Foreign exchange

EU adopts linking directive...

The European parliament has given the thumbs-up to the so-called linking directiveallowing companies within member states to benefit from emissions projects outsideof the EU. By James Ockenden and Paul Lyon

Governments face carbon allocation legal action

European governments face legal action from industry if they fail to provide carbon allocation plans by the end of the year, according to Peter Vis of the climate change unit of the European Commission.

Icap will not pay Prebon’s £2m damage claim

Icap has no intention of recognising rival broker Prebon’s £2 million claim for damages after a dispute over the employment of three Icap coal brokers, according to its director of corporate affairs Mike Sheard.

Deutsche asks SEC to clarify guidelines

Deutsche Bank claims the SEC’s guidelines for estimating oil reserves are outdated. And Shell, unsurprisingly,also believes that the SEC should clarify its reserve rules. By Joe Marsh

De Vitry elected to Isda board

Benoit de Vitry, London-based global head of commodities and emerging markets rates at Barclays Capital, has been elected to the board of the International Swaps and Derivatives Association (Isda).

Erasing Enron

Enron’s story may finally be drawing to a close. Jeffrey Skilling has finally been indicted and the company’s creditors have begun receiving ballots to vote on a plan of reorganisation. By Paul Lyon

Calpine scraps $2.3 billion loan and junk bond sale

San Jose-based Calpine last month cancelled a $2.3 billion secured term loan and secured notes offering. Its wholly owned subsidiary, Calpine Generating (CalGen) Company (formerly Calpine Construction Finance Company II ) cancelled its offerings due to…

Taking the slow road

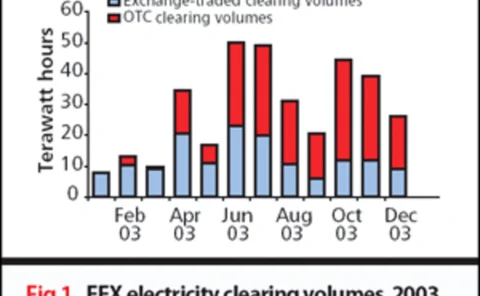

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

University of California adds four to Enron lawsuit

The University of California continues to add plaintiffs to its lawsuit against Enron. RBC, Goldman Sachs and two law firms are now facing the university’s wrath. By Paul Lyon

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch’s energy trading business. He has now pleaded guilty to a $43 million fraud. Paul Lyon reports

LNG drive gears up

The global push for LNG has reached a new level – particularly in the US. Big players had projects rubber-stamped or proposed further terminals, and the inaugural LNG summit took place. Joe Marsh reports

Nuclear stockpile

The US Nuclear Regulatory Commission has come under fire for not adequately monitoring the decommissioning funds of nuclear power plants. But the NRC says the criticism is unwarranted. By Paul Lyon

Banks grab distressed UK assets

Six European banks intend to buy around 10GW of distressed UK power assets usingfinancial instruments. But their main rival, MMC, says hard cash is needed towin the UK market. By James Ockenden

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Flexible bonds

A depressed power market means major firms face an uphill struggle to refinancetheir debt. But a commodity hedge has given US energy giant Calpine Corp considerableflexibility in its $800 million bond issue. By James Ockenden

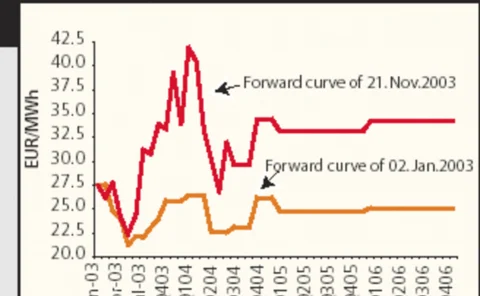

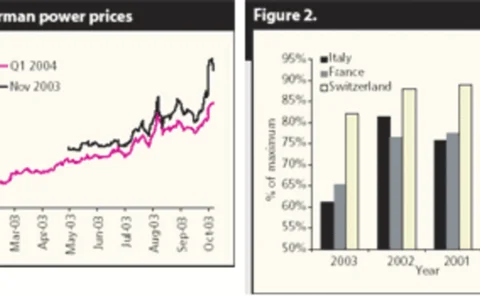

Searching for sellers in 2003

High volatility and rising prices in 2003 clearly above fundamental levels signal the need for improved guidelines from legislative institutions andeasily accessible information

The future of ETRM

As generation, trading and retailing companies come out from under the dark cloud to prepare for what looks to be a brighter future, one issue has become critical – the need to upgrade outdated ETRM systems with 21st century architecture, portfolio…

Creative challenges in customer-driven risk management

Shell Trading’s Ken Gustafson and Jemmina Gualy shed light on the environment in North America for customers and dealers in risk management, and look at the opportunities ahead for the business

Weathering the problems

Weather derivatives can reduce or eliminate the potential economic disastersthat extreme weather can provoke. Ross McIntyre of Deutsche Bank examines thevarious ways in which weather can affect key industries and reviews the benefitsof weather derivatives

A dark futurefor clearing

Clearing was the energy buzz word of early 2003. But as Clearing Bank Hannover goes into liquidation and the future of EnergyClear’s business remains uncertain, it seems energy clearing has lost its appeal. By Paul Lyon