Operational risk

Tools for the trade

Ken Nichols examines the mechanisms available for incorporating credit risk management into an energy company’s portfolio

Natural gas storage: a market driver changes horses

Given the importance of natural gas storage figures to energy market traders and analysts, a change in the provider and timing of the data release is an event of some significance. Software provider Logical Information Machines reports

Discovering new frontiers

Joerg Engels and Volker Linde report on the changes Germany’s deregulated energy market will have to make as a result of the country’s banking act

Mean-reverting smiles

Commodity markets such as crude oil exhibit mean reversion as well as option smiles. David Beaglehole and Alain Chebanier meet this challenge, constructing a model suitable for pricing exotic options in these markets

Utilities renegotiate to survive

For the past 10 years, Argentina’s privatised utilities have been icons of successful energy sector reform. But with the country’s deepening crisis, they face increased difficulties. What can investors do to mitigate such risks, asks Maria Kielmas

Mixed signals from the east

Flaws in Poland’s electricity regime have crippled Warsaw’s two-year-old power exchange. But Slovenia’s power exchange is faring rather better. Peter Joy reports

A cure for Enron flu

Brett Humphreys discusses recent events in the energy sector and the role risk managers can play in improving the industry

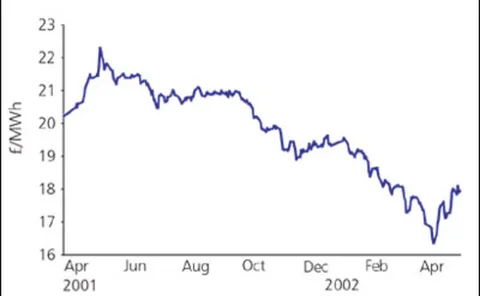

Worth waiting for?

Just over a year on from the delayed launch of the UK’s new electricity trading arrangements, prices have dropped to new lows. But just how low can generators go, asks Joel Hanley

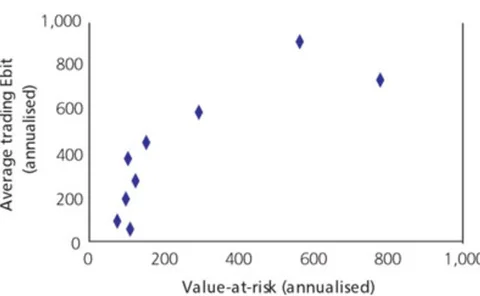

Keeping score

This month Brett Humphreys and Zach Jonasson show how energy trading firms can compare performance using publicly available corporate information

Banks take shelter in derivatives

While some banks have found the weather derivatives market a non-starter, others are doing deals worth more than $100 million. Eurof Thomas reports

A smooth handover?

A change in the way weekly natural gas storage figures are reported is proceeding fairly smoothly – but it may still cause price swings, as Kevin Foster discovers

Quantifying technical analysis

In the last of our series of tutorials on risk management tools, Richard Weissman provides an overview of technical analysis for the energy business

Covering the threat

Since September 11, energy companies have had to re-assess the threat of terrorist attack. Despite the insurance industry introducing new terms and products, some companies remain unprotected, as Joel Hanley discovers

Pause for thought?

Electricity deregulation in Ontario promises to avoid the price hikes and power shortages seen in some markets. So why are end-users unhappy? Kevin Foster reports