we need to use measures other than value-at-risk. Brett Humphreys discusses methods for creating effective stress tests

Rising fuel costs, diving profits

Airlines differ on how to manage jet fuel price ‘hyper-volatility’ as option prices point to more turbulence ahead. Catherine Lacoursière reports

In search of transparency

The open secret of index price manipulation in the natural gas sector is officially out, and the industry is scrambling to reform the system. Kevin Foster reports

Standardising electricity contracts

Electricity contracts have come and gone, but a new trio of financially settled futures contracts aims to widen the electricity market, reports James Ockenden

Cell mates

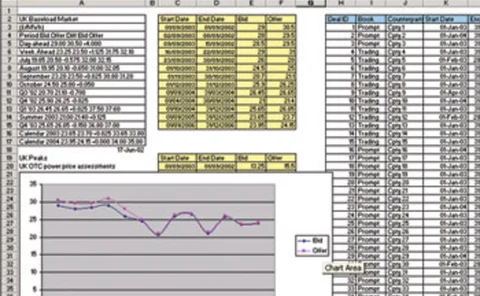

Traders love spreadsheets. But complex deals can quickly outgrow a sheet developed on the fly. Since traders won’t abandon their favourite tools, Stuart Cook and Tony Hughes of The Structure Group look at how firms can control their use

The front-month proxy hedge

The front-month proxy hedge is a correlation-based hedge that seeks to neutralise the aggregate sensitivity of a portfolio to a futures curve by converting the individual futures hedges into a single hedge with respect to only the front-month contract…

Between Kyoto and the caribou

Ratification of the Kyoto Protocol on climate change is unlikely to have an effect on the burgeoning Canadian oil and gas sector, as Maria Kielmas discovers

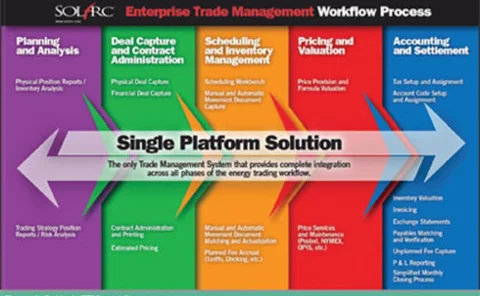

Capturing value from energy supply and trading

Companies that plan to engage in energy trading need to invest in the right personnel, processes and information management tools if they intend to be successful, says David Dunkin, SolArc’s Chief Strategic Executive

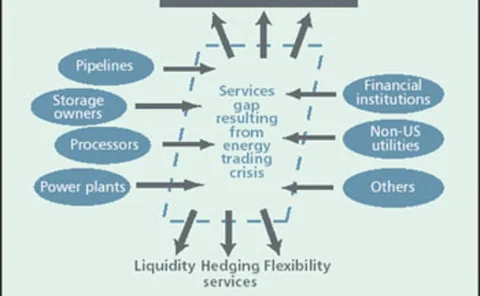

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

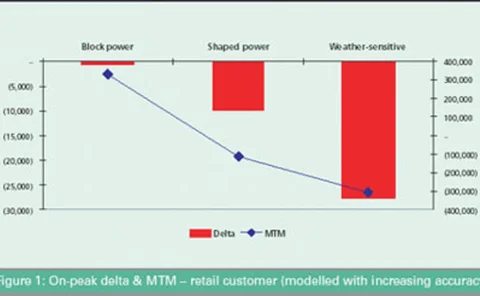

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

All clear for energy

Several organisations have brought over-the-counter clearing to the US energy markets over the past six months. Kevin Foster assesses their progress and asks whether they can all survive