Operational risk

California’s master plan

California’s energy regulators have an action plan to upgrade the electricity system. But if they don’t add generation, shortages could again hit. Kevin Foster reports

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

...while AEP exits Nordic energy trading

Ohio-based American Electric Power (AEP) last month completed its exit from theNordic energy trading market. The management team responsible for AEP’sactivities in the Nordic region will assume AEP’s Nordic trading book,office leases and related…

US power sector decline slows, says Fitch

The US power sector has seen little more than a slowing in the rate of its declinein 2003, said Richard Hunter, managing director of rating agency Fitch’sglobal power group, in May.

Energy firms find succour

US energy company debt has reached critical levels, with nervous investors and banks working hard to keep these companies afloat. But Paul Lyon finds the secretive hedge fund industry could also lend a helping hand

David Mooney

With 34 trading offices active in 40 countries, Swiss commodity trading house Trafigura is no small concern. But while the firm – perhaps best known for its oil, petroleum products and metals trading activities – employs some 600 energy traders worldwide…

Kiodex adds more energy forward curves

Kiodex, an energy risk management technology company based in New York, willadd five new forward curves to its global market data offering, it told delegatesat EPRM’s May congress in Houston.

Ferc calls for risk manager vigilance

The director of the office of market oversight and investigations (OMOI) at theUS Federal Energy Regulatory Commission (Ferc), has urged energy risk managersto alert his office to any suspicious market practices.

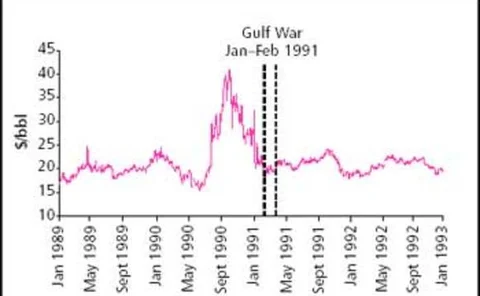

Detecting market transitions: from backwardation to contango and back

Svetlana Borovkova looks at detecting market transitions between backwardation and contango states using the forward curve. In this first part of a two-part article, she introduces two change indicators, which she applies to oil futures prices. Next…

CROs seen as vital for restoring confidence

Chief risk officers (CROs) have a vital role in helping shape the future of thetroubled energy sector and should report directly to their company’s boardif investor confidence is to be rebuilt in the industry. Vincent Kaminski, seniorvice-president of…

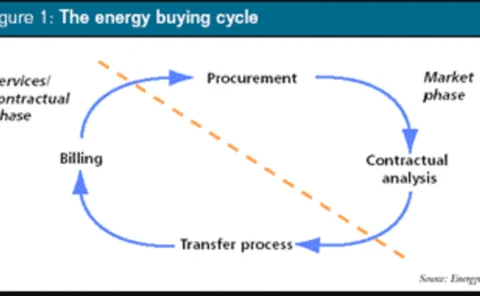

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

The case for financially settled contracts

Banks and hedge funds have shied away from trading electricity due to fear and ignorance of the physical nature of the market. But, as Todd Bessemer of Accenture points out, financially settled contracts can avoid the complexity of physical delivery and…

Tough talk on derivatives

The Commodity Futures Trading Commission and Ferc are getting tough in throwing fines around. Is this a ploy to avoid being lumbered with further over-the-counter regulatory responsibilities? Some market participants certainly think so. By Paul Lyon

Wanted: cash for new lines

Can Ferc’s standard market design encourage much-needed investment in the US power grid and develop a merchant model for transmission assets? By Kevin Foster

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments

A formula for high prices

The US chemical industry is crying foul over spiralling natural gas prices, but there are measures they can take to protect themselves, as Kevin Foster discovers