Operational risk

System-ready for Sarbanes-Oxley

Energy companies are not alone in having to review their operations to comply with the Sarbanes-Oxley Act. Energy software suppliers, too, are looking at their systems, although most are confident they are already well prepared, finds Clive Davidson

Deregulation versus re-regulation

While the US authorities are still ironing kinks out of a major electricity market redesign and looking to repeal the utility industry’s most influential Act, US regulators and self regulators are moving to fill the vacuum. Catherine Lacoursière reports

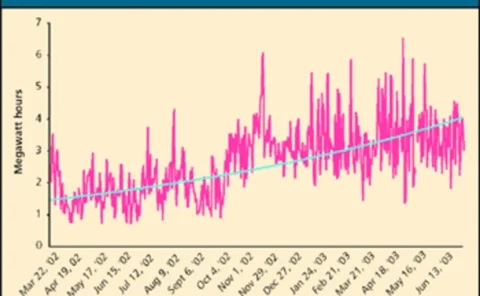

Utilities cut spending on IT

Energy utilities have cut spending on IT by 13% so far this year, according to the initial results of a study by Connecticut-based consultancy the Meta Group.

A true test for value-at-risk

The three classic approaches for measuring portfolio value-at-risk do not compare like with like, argues Richard Sage. Here he presents a test portfolio to highlight the differences between calculation methods

WRMA to campaign on data and against normalisation

Lynda Clemmons, president of the US Weather Risk Management Association (WRMA), is to sit on an American Meteorological Society (AMS) panel to address issues in the weather industry involving weather data and public-private partnerships.

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

Vincent Annunziata

During his time as a senior commodities trader and risk analyst, Vincent Annunziata noticed an alarming trend: like any other trading outfit, his company was prone to human error. He was working for Phibro – formerly the commodities trading division of…

UK energy brokers form association

Nine brokers operating in the over-the-counter energy markets in the UK formed the London Energy Brokers’ Association (LEBA) in July.

People Swaps

ABN Amro hires global energy trading head Dutch bank ABN Amro has hired Jonathan Arginteanu to the newly created positionof senior vice-president and deputy head of global energy trading operationsin New York. He was previously head of rival bank BNP…

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

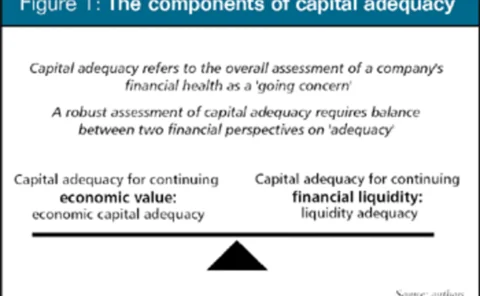

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

LNG not a short-term supply fix, warns US research firm

Liquified natural gas (LNG) will have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, despite its long-term promise, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

Management buys out SG’s weather and cat bond funds

Société Générale’s (SG) weather derivatives team completed an amicable management buyout of the weather division at the French bank. The buyout creates what is believed to be the largest range of dedicated weather derivative and catastrophe bond funds,…

Valuing exploration and production projects

Lukens Energy Group’s Hugh Li sets out an option method for valuing exploration and production projects, using a practical example

In search of power solutions

Blackouts across Italy in early July highlight the need for power plant investment – and the new market operator says promotion of derivatives trading is necessary to encourage such investment. But producers are yet to bite, finds James Ockenden

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

Backwardation and contango change indicators for seasonal commodities

In the first part of this two-part article, Svetlana Borovkova introduced two indicators for detecting changes between backwardation and contango market states. Here, in the second part, she applies the indicators to seasonal commodities and introduces a…

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

LNG may not fix gas supply problem

Despite its long-term promise, liquified natural gas (LNG) will only have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Avoiding STP failure

Entertaining as a Matrix-style spectre of a world governed by computers might be, for many involved in planning straight-through processing, seamless computing is the goal that every organisation should be trying to achieve, says Trayport’s Elliot Piggot

Running a smooth operation

Due to internal control scandals, process failures and the Sarbanes-Oxley Act, energy firms must keep an ever-closer eye on internal operations. Openlink’s Philip Wang and freelance author Jack King lay the basis for an operational risk framework