Foreign exchange

Arnie’s energy plan faces opposition

Californian governor-elect Arnold Schwarzenegger is facing stiff opposition and awkward questions over his energy deregulation plans. In particular, one consumer group is concerned about the implications of his meeting with formerEnron chairman Ken Lay…

Goldman Sachs buys 3,300MW of power generation capacity

Godman Sachs has agreed to buy US power producer Cogentrix, in a deal that willmore than quadruple the bank’s generation capacity. JoeMarsh reports

Scaling the credit cliff

How are designers of credit risk software reacting to the new credit realities of the energy trading sector? Kevin Foster talks to some leading companies to find out

Standing out from the crowd

Credit risk management groups can differentiate themselves from their competitors through their different capabilities. Randy Baker and Brett Humphreys explain how

Post-delivery problems

The credit exposures that arise from trading physical and financial energy are inherently more complicated and volatile than those encountered in trading purely financial products. Richard Sage looks at the different elements to be considered

Trying to model reality

Quantitative credit risk models are a must-have in today’s energy industry. But human judgement is still needed, as Maria Kielmas discovers

Cross-border conundrums

Analysts at rating agency Standard & Poor’s Lee Munden and Paul Lund look at the future of cross-border trading in Europe, given the credit crises of 2002

Power asset prices plummet

The energy price boom may be over, but bargain hunters beware: the predicted sale of US generation assets is yet to occur. Kevin Foster reports

Own, sell or restructure

UK and US utilities are presently saddled with a lot of debt, thanks to overcapacity and low power prices. But what’s the best way for these firms to deal with the power plants they don’t need? By Jessica McCallin

Delaying the inevitable?

As Reliant Resources celebrates a $6.2 billion refinancing deal, some in the industry say such deals are merely postponing problems that are bound to resurface. James Ockenden reports

Bearing the brunt

Building contractor bankruptcies of have recently stressed the credit profiles of several power projects in the US. Standard & Poor’s Scott Taylor and Tobias Hsieh look at how sponsors and lenders responded and the effects on the various parties

Ahead of the green game

Given the efforts they have already made to reduce emissions, many German firms do not share their environment minister’s enthusiasm for the EU’s new, obligatory cross-border greenhouse gas emissions trading market. Jessica McCallin reports

The bigger they come…

The German market is at the heart of the European power business, but it has stuttered since its early promise, and has yet to set the pace for the region as a whole. From a new entrant’s point of view, this is only to be welcomed, argues Ben Tait

Judicial stalemate

German natural gas market liberalisation is stalled between the courts and a corporatist business culture, finds Maria Kielmas

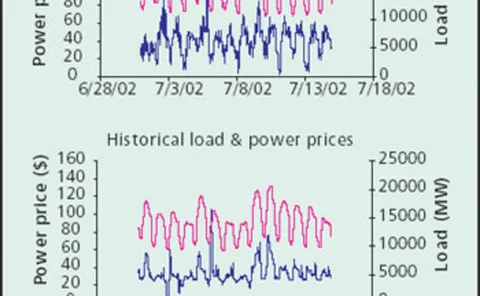

Option pricing for power prices with spikes

European power prices are very volatile and subject to spikes, particularly in German and Dutch markets. Ronald Huisman and Cyriel de Jong examine the impact of spikes on option prices by comparing prices from a standard mean-reverting model and a regime…

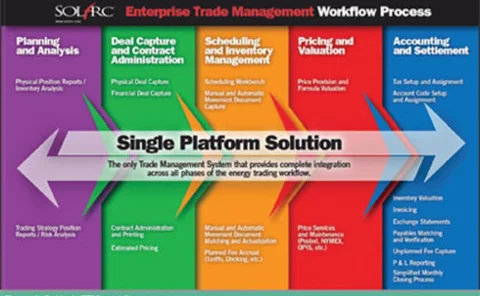

Capturing value from energy supply and trading

Companies that plan to engage in energy trading need to invest in the right personnel, processes and information management tools if they intend to be successful, says David Dunkin, SolArc’s Chief Strategic Executive

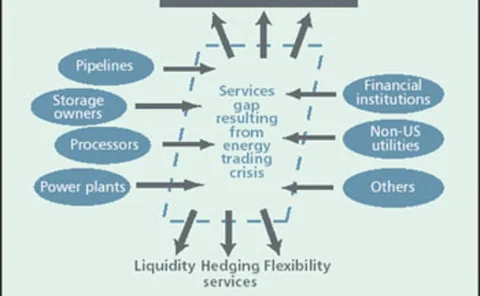

Who is left to manage risk?

The exodus of energy trading companies from the market has created a gap in managing risk. David Johnson and Ross Warriner of Protiviti report

The Power Sector Model

David Soronow, Mike Pierce and King Wang, of Financial Engineering Associates, introduce the firm’s Power Sector Model as the next step in derivatives pricing

New Energy Associates, a Siemens Company, presents the future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

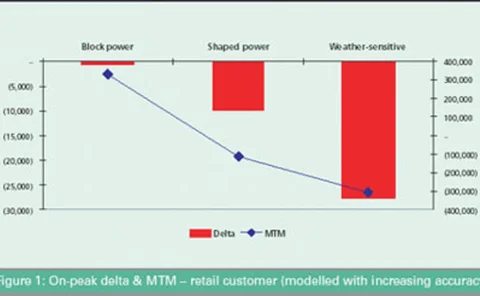

Making sense of the new power market

Bank of America’s Rogers Herndon and David Mooney examine expectations in the energy and power markets before and after the collapse of Enron and outline their predictions for the future

Quality data and solutions for a challenging market

FAME provides today’s uncertain energy market with transparent information and the tools to analyse it