Foreign exchange

Tullett Prebon forms wet freight derivatives venture

Tullett Prebon, part of Collins Stewart Tullett, is the latest interdealer broker to partner with a shipping broker to offer forward freight agreements (FFAs). It has started a venture with three international shipping brokers with the aim of…

EEX to launch carbon derivatives contract

The European Energy Exchange (EEX) plans to launch a futures contract for carbon emissions allowances in October, pending regulatory approval.

Indian exchange to list IPE Brent crude futures

Oil traders in India will from September 15 be able to trade rupee-denominated Brent crude futures, settled monthly by reference to the benchmark IPE Brent crude futures contract.

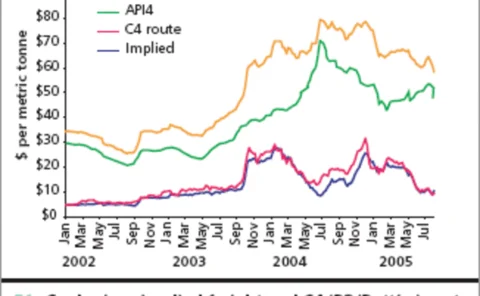

Trading routes open

The coal and dry bulk shipping markets are tightly intertwined and the strong influence of each on the other provides some interesting arbitrage opportunities, which are starting to draw wider attention, writes Barry Parker

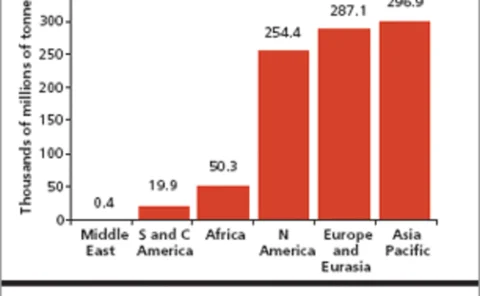

No sign of a slowdown

The fundamental outlook for coal looks price supportive for some years to come, but with other fuel prices sky high, coal looks set to retain its market share of electricity generation this decade. Stella Farrington reports

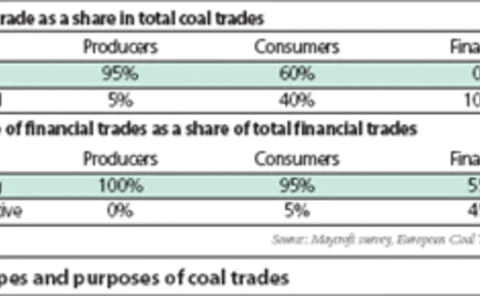

Coal facing changes

Coal derivatives trading is gaining popularity among coal consumers, producers and financial institutions in Europe, according to a recent survey of market players. Cyriel de Jong and Kasper Walet discuss the study’s results

James Tweed and Dave Wardley

At the end of last year, JAMES TWEED and DAVE WARDLEY launched the first hedge fund dedicated solely to trading freight. Stella Farrington meets them

A disciplined approach

E&P companies tend not to strategically hedge in a rising market. But there are good reasons for them to do so, and some are sticking to their hedging strategies, despite suffering losses on their derivatives contracts. By Joe Marsh

Icap to acquire United Fuels International

Interdealer broker Icap is to acquire the majority of the assets of United Fuels International, a leading US-based energy broking business with 2004 turnover of $24 million.

Lufthansa continues to save through fuel hedging

German airline Lufthansa has reported a increase in operating expenses of only 1.3% despite a big surge in fuel prices, partly thanks to its fuel-hedging strategy.

Baiting the hook

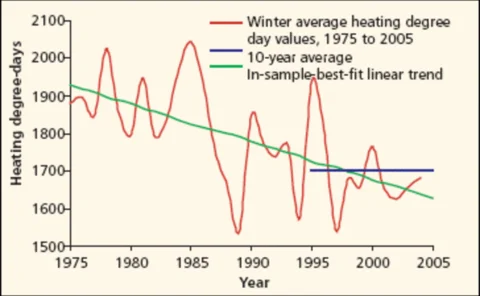

End-users such as utilities and industrial companies are not showing the same keenness as hedge funds for trading weather derivatives, despite the efforts of banks, dealers and brokers to lure them in. By Joe Marsh

Pricing the weather

Pricing weather derivatives is different from valuing other derivatives contracts – actuarial methods play a greater role. Steve Jewson looks at the varied approaches available

Strength in numbers

Weather derivatives seem to have a bright future: the market is enjoying record liquidity levels as new players, trading ever more diverse products, flood into the market. Oliver Holtaway reports

Former Swiss Re weather experts launch hedge fund

Weather risk veterans Mark Tawney and Bill Windle, who left global reinsurer Swiss Re on July 7, are starting a hedge fund, named Takara, Energy Risk has learned. Weather trader Bill MacLauchlan departed Swiss Re at the same time, for personal reasons.

Nymex, Icap to launch gas, crude oil daily settlement derivatives

The New York Mercantile Exchange (Nymex) and inter-dealer broker Icap are to launch an electronic market in same-day over-the-counter (OTC) options on prompt-month settlement prices for crude oil and natural gas. Starting on Monday (July 18), the…

In pole position

Sakonnet’s Thurstan Bannister says a sound footing in risk management and a customer-facing approach is the secret of his company’s success. By Stella Farrington

Francois-Xavier Saint Macary

It can’t be easy hauling a whole commodities division overseas, but SG CIB veteran Francois-Xavier Saint Macary has big ambitions. By Oliver Holtaway

Some brokers taking wrong approach to freight, says senior broker

Inter-dealer brokers could be taking the wrong approach by entering the freight derivatives market through joint ventures with physical shipping brokers rather than directly broking physical freight, says a senior energy broker.

The technology trap

Large banks are increasingly looking to energy trading to improve liquidity and develop relationships with large institutional and industrial clients. James Kemp looks at some of the technological challenges they face

Checking outside the box

Companies often use checklists to evaluate their IT buying requirements. But these rarely address what the firm actually needs. Brett Humphreys discusses how over-reliance on checklists may lead to poor software buying decisions

Making a connection

Addressing both sophisticated multi-asset trading and physical asset optimisation – while complying with stringent new regulation – are challenges few software firms claim to have the entire solution to. Oliver Holtaway reports

Calpine to sell US oil and gas assets for $1bn

Calpine Corp is to sell all its US oil and gas exploration and production assets for $1.05 billion to Rosetta Resources, a newly formed subsidiary of the California-based energy company.

A growing concern

Despite high natural gas prices, Canadian fertiliser maker Agrium has been posting strong profits, while some rivals have struggled. The company’s risk-management strategy has been a significant factor in its success. By Joe Marsh

Austrian Energy Exchange launches emissions trading

The Austrian Energy Exchange, EXAA, joined the ranks of European exchanges trading emissions yesterday with its first spot auction of European Union CO 2 allowances (EUAs).