Market risk

Asian basket spreads and other exotic averaging options

Giuseppe Castellacci and Michael Siclari of OpenLink introduce a class of exotic options that simultaneously generalises both Asian and basket options. They develop approximate analytic models for real-time pricing of complex instruments that average…

Climbing the competition Pole

The Polish government hopes to boost competition in the electricity market through a controversial securitisation plan that it will use to buy out long-term contracts between generators and the transmission grid operator. Maria Kielmas reports

US retreat hits European trading

The retreat of US energy firms from energy trading has reportedly hit European volumes hard. But volumes aside, James Ockenden finds that the withdrawal may bring a fundamental change in the market. With additional reporting by Eurof Thomas

Opportunity knocks for smelters

Aluminium manufacturers have long used sophisticated hedging and risk management techniques to protect against fluctuating metal prices, yet they have only recently looked at transferring these skills to power risk management. David Wilson reports

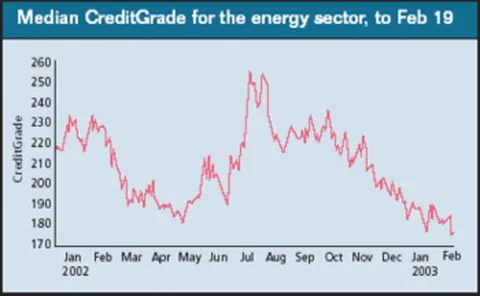

Credit watch

Risk management and analytics firm RiskMetrics gives this month’s analysis of energy companies’ credit quality using its CreditGrades tool

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Playing a waiting game

With energy – and particularly natural gas – costs on the rise, are end-users finally coming to terms with the importance of hedging or are they still waiting to get burned before they enter the hedging market? Kevin Foster reports

US energy prices: in line for a fall?

A combination of concerns in the second half of January 2003 has boosted US oil and natural gas prices to levels not seen since the winter of 2000/2001. Will the higher prices stick? Logical Information Machines examines cause and effect

Exchanges gradually gain pace

After much talk of new trading solutions for German power, only one platform – EEX – has made significant progress, although the new clearing solution from Clearing Bank Hannover seems to be picking up steam. James Ockenden reports

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Energy clearing – solutions for a changing trading environment

E. Michael Jesch, head of business development at Clearing Bank Hannover, examines the effect of energy market liberalisation, globalisation and recent technological advancement on short- and long-term trading

Option pricing for power prices with spikes

European power prices are very volatile and subject to spikes, particularly in German and Dutch markets. Ronald Huisman and Cyriel de Jong examine the impact of spikes on option prices by comparing prices from a standard mean-reverting model and a regime…

Blurring the lines

A turf war between Atlanta’s IntercontinentalExchange and the New York Mercantile Exchange reveals a shift in the traditional role of over-the-counter brokers and exchanges, finds Catherine Lacoursière

US pipelines follow the market

Todd Shipman of credit rating firm Standard & Poor’s finds that pipeline companies in the US will face more market risk than regulatory risk in the coming year

Enough’s enough

Brett Humphreys takes the guesswork out of determining how many simulations are needed to calculate value-at-risk

Crude oil takes a double hit

Mark Powell of GlobalView Software looks at how crude prices are being affected by the impending war with Iraq and the general strike in Venezuela

US gas market challenges

A new report from the investigative office of the Federal Energy Regulatory Commission finds that competitive natural gas markets in the US are robust, but warns of challenges ahead. Kevin Foster reports