Operational risk

How to spot a VaR cheat

Traders can use weaknesses in VaR measurement to make it appear that they are not taking any risks. Brett Humphreys exposes how easily this can be done

Petrochemicals firms take a stand against oil price volatility

Many petrochemicals firms are seeking to reduce price volatility through hedging, given that the cost of crude oil is strongly influencing the price of petrochemical products. GlobalView Software looks at the figures behind the trend

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

Models of good behaviour

The development of new models that describe the real dynamics of energy prices have to take into account the behavioural aspects of market players. The problem is how to quantify these aspects. Maria Kielmas reports

Rethinking European power

European energy firms are seeking to reposition their products and strategies in advance of European Union market deregulation. FAME Energy reports

Greening the markets

Environmental risks are increasingly being recognised as important financial issues, but the markets are still some way from rewarding companies for good environmental performance, as Kevin Foster discovers

Pointing the index finger

Concerns over manipulative energy price reporting has led to a call for price index reform. But many market participants are apprehensive about disclosing detailed confidential data to a third party. James Ockenden looks at developments

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

Opportunity knocks for smelters

Aluminium manufacturers have long used sophisticated hedging and risk management techniques to protect against fluctuating metal prices, yet they have only recently looked at transferring these skills to power risk management. David Wilson reports

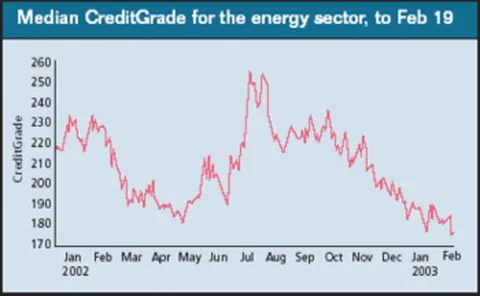

Credit watch

Risk management and analytics firm RiskMetrics gives this month’s analysis of energy companies’ credit quality using its CreditGrades tool

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Exchanges gradually gain pace

After much talk of new trading solutions for German power, only one platform – EEX – has made significant progress, although the new clearing solution from Clearing Bank Hannover seems to be picking up steam. James Ockenden reports

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

Energy clearing – solutions for a changing trading environment

E. Michael Jesch, head of business development at Clearing Bank Hannover, examines the effect of energy market liberalisation, globalisation and recent technological advancement on short- and long-term trading

Blurring the lines

A turf war between Atlanta’s IntercontinentalExchange and the New York Mercantile Exchange reveals a shift in the traditional role of over-the-counter brokers and exchanges, finds Catherine Lacoursière

Crude oil takes a double hit

Mark Powell of GlobalView Software looks at how crude prices are being affected by the impending war with Iraq and the general strike in Venezuela

US gas market challenges

A new report from the investigative office of the Federal Energy Regulatory Commission finds that competitive natural gas markets in the US are robust, but warns of challenges ahead. Kevin Foster reports