Market risk

People Swaps

ABN Amro hires global energy trading head Dutch bank ABN Amro has hired Jonathan Arginteanu to the newly created positionof senior vice-president and deputy head of global energy trading operationsin New York. He was previously head of rival bank BNP…

Mirant bankruptcy is not terminal

US energy firm Mirant’s July bankruptcy filing bucks the recent trend of last-minute restructuring deals that have saved many of its rivals from a similar fate. But analysts say the company is likely to emerge from its filing with at least some of its…

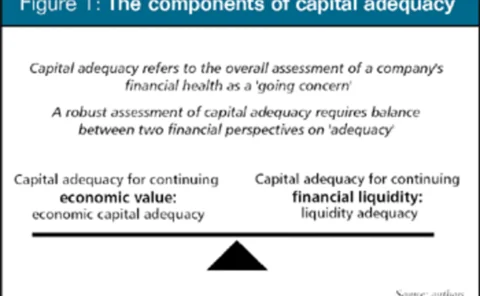

A capital adequacy primer

A summary of the Committee of Chief Risk Officers’ (CCRO) emerging guidelines on capital adequacy, by Cinergy’s Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith

LNG not a short-term supply fix, warns US research firm

Liquified natural gas (LNG) will have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, despite its long-term promise, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Management buys out SG’s weather and cat bond funds

Société Générale’s (SG) weather derivatives team completed an amicable management buyout of the weather division at the French bank. The buyout creates what is believed to be the largest range of dedicated weather derivative and catastrophe bond funds,…

Valuing exploration and production projects

Lukens Energy Group’s Hugh Li sets out an option method for valuing exploration and production projects, using a practical example

In search of power solutions

Blackouts across Italy in early July highlight the need for power plant investment – and the new market operator says promotion of derivatives trading is necessary to encourage such investment. But producers are yet to bite, finds James Ockenden

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

Oil prices cause ripples in chemicals market

The chemicals market has been hit by the effects of high oil prices. Higher feedstock prices have brought higher end-product prices. Fame Information Services looks at styrene prices and the soaring costs of feedstocks, particularly in the ethylene market

The trouble with normalisation

Weather derivatives practitioners say normalisation agreements between regulators and utilities in the US are posing a threat to their industry. Kevin Foster investigates

S&P to apply stress test to power firms

Standard & Poor’s (S&P) is to apply a stress test designed to measure how well power companies can stand price swings in volatile electricity markets. The move is part of the credit rating agency’s effort to combat criticism of rating agency failure to…

Backwardation and contango change indicators for seasonal commodities

In the first part of this two-part article, Svetlana Borovkova introduced two indicators for detecting changes between backwardation and contango market states. Here, in the second part, she applies the indicators to seasonal commodities and introduces a…

A secure base

Long praised as pioneers in the energy derivatives space, US energy firms are now looking to make their overall risk management practices more robust. And, as Paul Lyon discovers, these companies have several innovations up their sleeves, such as…

Ferc’s California clean-up

Sixty energy firms and utilities will have to justify their activities during the California energy crisis, the Federal Energy Regulatory Commission (Ferc) said in its regular bi-weekly meeting on June 25.

Icap shuts London weather desk

Inter-dealer broker Icap exited the European weather and environmental derivatives market last month. It thereby joined the growing ranks of other market participants – including BNP Paribas, Aquila and Italian bank Intesa BCI – that have fled the…

LNG may not fix gas supply problem

Despite its long-term promise, liquified natural gas (LNG) will only have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Keeping up with the markets

The power trading sector has changed substantially in the past 12 months. Have trading and risk management software vendors kept pace? Kevin Foster reports

Teething problems in Texas

Advocates of retail electricity deregulation cite Texas as evidence that competitioncan succeed. But big risks remain for power marketers, finds Kevin Foster

More power to the banks

Banks now have greater freedom to participate in derivatives markets based on physical commodities thanks to two recent ruling by US regulators. As a result, the balance of power looks set to shift from Houston to New York. By Paul Lyon

Lessons in loaning

Lenders and borrowers alike are becoming ever more innovative at a worrying time for energy company financing. But will the new ideas catch on? Paul Lyon reports

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

The cost of deregulation

US electricity deregulation does not necessarily make prices more competitive, as is shown in this study of New England power prices by Logical Information Machines

How to run a market

Former-derivatives-trader-turned-author Frank Partnoy wants to see tougher accounting standards and risk disclosures to deter corporate crooks. But are the regulators listening? Maria Kielmas reports